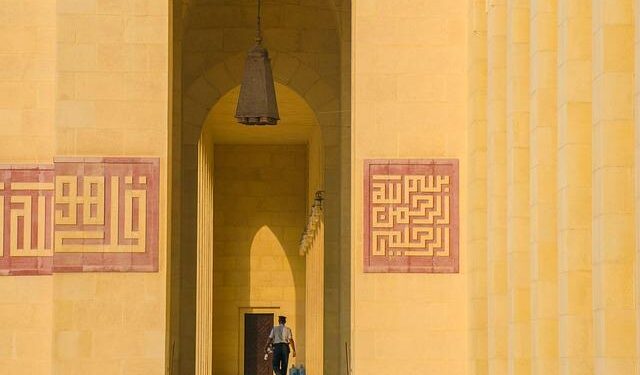

In a testament to its burgeoning financial technology landscape, Bahrain has made a significant mark in the Middle East’s dynamic fintech ecosystem, as highlighted by Forbes’ recent list of the region’s top 50 fintech companies. With a robust regulatory framework adn a forward-thinking approach, Bahrain is rapidly establishing itself as a formidable hub for innovative financial solutions. Recognizing the trailblazers leading this charge, Forbes has spotlighted several Bahraini fintech stars that embody the spirit of innovation and entrepreneurship essential to the industry’s growth. This article delves into the achievements of these key players, exploring how they are redefining financial services in the Gulf region and contributing to Bahrain’s reputation as a leader in fintech innovation.

Bahrain Emerges as a Fintech Hub in the Middle East

Bahrain’s strategic geographical location and progressive regulatory framework have catalyzed its transformation into a vibrant fintech hub within the MENA region. A confluence of innovation and financial acumen has led to the emergence of several fintech companies that are redefining customary banking and financial services. Notable homegrown startups have garnered attention on platforms like Forbes, showcasing their potential and positioning Bahrain as a fertile ground for tech-driven financial solutions. With initiatives such as the Bahrain Fintech Bay, stakeholders in the ecosystem can access a collaborative space designed to foster creativity and technological advancement.

This dynamic surroundings is complemented by government support, which has played a pivotal role in nurturing the fintech ecosystem. Key players in the sector highlight the importance of regulatory sandbox initiatives that encourage experimentation and innovation without the confines of traditional regulations. Noteworthy contributors to Bahrain’s fintech landscape include:

- Rain - The first licensed cryptocurrency exchange in the Gulf region.

- Tarabut Gateway – A platform that facilitates open banking and enhances customer experiences.

- StashAway – A robust digital wealth management platform catering to diverse investor needs.

Highlighting Innovative Startups Among Forbes’ Top Fintech 50

Bahrain is making remarkable strides in the fintech landscape, and its portrayal in Forbes’ esteemed list underscores this transformation. This year’s selection highlights a diverse group of innovative startups that are redefining how financial services are perceived and executed. Among these standout companies,several are pioneering advancements that not only cater to the local market but also resonate on a global scale.

- Fawry - Revolutionizing payment solutions with an emphasis on accessibility.

- Beet - Enabling seamless money transfers with cutting-edge technology.

- Fintech Galaxy – Accelerating fintech growth through collaboration and innovation.

These startups are pushing the envelope by integrating emerging technologies such as AI and blockchain, ensuring their products are not only efficient but also secure. The underlying ambition shared by these companies is to foster financial inclusion and streamline operations throughout the region.

| Startup | Key Innovation | Impact Area |

|---|---|---|

| Fawry | Accessible payment systems | Retail & E-commerce |

| Beet | Instant money transfers | Remittance |

| Fintech Galaxy | Fintech hub for collaboration | Startup ecosystem |

Key Trends Shaping Bahrain’s Fintech Landscape

Bahrain has emerged as an influential player in the fintech arena, showcasing a blend of innovation and regulatory support that is redefining financial services in the region. The government’s commitment to a digital economy has paved the way for fintech startups, particularly those focusing on blockchain technology, payment solutions, and regulatory technology (RegTech). This environment has attracted not only local entrepreneurs but also international firms looking to tap into Bahrain’s strategic position as a financial hub in the Middle East.

Key players in Bahrain’s fintech sector are increasingly prioritizing collaboration with traditional financial institutions, creating an ecosystem that enhances service delivery and customer experience. the rise of open banking initiatives has also been notable, as banks and fintech firms synergize their strengths to provide tailored financial products. additionally,the increasing adoption of artificial intelligence (AI) for analytics and customer service enhancement is revolutionizing how financial services are delivered to businesses and consumers alike. The following table highlights some standout trends currently shaping the landscape:

| Trend | Description |

|---|---|

| Regulatory Support | Proactive regulations fostering fintech innovation and security. |

| funding Growth | Increased investment in startups, attracting venture capital. |

| Digital Wallets | Rising popularity and usage of mobile payment solutions among consumers. |

| Cybersecurity Focus | Enhanced measures to protect data and build consumer trust. |

regulatory Support and its Impact on Fintech Growth

Bahrain has emerged as a beacon of innovation in the fintech landscape, largely attributed to a proactive regulatory environment that fosters growth and creativity. The Central Bank of Bahrain (CBB) has implemented various initiatives that streamline processes for startups, allowing them to navigate the complex regulatory landscape with greater ease. This supportive infrastructure includes initiatives such as:

- Sandbox Environments: Offering startups a controlled space to trial their products without the burdensome compliance hurdles faced by established financial institutions.

