Asia-Pacific Markets Surge Amid Concerns on Fed’s Rate Cut Prospects

As global financial landscapes continue to react to shifting economic signals, the Asia-Pacific markets have displayed a notable upward trajectory, buoyed by investor optimism in the face of uncertainties surrounding the U.S. Federal Reserve’s interest rate policies. Recent reports indicate growing trepidation over the Fed’s potential rate cuts, prompting market participants across the region to reassess their positions amidst fluctuating global economic conditions. This surge underscores a complex interplay of regional economic indicators, geopolitical tensions, and broader trends within international markets. In this article, we delve into the recent performance of Asia-Pacific markets, explore the implications of anticipated Federal Reserve policies, and analyze how these dynamics are shaping investor sentiment in the current economic climate.

Asia-Pacific Markets Experience Upward Momentum Amid Fed Rate Cut Speculations

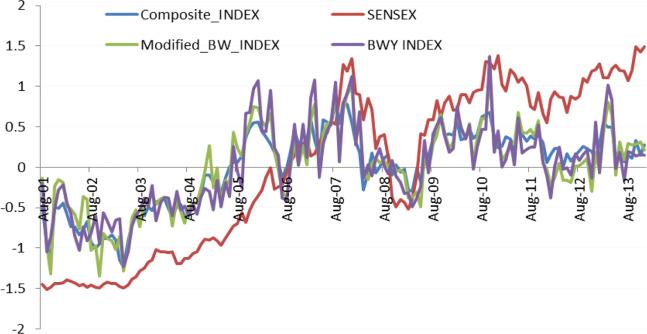

The Asia-Pacific markets have exhibited a robust upward trajectory as investors respond positively to renewed speculations regarding potential interest rate cuts by the Federal Reserve. Following recent statements from Fed officials hinting at a more accommodative monetary policy, traders are recalibrating their expectations, driving stock indices higher across the region. Major markets, including Japan’s Nikkei 225 and Australia’s ASX 200, saw notable gains, buoyed by the prospect of cheaper borrowing costs fostering consumer spending and business investments.

As the sentiment grows more optimistic, various sectors are benefiting from this momentum. Key industries such as technology and consumer discretionary are at the forefront, attracting substantial capital inflows. Analysts highlight several factors contributing to this uplift:

- Increased liquidity due to anticipated rate cuts

- Positive macroeconomic indicators, including resilient consumer spending

- Strong corporate earnings reports providing a solid backdrop for growth

| Market Index | Change (%) | Closing Value |

|---|---|---|

| Nikkei 225 | 1.8 | 29,734 |

| ASX 200 | 1.5 | 6,875 |

| Hang Seng Index | 1.2 | 24,555 |

Investor Sentiment: Navigating the Impact of Potential Monetary Policy Shifts

Investor sentiment in the Asia-Pacific region is being markedly influenced by the uncertainty surrounding potential monetary policy shifts, particularly in light of the Federal Reserve’s recent discussions on rate cuts. As markets react to these looming changes, many investors are weighing the implications of lower interest rates, which could spur borrowing and spending but might also signal concerns over economic growth. The prospect of a Fed pivot has elicited a mixed response, with optimism among certain sectors countered by caution and volatility elsewhere.

In this evolving landscape, key factors contributing to investor sentiment include:

- Market Liquidity: Anticipation of increased liquidity from rate cuts may encourage bullish behavior.

- Geopolitical Factors: Ongoing tensions in trade relations and regional stability can amplify market volatility.

- Corporate Earnings Reports: Strong earnings can bolster investor confidence, particularly if they contrast sharply with broader economic concerns.

| Indicator | Current Status |

|---|---|

| Interest Rate Outlook | Potential Cuts Anticipated |

| Market Reaction | Mixed Sentiments |

| Investor Confidence | Shifting Dynamics |

Sector Performance: Key Industries Benefiting from Market Optimism

Recent trends reveal that various industries are experiencing a remarkable uplift as market participants look past Fed rate cut uncertainties. Technology, consumer discretionary, and financial services are at the forefront, benefitting from renewed investment sentiment. The tech sector is fueled by innovation and shifts toward digital transformation, driving demand for software and cloud solutions. Meanwhile, consumer discretionary is seeing positive momentum as spending rises, reflecting increased consumer confidence amid economic recovery.

