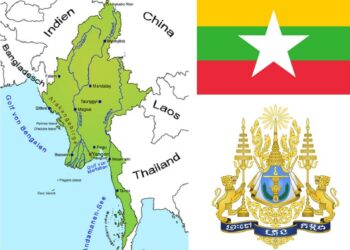

In recent weeks, tin prices have experienced a notable decline, largely attributed to shifting supply dynamics emerging from Myanmar, a key player in the global tin market. As one of the leading producers of this essential metal, Myanmar’s output has meaningful implications for pricing trends, which have seen fluctuations amid varying demand and geopolitical factors. The latest analysis by Nikkei Asia highlights not only the current state of tin prices but also the broader economic forces at play. This article delves into the reasons behind the recent drop in prices, the expected supply from Myanmar, and what this means for manufacturers and investors in the tin market.

Tin Prices Retreat as Myanmar’s Production Prospects Improve

Recent market shifts have seen a decline in tin prices,primarily driven by renewed optimism regarding Myanmar’s production capabilities. After enduring regulatory changes and political strife that disrupted output, the country is poised to reinstate its position as a significant player in the global tin market. Industry analysts point to several factors contributing to this outlook:

- Enhanced mining operations: Recent governmental initiatives aimed at stabilizing the sector are expected to yield more consistent outputs.

- International collaborations: Partnerships between local producers and foreign companies are anticipated to improve technology and operational efficiency.

- Increased investment: The influx of capital from abroad, as investors regain confidence, will likely boost production levels in the coming quarters.

This promising scenario for Myanmar’s tin production has sparked a recalibration in market expectations, as evidenced by a recent dip in global tin prices. Consequently, stakeholders are adjusting their strategies, taking into consideration factors such as:

| Factor | Impact on Prices |

|---|---|

| Increased Supply from Myanmar | downward pressure on pricing |

| Global Demand Trends | Potential price stabilization |

| Technological Advancements | more efficient production methods |

Given these developments, market participants are closely monitoring the situation, weighing potential shifts in supply dynamics against global demand forecasts. while Myanmar’s improved production prospects carry the potential for lower prices,the overall sentiment remains cautiously optimistic as stakeholders balance risks and rewards in this ever-evolving landscape.

Market Dynamics Shift Amid increased Supply from Southeast Asia

The recent surge in tin supply from Southeast Asia, particularly Myanmar, has considerably altered market dynamics, leading to a notable decline in tin prices. As production ramps up, analysts are reevaluating supply forecasts and pricing strategies. The influx of tin from this region is partly influenced by *increased mining activities* and *government policies aimed at revitalizing the mining sector*.This resurgence of supply can be categorized by several key factors:

- Increased output: Accelerated mining operations post-pandemic.

- Regulatory changes: Easier permitting processes encouraging investment.

- Global demand fluctuations: Changes in consumption patterns from major industries like electronics and automotive.

The implications of these shifts are significant, with tin prices now facing downward pressure as supply overtakes demand projections. Stakeholders across the board are adjusting their outlooks as they anticipate further decreases in pricing. To illustrate the current trends, the following table summarizes recent price changes in the tin market:

| Month | Price per Ton (USD) | Change (%) |

|---|---|---|

| August 2023 | 25,500 | -5.2% |

| September 2023 | 24,700 | -3.1% |

| October 2023 | 23,900 | -3.2% |

impact of global Demand Fluctuations on Tin Price Trends

The recent volatility in tin prices has underscored the significant influence of global demand dynamics. Factors such as shifting industrial production levels, emerging market appetites, and technological advancements in tin usage all contribute to the fluctuations observed in the commodity markets. As nations recover from pandemic-induced disruptions, the demand for tin, particularly in electronics and renewable energy sectors, has experienced intermittent spikes. However, these surges can quickly be countered by geopolitical tensions, changing policies in major producing countries, and economic retrenchments leading to fluctuating market confidence.

Myanmar’s role as a critical supplier also plays a pivotal part in shaping price trends. As market participants assess the outlook of tin production from Myanmar, aspects like political stability, export policies, and mining regulations become increasingly crucial. The following points summarize the current state of tin supply and its implications for pricing:

- Political Uncertainty: Ongoing instability may hinder output levels.

- Supply Chain Disruptions: Reports indicate potential delays in shipments due to regulatory changes.

