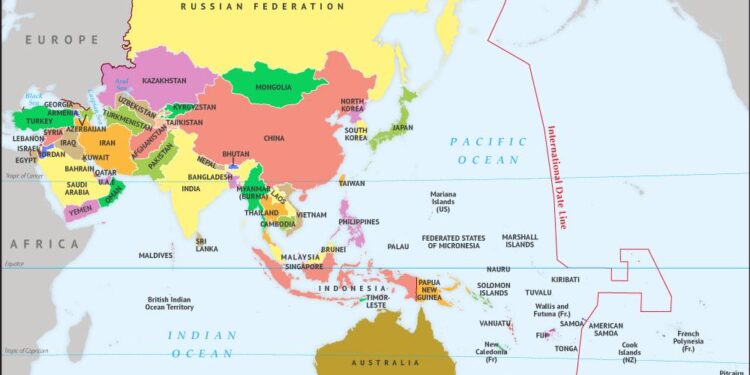

The Asia-Pacific region remains at the center of global economic attention as the lingering effects of former President Donald Trump’s tariffs continue to influence trade dynamics. Despite shifts in political and economic landscapes, these tariffs still play a significant role in shaping supply chains, market access, and bilateral relations across the region. This article delves into how countries in Asia-Pacific are navigating the complexities of ongoing tariff measures amid evolving geopolitical tensions and trade negotiations.

Asia-Pacific Trade Dynamics Amid Ongoing Trump Tariffs

Trade patterns across the Asia-Pacific region remain volatile as the indefinite extension of tariffs originally imposed during the Trump administration continues to reverberate through global supply chains. Key economies like China, South Korea, Japan, and ASEAN nations have had to recalibrate their export strategies, balancing demand fluctuations with rising input costs. Exporters report increased diversification efforts, seeking alternative markets to mitigate the impact of U.S. tariffs, while importers grapple with rising prices on essential components and raw materials.

- China: Focus on high-tech goods and rare earth minerals

- South Korea: Automotive and semiconductor exports adapting to tariff challenges

- ASEAN: Emerging as alternative manufacturing hubs

| Country | Key Affected Sector | Recent Trade Shift |

|---|---|---|

| China | Electronics | Increased shipments to Europe |

| Japan | Automotive | Supply chain diversification in SE Asia |

| Vietnam | Textiles | Expanded production capacity for US markets |

Alongside these adjustments, governments across the region have launched targeted stimulus programs and trade facilitation initiatives to offset the adverse effects. Industry leaders emphasize the growing importance of bilateral free trade agreements and digital trade frameworks to sustain momentum. Analysts warn that, without resolution or rollback of tariffs, the Asia-Pacific’s trade architecture will likely continue evolving toward a more fragmented but resilient landscape.

Impact on Regional Supply Chains and Market Stability

Regional supply chains across the Asia-Pacific have encountered considerable turbulence as the persistence of Trump’s tariff policies continues to cast a long shadow over trade dynamics. Manufacturing hubs from Vietnam to Malaysia are recalibrating logistics and sourcing strategies to mitigate cost inflations and avoid tariff penalties. This realignment is not only increasing operational complexities but also impacting delivery timelines and inventory management for companies deeply reliant on just-in-time supply methodologies. Businesses are now prioritizing diversification of suppliers, increased inventory buffers, and stronger risk assessment frameworks to maintain continuity and competitiveness in a volatile trade environment.

Market stability in Asia-Pacific remains fragile as tariffs indirectly exacerbate price fluctuations and demand uncertainties. Economies dependent on export-led growth face the dual challenge of protecting domestic industries while preserving access to key markets. The ripple effects extend to sectors such as electronics, automotive, and agriculture, where tariff-induced cost pressures are passed down to consumers and retailers, further influencing purchasing behavior. The table below summarizes the immediate supply chain challenges juxtaposed with strategic responses observed in the region:

| Supply Chain Challenge | Regional Strategic Response |

|---|---|

| Rising import costs | Shifting to local suppliers |

| Delays in cross-border shipments | Investing in alternative logistics routes |

| Inventory shortages | Building larger safety stocks |

| Uncertainty in demand forecast | Enhanced market analytics and flexibility |

Strategic Recommendations for Businesses Navigating Tariff Challenges

To effectively counteract the ripple effects of tariffs imposed under the previous U.S. administration, businesses must prioritize diversifying supply chains beyond traditional Asia-Pacific hubs. Leveraging emerging markets within Southeast Asia and South Asia can reduce dependency on tariff-sensitive regions and foster resilience against future geopolitical shifts. Companies should also invest in advanced data analytics, enabling real-time monitoring of tariff fluctuations and aligning procurement strategies accordingly to optimize costs. Emphasizing agility, agility in contractual agreements and inventory management will be crucial to adapt swiftly to evolving trade regulations.

Additionally, firms should implement a multi-layered strategy by incorporating:

- Proactive lobbying and engagement with policymakers to stay ahead of regulatory changes.

- Enhanced cost modeling that factors in tariff impacts and alternative sourcing expenses.

- Focus on product innovation to develop tariff-exempt or lower-duty goods.

| Strategic Focus | Key Action | Expected Benefit |

|---|---|---|

| Supply Chain Diversification | Shift sourcing to Southeast Asia | Reduced tariff exposure |

| Real-Time Data Analytics | Monitor tariff changes instantly | Agile procurement decisions |

| Policy Advocacy | Engage with It looks like your content is clipped at the end, specifically at the last table row under “Policy Advocacy.” If you’d like, I can help you complete or refine the last part of the table or assist with any other edits to the section. Here’s a possible continuation and completion for the last row based on the style and content you’ve provided: | |

| Policy Advocacy | Engage with policymakers proactively | Influence favorable trade regulations |