Azerbaijan has reported that British oil giant BP produced a total of 12.9 million metric tons (mmt) of oil in the country from January to September 2024, underscoring the company’s pivotal role in the nation’s energy sector. The production figures, disclosed amid ongoing developments in the Caspian region’s oil industry, highlight strong output levels despite global market uncertainties. This update provides valuable insight into Azerbaijan’s oil performance and BP’s operational footprint, as detailed in a recent TradingView report.

Azerbaijan Reports Strong Oil Output by BP in the First Three Quarters

BP’s operations in Azerbaijan have demonstrated robust performance during the first nine months of the year. According to official records, the company successfully extracted 12.9 million metric tons (mmt) of oil from the region, marking a significant contribution to both local and global energy supplies. This production level highlights the continued importance of Azerbaijan as a key player in the oil sector, particularly through its strategic partnership with BP. The sustained output underscores the effectiveness of ongoing field development and investment in advanced extraction technologies.

Key highlights of BP’s oil output in Azerbaijan include:

- Consistent production above forecasted targets

- Strong operational efficiency leading to optimized resource use

- Collaboration with local stakeholders to ensure sustainable exploration

| Period | Oil Production (mmt) | Production Change (%) |

|---|---|---|

| Q1 2024 | 4.2 | +3.5% |

| Q2 2024 | 4.3 | +4.0% |

| Q3 2024 | 4.4 | +4.5% |

Implications of Azerbaijan’s Oil Production on Regional Energy Markets

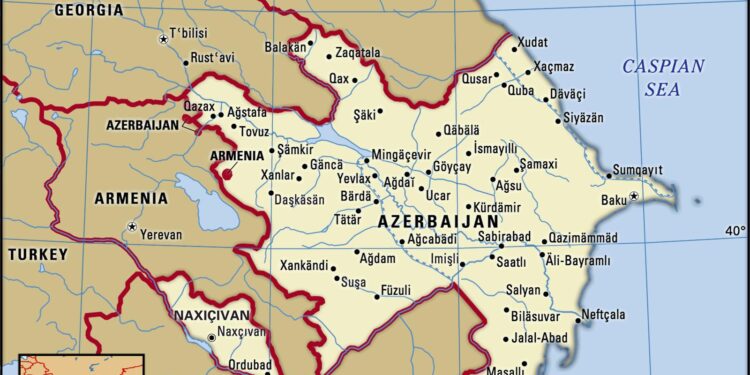

Azerbaijan’s robust oil output of 12.9 million metric tonnes between January and September, as reported by BP, has notably reinforced its position within the regional energy landscape. This substantial production volume is pivotal in stabilizing supply amid fluctuating global oil demands, particularly in the Caspian and Caucasus regions. Analysts observe that Azerbaijan’s consistent contribution not only supports domestic economic growth but also offers a strategic buffer for neighboring countries dependent on imported hydrocarbons. Key implications include:

- Enhanced energy security for South Caucasus countries through diversified supply routes.

- Increased bargaining power for Azerbaijan in regional energy partnerships and negotiations.

- Stimulus for infrastructural development, with expansions in pipeline networks like Baku-Tbilisi-Ceyhan (BTC).

Moreover, Azerbaijan’s output figures encourage a recalibration of regional energy market strategies, particularly among European and Central Asian consumers seeking alternatives to traditional suppliers. The following table outlines the comparative oil production trends of key regional players, illustrating Azerbaijan’s competitive edge:

| Country | Oil Production (MMT, Jan-Sept) | Year-on-Year Growth |

|---|---|---|

| Azerbaijan | 12.9 | +5.2% |

| Kazakhstan | 18.5 | +2.8% |

| Russia (South Region) | 25.1 | +1.5% |

| Turkmenistan | 8.3 | -0.9% |

Strategies for Investors Amid Rising Oil Supply from Azerbaijan

Investors should recalibrate their portfolios in response to the recent surge in oil production reported from Azerbaijan, where BP’s output reached 12.9 million metric tonnes in the first nine months of the year. This uptick in supply adds a layer of complexity to global oil markets already grappling with volatility. Strategic diversification is crucial, focusing on sectors that may benefit indirectly from stable or lower energy prices, such as manufacturing and transportation. Additionally, staying alert to geopolitical shifts in the Caspian region can provide early signals for market adjustments.

In light of these developments, risk management frameworks should incorporate the following approaches:

- Monitoring supply chain dynamics: Assess how increased Azerbaijani oil exports affect regional infrastructure and logistics.

- Hedging with derivatives: Use futures and options to protect portfolios against unexpected price movements.

- Exploring renewable alternatives: Invest selectively in clean energy initiatives to balance fossil fuel exposure.

| Investment Focus | Potential Impact | Recommended Action |

|---|---|---|

| Oil & Gas Stocks | Short-term pressure on prices | Implement stop-loss limits |

| Renewables | Long-term growth potential | Increase allocation |

| Logistics & Transport | Benefit from lower fuel costs | Identify undervalued equities |

In Retrospect

In summary, Azerbaijan’s announcement that BP produced 12.9 million metric tons of oil from January to September underscores the continued significance of the country’s hydrocarbon sector in the regional energy landscape. As BP maintains its pivotal role in Azerbaijan’s oil production, market observers will closely watch upcoming output figures and geopolitical developments that may influence future trends. This data not only reflects current production capabilities but also highlights Azerbaijan’s strategic importance to global energy markets.