- Regulatory Clarity: Providing clear guidelines that help fintech companies understand compliance requirements while innovating.

- Incentives for Investment: Attracting venture capital through favorable conditions to encourage the influx of funding into the local fintech scene.

The positive impact of these regulatory measures is evident in the recent recognition of several Bahrain-based fintech companies in Forbes’ Middle East Fintech 50 list. The continued investment in regulatory frameworks is crucial, as it not only enhances the confidence of local startups but also positions Bahrain as a competitive hub for foreign fintech firms. The collaborative approach between governmental bodies and the private sector encourages a thriving ecosystem where innovation can flourish amidst a foundation of security and trust. This harmonious relationship cultivates a dynamic market, leading to the emergence of groundbreaking solutions that are set to revolutionize the financial services industry.

Strategies for Leveraging Investment Opportunities in Bahrain’s Fintech Sector

Bahrain’s fintech sector has emerged as a vibrant hub for innovation and investment, attracting both local and international players eager to capitalize on its growth. Investors looking to tap into this burgeoning market should focus on understanding the unique regulatory environment that supports fintech initiatives. Key considerations include:

- Regulatory Framework: Familiarize yourself with the Central Bank of Bahrain’s guidelines that facilitate fintech operations.

- Networking Opportunities: Engage with local incubators and accelerator programs that connect investors with startups poised for growth.

- Market Trends: Stay updated with emerging technologies such as blockchain and AI that are reshaping the financial landscape.

Moreover, aligning with Bahrain’s strategic vision can provide additional benefits. The government’s commitment to fostering a diversified economy means that fintech companies are well-positioned for long-term success. Consider these approaches to maximize your investment potential:

| Investment Approach | Benefits |

|---|---|

| Venture Capital Involvement | Access to early-stage startups with high growth potential. |

| Collaborative Partnerships | Leverage synergies with established firms to co-develop innovative solutions. |

| Government Grants and Incentives | Utilize financial support aimed at encouraging tech advancements. |

Future prospects for Fintech Entrepreneurs in Bahrain and Beyond

The recent recognition of Bahrain’s fintech innovators in the Forbes Middle East fintech 50 highlights the country’s advancing role as a burgeoning fintech hub. This accolade not only reflects the remarkable strides made by local startups but also positions Bahrain at the forefront of the financial technology revolution in the region. As the global financial landscape evolves, Bahrain entrepreneurs are uniquely positioned to capitalize on several emerging trends that could shape the future of fintech, including:

- Regulatory Support: The Central Bank of Bahrain’s proactive regulatory framework encourages innovation and fosters a secure environment for fintech startups.

- Investment Opportunities: Increased venture capital interest in the region opens new avenues for funding and collaboration.

- Technological Advancements: The adoption of AI, blockchain, and cryptocurrency offers fintech companies diverse tools to enhance service delivery.

Moreover, as Bahrain embraces its strategic location within the Gulf Cooperation Council (GCC) and its commitment to digital transformation, it is becoming an attractive entry point for global fintech players looking to expand in the Middle East. A collaborative ecosystem is emerging, driven by partnerships between established banks and agile startups, which fosters innovation and drives economic growth.Key factors for success in this landscape include:

| Factor | Description |

|---|---|

| Innovation | Developing unique solutions that address market gaps |

| Adaptability | Ability to quickly respond to regulatory changes and market needs |

| Networking | Building relationships with stakeholders across the fintech ecosystem |

To Wrap It Up

As Bahrain continues to solidify its reputation as a burgeoning fintech hub in the Middle East, the recognition of its leading innovators in Forbes’ Middle East fintech 50 further highlights the kingdom’s commitment to fostering a dynamic financial ecosystem. The diverse range of companies making the list not only showcases the entrepreneurial spirit prevalent in Bahrain but also emphasizes the vital role of technology in shaping the future of finance. With supportive regulations and a proactive approach to digital transformation, Bahrain is poised to lead the region in fintech advancements. As these stars ascend, they pave the way for new innovations, partnerships, and opportunities, setting the stage for a promising future in the global fintech landscape. As we look ahead, the spotlight remains on these trailblazers as they continue to redefine the limits of what is possible in financial technology.