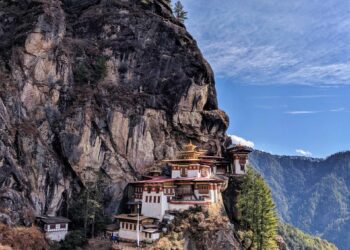

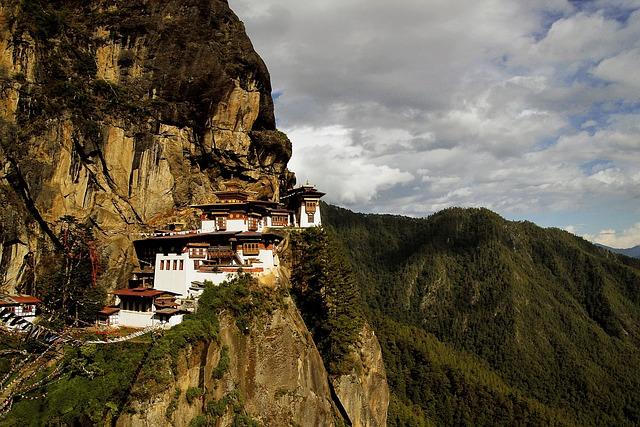

bhutan Establishes Strategic Bitcoin Reserve: A New Chapter in Cryptocurrency Adoption

In a notable move that underscores its progressive approach to technology and economics,Bhutan has announced the establishment of a strategic Bitcoin reserve,positioning itself as a trailblazer among nations in adopting cryptocurrency as a viable asset class. This landmark decision reflects the government’s commitment to integrating blockchain technology into its economic framework, leveraging digital currencies to bolster national growth and resilience. As global interest in cryptocurrencies continues to surge, Bhutan’s initiative not only highlights the potential benefits of Bitcoin in diversifying its financial portfolio but also sets a precedent for other countries considering similar ventures. This article explores the implications of Bhutan’s strategic reserve, the motivations behind this pioneering initiative, and its potential impact on the nation’s economy and global cryptocurrency landscape.

Bhutan’s Innovative Move into Cryptocurrency Reserves

Buddha’s land is taking a bold stride into the digital financial landscape by establishing a reserve for Bitcoin, setting an intriguing precedent for small nations navigating the evolving world of cryptocurrency. This strategic decision underscores Bhutan’s commitment to integrating modern financial technologies into its economy. Analysts suggest that such a move not only positions the country favorably within the global cryptocurrency market but also provides a potential buffer against economic volatility. Among the key factors driving this decision are:

- Diversification of Reserves: Enhancing conventional asset holdings with cryptocurrency.

- Attracting Foreign Investment: Demonstrating innovation to entice global investors.

- Technological Advancement: Leveraging blockchain technology to increase financial transparency.

The decision to allocate resources into Bitcoin aligns with Bhutan’s broader strategy to position itself as a leader in lasting technology and sound economic practices. By tapping into the potential of digital currencies, Bhutan is paving the way for a future where financial inclusion and technological advancement go hand-in-hand. The government is expected to closely monitor the performance of its Bitcoin reserves, making adjustments as necessary based on market dynamics.To provide transparency and understanding of this innovative approach, the following table illustrates Bhutan’s key goals and initiatives related to its cryptocurrency reserve:

| Goal | Initiative |

|---|---|

| Financial Stability | Diversifying assets to mitigate risks |

| Economic Growth | Attracting tech-savvy investors |

| Innovation Leadership | integrating blockchain solutions in public services |

Analyzing the Economic Implications of Bhutan’s Bitcoin Strategy

The strategic decision by Bhutan to establish a bitcoin reserve could herald a new economic landscape for the nation. The implications of such a move are significant, especially in a country where traditional economic models have predominantly focused on hydropower and agriculture. By positioning itself as an early adopter of cryptocurrency, Bhutan may stand to benefit from several factors:

- Diversification of Revenue Streams: Bitcoin and other cryptocurrencies can provide an choice revenue source, perhaps easing reliance on hydropower exports.

