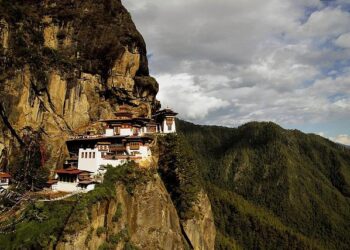

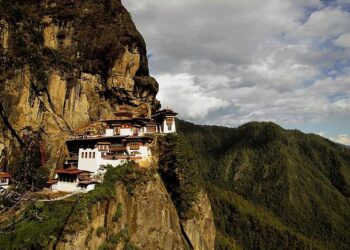

In a surprising development on the cryptocurrency front, the government of Bhutan has reportedly moved $107 million worth of Bitcoin, signaling a notable shift amid recent market volatility. This transaction comes as major investors, often referred to as “whales,” make strategic moves following the Federal Reserve’s latest interest rate cut. The activity has stirred considerable interest across trading platforms, including TradingView, highlighting Bhutan’s emerging role in the global digital asset landscape.

Bhutan Government Executes Significant Bitcoin Transaction Amid Market Volatility

In a strategic move that has caught the attention of crypto analysts worldwide, Bhutan’s government has successfully shifted $107 million worth of Bitcoin amidst a turbulent market influenced by the Federal Reserve’s recent rate cut. This massive transaction highlights the growing role of sovereign entities in the cryptocurrency ecosystem and signals Bhutan’s intent to actively engage with digital assets despite prevailing global uncertainties. Market observers note that this transfer aligns with broader whale activity, suggesting coordinated efforts to capitalize on the volatility following the Fed’s monetary policy adjustment.

The transaction coincides with a series of significant movements from other large holders, reshaping liquidity and price dynamics across major exchanges. Key implications of the Bhutan government’s decision include:

- Enhanced market liquidity: Infusion of high-volume BTC transfers supports trading volumes amid uncertainty.

- Increased institutional interest: Government-level participation is encouraging more regulatory and financial entities to consider digital assets.

- Price stabilization signals: Large transactions by whales often prelude market shifts, offering clues for traders.

| Parameter | Details |

|---|---|

| Transaction Volume | ~15,000 BTC |

| Date Executed | June 16, 2024 |

| Fed Rate Cut | 25 basis points |

| Whale Activity | Surged by 40% |

Analyzing Whale Activity Following Federal Reserve’s Interest Rate Reduction

In the aftermath of the Federal Reserve’s decision to cut interest rates, large Bitcoin holders, commonly referred to as whales, have significantly shifted their positions. Notably, the Bhutan government executed a massive transfer of approximately $107 million in BTC, signaling heightened activity within this elite cohort. Market analysts suggest this movement reflects a strategic response to anticipated inflationary trends and a desire to leverage Bitcoin’s potential as a hedge amidst evolving monetary policies.

Key patterns observed in whale activity since the rate cut include:

- Increased accumulation: Whales are notably increasing holdings in mid-range addresses, possibly expecting price appreciation.

- Heightened on-chain transfers: A surge in high-value wallet-to-wallet transactions indicates portfolio reshuffling.

- Reduced vending activity: Some whales are holding off on liquidating assets, signaling confidence in long-term growth.

| Whale Activity Metrics | Pre-Rate Cut | Post-Rate Cut | Change |

|---|---|---|---|

| Total BTC Transferred (Million) | 85 | 132 | +55% |

| Average Transfer Size (BTC) | 4,500 | 6,200 | +38% |

| Number of Active Whales | 120 | 158 | +32% |

Strategic Implications for Cryptocurrency Investors After Major BTC Movements

Recent large-scale BTC transactions, such as the Bhutan government’s $107 million move, underscore a shifting dynamic within the cryptocurrency landscape. Investors should now consider how institutional actions and macroeconomic policies, including the Federal Reserve’s rate adjustments, interplay to influence market volatility and liquidity. The unexpected influx or redistribution of BTC by so-called “whales” often precedes significant price movements, suggesting that retail and institutional traders alike must hone their monitoring of blockchain analytics and on-chain data to better anticipate market trends.

Key strategic considerations for investors include:

- Diversification of holdings to weather sudden asset reallocation by large players.

- Close observation of Fed policy announcements to gauge possible ripple effects on cryptocurrency valuations.

- Utilization of on-chain indicators such as wallet movement patterns and whale transaction statistics to time entry and exit points effectively.

| Factor | Potential Impact | Investor Action |

|---|---|---|

| Fed Rate Cuts | Increased risk appetite, bullish momentum | Consider strategic accumulation phases |

| Whale BTC Movements | Short-term price swings | Monitor on-chain whale alerts closely |

| Government BTC Transfers | Potential regulatory or market signal | Evaluate geopolitical risks and Market implications |

In Conclusion

As the Bhutan government’s substantial $107 million Bitcoin transaction underscores growing institutional interest, the latest activity from crypto whales hints at a potentially transformative period shaped by the Federal Reserve’s recent rate cut. Market participants and observers will be closely watching how these strategic moves influence broader cryptocurrency trends in the weeks ahead.