- Market Sentiment: Investor confidence can swing drastically based on news from the region.

| Factors | Impact on Prices |

|---|---|

| Increased Production from Myanmar | potential price stabilization or reduction |

| Weakening Global Demand | Price decline |

| New Technology Adoption | Price increase due to elevated demand |

Expert Analysis: Long-term Implications for Tin Investors

The recent drop in tin prices can be primarily attributed to increasing clarity around Myanmar’s supply,a crucial supplier in the global tin market. As geopolitical situations stabilize and production ramps up in the Southeast Asian nation, investors may need to recalibrate their expectations. Supply dynamics are shifting as Myanmar significantly contributes to tin mining, and with reported recovery from previous disruptions, we might anticipate an influx of tin that could further affect market prices. This situation raises questions about market resilience and potential price volatility, especially for those with vested interests in the metal. Factors influencing these shifts include:

- Supply Recovery: Enhanced mining operations in Myanmar could lead to oversupply in the global market.

- Demand fluctuations: Tin is primarily used in electronics; changes in production in that sector could significantly affect price.

- Currency Dynamics: Shifts in the US dollar could impact tin prices as it is traded internationally.

For long-term investors, these fluctuations present both opportunities and risks. Assessing macroeconomic indicators will be crucial for making informed decisions. Investors should consider not only the current market sentiment but also geopolitical stability and technological developments in industries reliant on tin. Crafting a strategy around diversification could mitigate risks associated with the inherent volatility of this resource. Monitoring key trends will be pivotal, including:

- technological Advancements: Innovations in electronics may alter tin demand patterns.

- Sustainability initiatives: Increased focus on environmentally responsible mining could reshape supply chains.

- Regulatory Changes: Policies in mining-heavy countries could impact production timelines and costs.

| Factor | Potential Impact on Price |

|---|---|

| Myanmar Supply levels | Increased supply may lead to price decline. |

| Global Demand for Electronics | Higher demand may stabilize or increase prices. |

| Geopolitical Stability | Aids in secure supply chains, perhaps lowering risk premiums. |

Strategies for Navigating Tin Commodities Amid Price Volatility

As tin prices experience fluctuations primarily driven by supply forecasts from Myanmar,investors must employ a range of strategies to mitigate risks while capitalizing on opportunities. Monitoring market indicators, such as global production levels and demand from key sectors like electronics and construction, can provide insights into potential price movements. Additionally, diversifying investments across different commodities can help reduce exposure to tin-specific volatility.Consider these approaches:

- Supply Chain Analysis: Keep an eye on geopolitical developments and regulatory changes that may affect Myanmar’s tin exports, as these can directly impact prices.

- Technological Innovations: Explore advancements in tin recycling and alternative materials that may influence long-term demand trends.

- Risk Management Tools: Utilize financial instruments such as futures contracts and options to hedge against price declines.

understanding the broader economic context is equally important. The dynamics of tin supply and demand are often linked to global economic health. As consumers shift towards sustainability, tin’s role in green technology can influence its utilization rates and, afterward, its market value. Managing investments in this habitat requires a keen eye on key metrics, including:

| Metric | current Insight |

|---|---|

| Global Demand Growth | Projected growth of 3-5% annually, driven by electronics. |

| Production Levels in Myanmar | Increasing output, raising concerns about oversupply. |

| Recycling Rates | Rising, potentially reducing the need for newly mined tin. |

Future outlook: Factors Influencing Tin Prices Beyond Myanmar

The dynamics of tin prices extend far beyond the borders of Myanmar, influenced by a myriad of global factors that shape market sentiments and supply chains. Geopolitical tensions in major tin-producing regions can create ripples in the market, causing investors to reassess the stability and reliability of supply. Additionally,global demand shifts,driven by industries such as electronics and renewable technologies,play a crucial role in determining price trajectories.as an example, the surge in demand for tin used in soldering for electric vehicles and renewable energy systems could counterbalance any temporary disruptions in supply from Myanmar.

Moreover, environmental regulations and sustainability initiatives increasingly impact extraction practices in tin mining, influencing overall output. Companies may face higher production costs as they adjust to stricter environmental standards, subsequently affecting tin availability on the market. Economic indicators,such as inflation rates and currency fluctuations,also contribute significantly to tin pricing. Investors closely monitor these elements as they gauge potential shifts in purchasing power and investment viability across different markets. To summarize, a multifaceted approach to understanding tin prices must consider these interconnected factors beyond Myanmar, allowing for a more comprehensive view of the market.

The Conclusion

the recent decline in tin prices,largely attributed to an improved supply outlook from Myanmar,underscores the dynamic nature of the global metals market. As producers ramp up output in response to rising demand, particularly from the electronics and battery sectors, market watchers will need to keep a close eye on supply chain developments and geopolitical factors that could influence future pricing. While the current downturn offers some respite for manufacturers grappling with elevated costs, sustained volatility is highly likely to remain a defining characteristic of the tin market. Stakeholders—from miners to end-users—must navigate this complex landscape with agility to adapt to the shifting economic conditions. As we move forward, the interplay between supply stability and demand growth in emerging technologies will be crucial in shaping the trajectory of tin prices in the coming months.