- Foreign Investment Attraction: A Bitcoin reserve may entice tech-savvy investors looking to tap into emerging markets,fostering economic growth.

- Technological Advancement: Engaging with blockchain technology could enhance Bhutan’s digital infrastructure and create jobs in the tech sector.

Though, the transition to embracing Bitcoin is not without risks that could affect the nation’s economic stability. Fluctuations in cryptocurrency values could influence Bhutan’s fiscal health, prompting the government to consider robust risk management strategies. Key factors to monitor include:

| Risk Factor | Potential Impact |

|---|---|

| Market Volatility | Uncertain revenue projections due to price swings. |

| Regulatory Challenges | Possible legal hurdles in cryptocurrency usage or transactions. |

| Public Perception | resistance from citizens unaccustomed to digital currencies. |

while Bhutan’s foray into the world of Bitcoin presents numerous opportunities for economic advancement,it must proceed with caution. Balancing innovative financial strategies with the need for economic stability and public confidence will be vital as this small nation navigates uncharted waters in the digital economy.

Regulatory Framework: Ensuring Stability in Bhutan’s Bitcoin Holdings

The establishment of a strategic Bitcoin reserve by Bhutan represents a significant move toward integrating cryptocurrency within the framework of national finance. To ensure the effective management and sustainability of these digital assets, a robust regulatory framework is essential. This framework is designed to mitigate risks associated with cryptocurrency volatility and prevent market manipulation while promoting transparency and security for all stakeholders involved. The government is proactive in addressing concerns surrounding illicit activities and compliance with international standards, thereby fostering an environment conducive to responsible Bitcoin holding.

Key elements of this regulatory framework include:

- Risk Assessment Protocols: A complete analysis of potential market fluctuations to safeguard Bhutan’s financial interests.

- Consumer Protection Measures: Guidelines that aim to protect individuals engaging with or investing in Bitcoin.

- Awareness Campaigns: Initiatives to educate the population about the benefits and dangers of cryptocurrency.

- Collaboration with Financial Institutions: Engaging banks and other financial entities to ensure adherence to regulatory standards.

To illustrate the planned phases of this regulatory approach,the following table summarizes the key actions and their desired outcomes:

| Phase | Action | outcome |

|---|---|---|

| Phase 1 | Establishing Regulatory Guidelines | Clear framework for Bitcoin transactions |

| Phase 2 | Implementing monitoring Tools | Enhanced oversight to prevent fraud |

| Phase 3 | Engaging Stakeholders | Inclusive approach for community input |

Environmental Concerns: Addressing the Sustainability of Bitcoin Mining

As the world increasingly turns to cryptocurrencies, the environmental impact of Bitcoin mining has become a significant concern.Traditional mining operations consume vast amounts of energy and contribute to carbon emissions, leading to a growing debate about their sustainability. In response,countries like Bhutan are strategically positioning themselves to leverage their unique resources. By harnessing renewable energy—primarily hydropower—this Himalayan kingdom is exploring methods to maintain an eco-pleasant mining operation while also creating a reserve of Bitcoin. This approach not only fosters economic growth but also leads the way in sustainable cryptocurrency practices.

To address the urgent need for environmental duty in the Bitcoin mining sector,Bhutan can adopt the following strategies:

- Investment in Renewable Energy: Focus on expanding hydropower generation,utilizing its abundant water resources.

- Implementation of Carbon Offsetting: Initiate projects that neutralize emissions produced by mining activities.

- Partnership with Eco-friendly Technologies: Collaborate with companies innovating in energy-efficient mining rigs.

- Public Awareness Campaigns: Educate the community about sustainable practices in cryptocurrency mining.

