In an era where mass tourism has become both a boon and a burden for popular destinations,the global conversation around lasting travel is gaining momentum. Following in the footsteps of countries like Italy, Spain, Bhutan, Greece, and Thailand, Indonesia is now contemplating the implementation of a travel tax aimed at regulating the influx of visitors to its celebrated tourist haven, Bali. This initiative seeks not onyl to alleviate the pressures of over-tourism but also to generate funds for infrastructure development and environmental preservation. As Bali grapples wiht the environmental and social impacts of its immense popularity,this potential tax highlights the growing need for a balanced approach to tourism that prioritizes the well-being of both local communities and natural landscapes. In this article, we explore the details of Bali’s proposed travel tax, its implications for travelers and local stakeholders, and the broader trend towards responsible tourism worldwide.

Travel Tax Initiatives in Bali: A Response to Unsustainable Mass Tourism

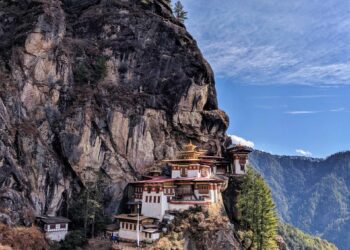

Bali, often referred to as the “Island of the Gods,” has become a victim of its own popularity, facing challenges stemming from the excessive influx of tourists. To address this pressing issue, local authorities are considering the implementation of a travel tax aimed at regulating visitor numbers and ensuring sustainable tourism practices. the proposed tax could serve as a mechanism to fund infrastructure improvements, environmental conservation efforts, and community development programs that benefit both locals and the ecosystem. This initiative aligns with global trends, where destinations like Bhutan and Spain have successfully introduced similar measures to combat the adverse effects of mass tourism.

The specifics of the travel tax being discussed in Bali involve several key components:

- Fee Structure: A tiered system may be implemented, where the tax amount varies based on the length of stay and type of accommodation.

- Usage of Funds: Revenue generated from the tax is envisioned to directly support local projects focused on waste management,wildlife protection,and cultural preservation.

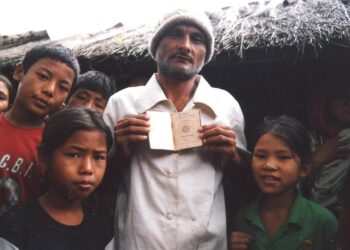

- Community Engagement: Local stakeholders will have a voice in determining priorities for tax revenue allocation, ensuring that the needs of residents are met.

while the details are still being ironed out, the discussions mark a important step towards achieving a balanced approach to tourism in Bali, where the well-being of both visitors and locals can coexist harmoniously. Stakeholders hope that this initiative will not only lessen the environmental impacts of tourism but also foster a more enriching experience for tourists eager to explore Bali’s rich cultural heritage.

Comparative Analysis of Travel Tax Policies in Global Destinations

the discussion surrounding travel tax policies has gained momentum as various destinations strive to manage the effects of mass tourism. Countries like Italy and Spain have implemented visitor taxes to enhance local infrastructure and preserve cultural heritage. These taxes are often minimal but can contribute considerably to local economies. As an example, Bali, known for its breathtaking landscapes and vibrant culture, is exploring similar measures to limit tourist numbers while ensuring that the island’s ecosystem is protected. By instituting a travel tax, Indonesian authorities hope to promote sustainable tourism practices while maintaining the allure of Bali as a top tourist attraction.

comparing travel tax approaches across different regions reveals a range of strategies aimed at striking a balance between economic benefit and environmental protection. Some key aspects include:

- Rate Structure: Varies from flat fees to percentage-based charges.

- Usage of Funds: Often earmarked for infrastructure,environmental protection,and cultural preservation.

- tourist Engagement: Many destinations involve stakeholders in the process to promote transparency.

| Destination | Travel Tax Rate | Fund Usage |

|---|---|---|

| Italy | €2 – €7 per night | City services, cultural sites maintenance |

| Spain | €1 – €3 per night | Local development, public transport |

| Bali, Indonesia | Proposed $10 | Environmental conservation, infrastructure |

Impact of Travel Taxes on Local Economies and Community Well-being

The implementation of travel taxes has sparked discussions across various tourist destinations, highlighting its dual role in regulating mass tourism while together impacting local economies and community well-being. by imposing taxes on travelers, regions aim to manage visitor overflow, which can stretch infrastructure and resources thin. Communities frequently enough embrace these measures as a means to fund essential services,allowing for improved public amenities,environmental conservation efforts,and the preservation of cultural heritage. However, there’s a delicate balance to maintain; if taxes become excessive, they may deter potential tourists, later impacting local businesses dependent on tourism revenue.

In places like Bali, where tourism forms a core element of the economy, the conversation around travel taxes unveils a broader narrative about sustainability.Local stakeholders have expressed benefits such as:

- Enhanced funding for health and education services

- A more sustainable approach to tourism that prioritizes community needs over sheer numbers

- Opportunities for local businesses to flourish without overwhelming tourist traffic

However, there exists a concern that higher costs for travelers might lead to a shift toward less sustainable tourism models or attract a different demographic of visitors.Thus, as destinations contemplate travel taxes, they must engage in thorough dialogues with residents and stakeholders to ensure that such policies are truly beneficial for both the economy and the community’s overall quality of life.

