In response to the extensive sanctions placed on Russia following its actions in Ukraine, Asian nations are rapidly adjusting their energy strategies to ensure a steady supply of crude oil. With traditional procurement channels becoming limited, countries throughout Asia are intensifying efforts to compensate for the significant reduction in Russian oil exports caused by global restrictions. This article examines the complex dynamics of the Asian oil market, highlighting how nations such as China and India are seeking alternative sources for crude oil, the effects on global oil prices, and the wider geopolitical consequences of this shift in energy sourcing. As global energy landscapes continue to transform, Asia’s proactive measures may not only reshape its approach to energy security but also impact future trends within the international oil market.

Asia’s Energy Realignment: Seeking New Oil Supplies

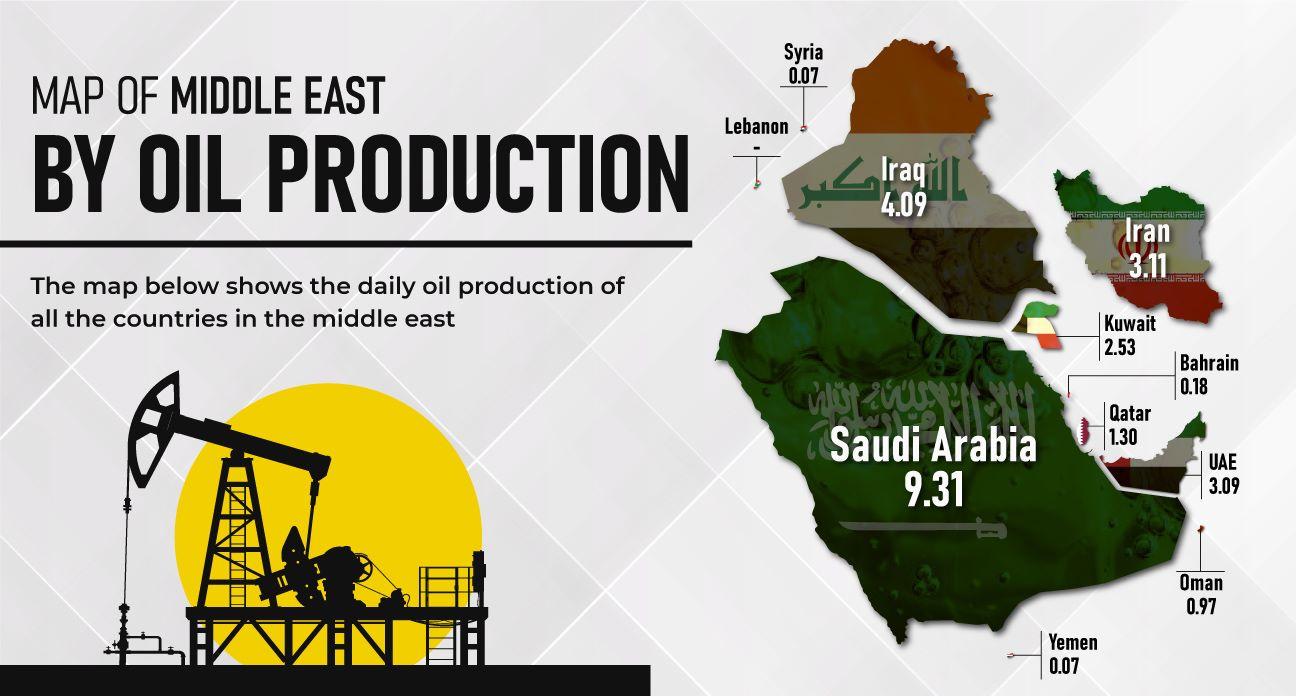

As Asian countries navigate the repercussions of sanctions against Russian crude oil, a noticeable strategic transformation is taking place across the continent. Major economies are actively pursuing new sources of oil to diversify their energy dependencies and mitigate potential disruptions. Leading players like India and China are at the forefront of this initiative, forging agreements with resource-rich nations in Africa and the Middle East to secure their energy requirements. The urgency is amplified by escalating global oil prices and a pressing need for stable supply chains, prompting these countries to quickly adapt their purchasing strategies.

This evolving landscape has led to new partnerships characterized by unprecedented long-term contracts. Nations are exploring various avenues including:

- Increasing imports from Saudi Arabia and UAE

- Boosting purchases from West African producers

- Cultivating renewable energy collaborations

The shift towards alternative sources is illustrated in this data table:

| Country | New Oil Source | Contract Duration |

|---|---|---|

| India | Saudi Arabia | 5 years |

| China | <Nigeria |

3 years < tr > < td > Japan < / td > < td > UAE < / td > < td > 4 years< / td > < / tr >

p>This strategic realignment not only bolsters energy security but also positions Asia as a crucial player within an evolving global oil market amidst shifting geopolitical circumstances.

Market Dynamics: Adaptation Strategies Among Asian Nations Facing Supply ShortagesThe changing geopolitical environment has prompted rapid adjustments among Asian nations regarding their energy strategies due to sanctions on Russian crude oils. Countries such as India, China, along with several Southeast Asian states are enhancing their energy security through diversification of crude supplies. This transition involves increased imports from regions like Africa and Latin America that allow these nations access amid restricted availability from Russia’s resources. The rising demand for alternative suppliers has catalyzed intensified negotiations leading toward long-term agreements that foster stronger bilateral ties with both established and emerging exporting countries. Nations have also begun investing significantly into local refining capabilities while promoting innovation within various sectors related to clean technologies through initiatives such as:

Additionally some governments explore establishing strategic reserves which can be utilized during crises ensuring stability remains intact despite fluctuations occurring globally; thus demonstrating proactive measures taken not merely aimed at surviving disruptions but emerging resiliently amidst changing dynamics surrounding worldwide energies. Middle Eastern Producers’ Role In Addressing Supply Gaps < p > The international landscape concerning energies has undergone substantial changes particularly after implementing restrictions against Russian petroleum products . Middle eastern producers endowed with vast reserves alongside well-established infrastructures find themselves ideally positioned stepping into voids left behind . Nations including Saudi Arabia , Iraq , & United Arab Emirates possess capacities enabling them increase outputs while maintaining stability across supplies directed towards asian markets . Their geographical proximity coupled logistical advantages allows these states fill gaps effectively transitioning into pivotal roles reshaping economic structures where demands continue surging .

To grasp underlying dynamics involved it’s essential consider economic implications arising out shifts occurring here . These middle eastern entities leverage wealth generated via hydrocarbons enhancing trade relations throughout asia especially amongst eager participants like china & india looking diversify options available when sourcing energies needed . Benefits extend beyond mere provision facilitating broader cooperation opportunities economically speaking too ; key contributors include :

This evolving scenario necessitates nuanced understanding pricing trends export patterns along geopolitical influences shaping markets today ; interplay between supply/demand likely dictate future relationships making it imperative stakeholders remain informed about ongoing changes impacting sourcing practices involving crudes moving forward .

Moreover realigning supply chains expected introduce volatility complicating logistics increasing transport expenses incurred during transitions undertaken replacing russian sourced materials initially faced disruptions however longer term outcomes could yield greater stability achieved via diversifying origins sought after ! A quick glance reveals potential scenarios ahead: |