To further analyze the impact of various energy sources utilized in Bitcoin mining,the following table outlines the carbon footprint associated with diffrent mining methods in comparison to Bhutan’s potential hydropower model:

| Mining Method | Energy Source | carbon Footprint (g CO2/kWh) |

|---|---|---|

| Traditional Mining | Fossil Fuels | 900 |

| Coal-based Mining | Coal | 1000 |

| hydropower Mining | Renewable | 0 |

This data highlights the stark differences in sustainability between traditional and renewable energy sources. As Bhutan moves forward with its Bitcoin reserve, prioritizing sustainable mining practices will be essential in setting an example for other nations in the cryptocurrency landscape.

Opportunities and Risks for Bhutan in a Volatile Market

The establishment of a strategic Bitcoin reserve presents a myriad of opportunities for Bhutan, especially in an increasingly digitized global economy. By positioning itself as a pioneer in cryptocurrency adoption, Bhutan could attract foreign investments and enhance its status as a financial innovation hub. Potential advantages include:

- Economic Diversification: Bitcoin can serve as a new asset class, helping Bhutan reduce its dependence on traditional sectors such as hydropower.

- Increased Revenue Streams: By capitalizing on Bitcoin investments, the government may generate significant revenue that can be utilized for infrastructure and public services.

- International Collaboration: The reserve could facilitate partnerships with global crypto firms and other nations interested in blockchain technology.

However, the volatility and uncertainty surrounding cryptocurrencies pose significant risks that Bhutan must navigate carefully. With values fluctuating dramatically, the potential for significant financial losses is a pressing concern. Key risks include:

- market Volatility: Rapid price fluctuations can lead to instability in bhutan’s newly established reserve.

- Regulatory Challenges: Navigating the evolving landscape of cryptocurrency regulation could pose legal hurdles and compliance costs.

- Technological Vulnerabilities: Risks related to cybersecurity and hacking must be addressed to safeguard the reserve’s assets.

| Opportunity | risk |

|---|---|

| Economic Diversification | Market Volatility |

| Increased Revenue Streams | regulatory challenges |

| International Collaboration | Technological Vulnerabilities |

Recommendations for International collaboration in Cryptocurrency Efforts

To strengthen international collaboration in cryptocurrency efforts, nations should prioritize the establishment of bilateral and multilateral frameworks that address regulatory challenges and promote transparency. By sharing best practices, countries can create a cohesive approach to cryptocurrency governance, reducing risks associated with fraud and market manipulation. key strategies may include:

- Regular Knowledge Exchange: Hosting conferences and workshops where policymakers and industry leaders can discuss regulatory approaches and technological advancements.

- Joint Research Initiatives: Collaborating on studies to assess the socioeconomic impact of cryptocurrencies and blockchain technology on global markets.

- Standardization of Regulations: Developing a common regulatory framework that encourages innovation while safeguarding investors and consumers.

Additionally, nations should explore partnerships with private sectors and academic institutions to foster a culture of innovation and education in blockchain and cryptocurrency.Initiatives could include:

- Public-Private partnerships: Encouraging investments in blockchain projects by leveraging government support to mitigate risks for private investors.

- Cross-Border Pilot programs: testing new cryptocurrency applications in controlled environments to evaluate their viability before broader implementation.

- Blockchain Education Programs: Integrating blockchain technology and cryptocurrency into educational curricula to prepare the future workforce for upcoming challenges and opportunities.

To Wrap It Up

Bhutan’s establishment of a strategic bitcoin reserve marks a significant milestone in the nation’s approach to modern finance and resource management. By embracing cryptocurrency within a framework that prioritizes sustainable development, Bhutan not only seeks to amplify its economic resilience but also positions itself as a forward-thinking player in the increasingly digital global marketplace. As nations worldwide explore the potential of digital currencies, Bhutan’s pioneering steps could serve as a compelling model for integrating traditional values with cutting-edge technology. The ongoing developments in Bhutan’s Bitcoin reserve strategy will be closely watched, not only for their potential financial implications but also for the broader questions they raise about the role of cryptocurrencies in the economies of the future.