Recommendations for Sustainable Tourism Practices in Bali and Beyond

To mitigate the adverse effects of mass tourism in Bali and other destinations,a collaborative approach involving governments,stakeholders,and tourists is essential.Responsible behavior begins with education: visitors should be informed about local customs, environmental preservation, and the importance of supporting local economies. Implementing a travel tax can generate funds for conservation efforts, infrastructure, and community programs. This ensures that tourism contributes positively to the destination while minimizing its ecological footprint. Additional strategies might include:

- Promoting eco-friendly accommodations that prioritize sustainability.

- Encouraging visitors to participate in community-based tourism activities.

- Implementing regulations to manage tourist flows, especially in sensitive areas.

- Offering incentives for tourists who engage in sustainable practices, like reducing single-use plastics.

Moreover, fostering partnerships between local businesses and tourism boards can empower communities while enhancing visitor experiences. The development of eco-certification programs for businesses can encourage sustainable practices in tourism-related services. By investing in infrastructure that supports public transportation,waste management,and renewable energy sources,destinations can reduce their carbon footprint. Below is a sample framework for sustainable tourism initiatives:

| Initiative | Description |

|---|---|

| Green Certifications | Encourages local businesses to adopt sustainable practices through certification. |

| Community Involvement | programs that allow tourists to engage with local cultures and contribute to community welfare. |

| Waste Reduction Campaigns | Encouraging businesses and tourists to minimize waste, especially plastic. |

The Role of Government and Stakeholders in Shaping Travel Tax Frameworks

Government and stakeholders play a pivotal role in formulating effective travel tax policies aimed at managing the influx of tourists and ensuring sustainable tourism practices. Through strategic legislation, governments can implement taxes that directly address the challenges posed by mass tourism, encouraging responsible travel behavior among visitors.The involvement of local governments,tourism boards,and community organizations is essential,as they provide valuable insights into the unique needs and characteristics of their destinations. By collaborating, these entities can develop a travel tax framework that balances economic benefits with environmental preservation and cultural integrity.

Furthermore, stakeholder engagement is crucial in the transparency and acceptance of travel tax measures. Tour operators, hospitality providers, and local businesses must be included in discussions to assess the potential impact of taxes on the overall tourism ecosystem. Key factors to consider include:

- Economic sustainability: Ensuring that taxes contribute positively to local economies.

- Environmental impact: Using tax revenue for conservation and infrastructure enhancements.

- Visitor experience: Maintaining a welcoming atmosphere while managing tourist volumes.

Properly leveraging stakeholder expertise can lead to innovative approaches in tax implementation that not only address immediate issues but also promote long-term strategic goals for tourism sustainability in sought-after destinations like Bali.

Visitor Perspectives: Balancing Enjoyment and Environmental Responsibility

As travelers flock to idyllic destinations like Bali, many visitors are confronted with a dilemma: how to embrace the beauty and charm of these places while ensuring their adventures do not contribute to environmental degradation. With mass tourism leading to overcrowding and increased waste, it is crucial for tourists to adopt a mindset that prioritizes sustainability. Key strategies to achieve this balance include:

- Choosing eco-Friendly Accommodations: Opt for hotels and resorts committed to sustainable practices, such as waste reduction and energy efficiency.

- Supporting local Economies: Engage with local artisans and vendors to ensure that tourism dollars benefit the community directly.

- Mindful Exploration: Participate in responsible tours that prioritize low impact activities, such as hiking rather than motorized excursions.

- Participating in conservation Efforts: Take part in local environmental initiatives, such as beach clean-ups or wildlife protection programs.

Furthermore, the implementation of travel taxes in popular tourist destinations aims to address the environmental challenges associated with mass tourism. By levying a small fee on visitors, governments can fund essential conservation projects and infrastructure improvements that protect natural resources and public spaces. A recent analysis comparing proposed travel taxes and environmental investments illustrates the potential impact:

| Destination | Proposed Travel Tax | Projected Environmental Fund Allocation |

|---|---|---|

| Bali | $5 | Reforestation Projects |

| Thailand | $10 | Marine Conservation |

| Greece | $7 | cultural Heritage Restoration |

Final Thoughts

as various tourist hotspots around the globe grapple with the implications of mass tourism, Bali’s discussions on implementing a travel tax signify a growing trend towards sustainable travel practices. Following in the footsteps of countries like Italy, Spain, Bhutan, Greece, and Thailand, which have also introduced measures to manage visitor impact on their unique environments and cultures, Bali’s initiative reflects a pivotal shift in how popular destinations are addressing the challenges posed by overwhelming tourist numbers. This proposed tax is not merely a financial mechanism but rather a proactive step aimed at preserving the island’s natural beauty and cultural heritage for future generations. As travelers become increasingly mindful of their environmental footprint, such measures may pave the way for a new era in tourism—one that balances economic benefits with responsible stewardship of our planet’s most cherished destinations. As Bali navigates this pivotal moment, it sets a precedent for other locations facing the same challenges, reinforcing the critical message that sustainable tourism is not just an option; it is a necessity.