Additionally, infrastructure and green energy sectors are capturing attention as governments ramp up spending to drive economic growth, particularly through sustainable initiatives. These sectors are expected to see considerable inflows as investors seek long-term growth opportunities. The table below outlines the current performance metrics of these key industries:

| Industry | Current Performance | Projected Growth (%) |

|---|---|---|

| Technology | +12.5% | 15% |

| Consumer Discretionary | +9.8% | 10% |

| Financial Services | +7.2% | 8% |

| Infrastructure | +11.0% | 12% |

| Green Energy | +13.3% | 20% |

Strategic Investment Recommendations for Navigating Market Volatility

Amid heightened market volatility driven by speculation regarding the Federal Reserve’s interest rate policies, investors must consider strategic avenues to safeguard their portfolios. Diversification remains a key principle; allocating assets across various sectors and geographic regions can mitigate risk and enhance potential returns. Focus on sectors that typically exhibit stability during turbulent times, such as utilities, consumer staples, and healthcare, which often perform well irrespective of economic fluctuations. Additionally, consider incorporating defensive stocks or low-volatility ETFs that provide a cushion against sharp market downturns while still offering modest growth opportunities.

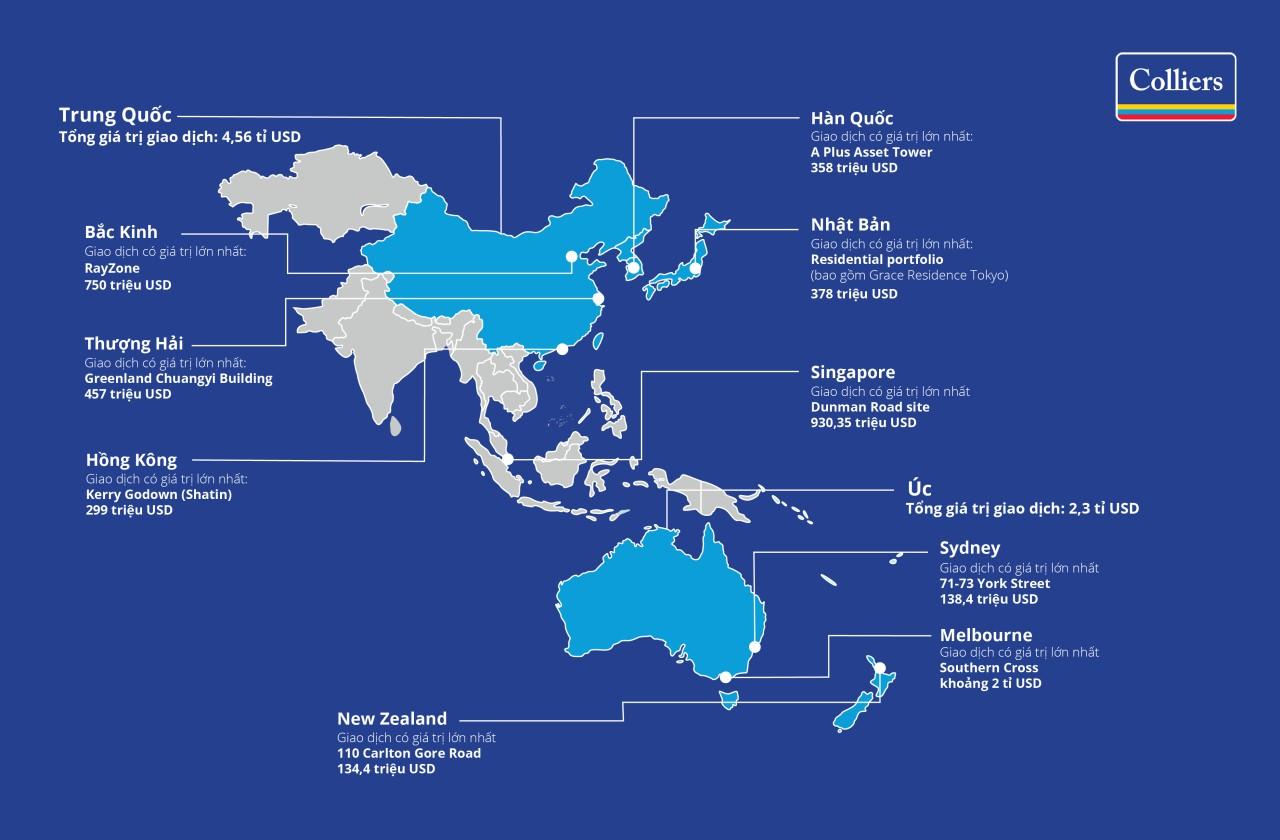

Furthermore, keeping an eye on emerging markets within the Asia-Pacific region can provide significant upside potential. Countries like India, Vietnam, and Indonesia are increasingly becoming attractive due to their robust economic fundamentals and young demographics. Here’s a snapshot of sectors worth exploring:

| Sector | Key Focus |

|---|---|

| Technology | Innovative startups and strong digital infrastructure |

| Renewable Energy | Investment in solar and wind energy initiatives |

| Consumer Goods | Brands catering to a growing middle class |

By adopting a balanced and forward-looking investment approach, participants in the Asia-Pacific markets can strategically position themselves to navigate ongoing volatility while seizing growth opportunities. Active monitoring of economic indicators and geopolitical developments will further aid investors in making informed decisions as the market landscape continues to evolve.

Global Implications: How Fed Decisions Affect Regional Economic Stability

The decisions made by the Federal Reserve ripple far beyond the borders of the United States, playing a crucial role in shaping regional economic stability across the globe. As the Fed signals potential rate cuts, particularly amid inflationary pressures and economic uncertainties, markets worldwide respond with heightened volatility. Investors and policymakers in the Asia-Pacific region are particularly attuned to these developments, as changes in U.S. interest rates can greatly influence foreign exchange rates, capital flows, and even domestic monetary policies. This interconnectedness necessitates a proactive approach from regional central banks to mitigate any adverse impacts stemming from Fed actions.

Countries in the Asia-Pacific are already experiencing the consequences of these decisions. With the prospect of lowered rates in the U.S., Asian markets often see a surge in investment inflows, which can lead to currency appreciation and asset inflation. However, this can also cause concern around asset bubbles and financial imbalances. Hence, regional economies must navigate this dual-edged scenario carefully. Key factors at play include:

- Capital Mobility: Increased movement of funds can lead to rapid changes in stock and real estate markets.

- Exchange Rate Fluctuations: Currency strength can impact export competitiveness.

- Inflationary Pressures: Higher capital flows may exacerbate inflation in already booming economies.

| Key Impacts | Economic Consequences |

|---|---|

| Increased Investment Inflows | Boosts local markets but may lead to value overestimation. |

| Currency Appreciation | Impacts export-driven economies negatively. |

| Global Economic Synchronization | Heightens the dependence on U.S. economic health. |

To Wrap It Up

the recent surge in Asia-Pacific markets reflects a complex interplay of investor sentiment, economic indicators, and ongoing speculation surrounding the Federal Reserve’s interest rate policies. As market players navigate these uncertainties, the potential for a rate cut has stirred both optimism and caution among stakeholders across the region. Attention will invariably shift to upcoming economic data and central bank communications that could further influence market dynamics. As developments unfold, staying informed will be crucial for investors looking to capitalize on opportunities while managing risks. The Asia-Pacific financial landscape remains vibrant and ever-evolving, reinforcing its significance on the global stage.