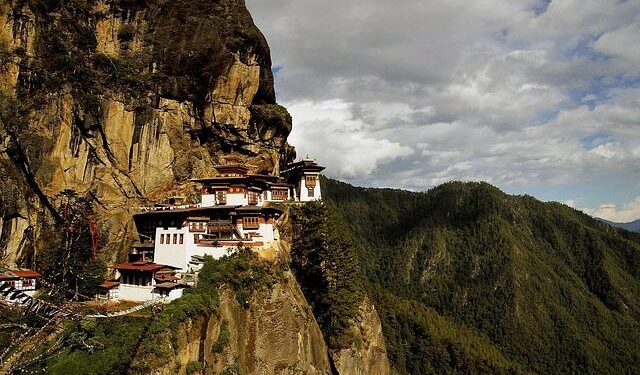

Bhutan is poised to become a pioneering force in the world of digital finance with its latest initiative, “OneSafe,” a comprehensive blueprint for integrating cryptocurrency into the nation’s financial framework. As global interest in blockchain and digital currencies continues to surge, Bhutan’s government is stepping forward with a strategic plan aimed at harnessing the benefits of crypto while safeguarding economic stability. This bold move not only positions the Himalayan kingdom at the forefront of financial innovation but also reflects its broader commitment to modernizing its economy while upholding its unique values. In this article, we examine the key components of Bhutan’s OneSafe plan, its potential impact on the national economy, and what it could mean for the future of crypto adoption worldwide.

Bhutan’s Strategic Approach to Integrating Cryptocurrency into National Finance

Embracing both innovation and caution, Bhutan has crafted a well-rounded framework aimed at responsibly weaving cryptocurrency into its national finance fabric. The government’s strategy prioritizes regulatory clarity, emphasizing consumer protection and financial stability. To this end, the Royal Monetary Authority (RMA) is spearheading initiatives that call for stringent anti-money laundering (AML) measures and robust Know Your Customer (KYC) protocols. This dual approach ensures that while the transformative potential of crypto assets is unlocked, the risks associated with volatility and illicit activities remain tightly managed.

Central to Bhutan’s blueprint is fostering collaboration across multiple sectors. The government is encouraging partnerships between fintech startups, traditional banking institutions, and regulatory bodies to create a seamless ecosystem. Key features include:

- Integrated digital wallets compatible with both fiat and cryptocurrencies

- Tax incentives promoting blockchain innovation

- Public awareness campaigns on the benefits and risks of crypto adoption

This strategy positions Bhutan as a pioneering hub in South Asia, balancing progressive digital finance ambitions with the nation’s socio-economic values.

Examining Regulatory Frameworks and Security Measures in Bhutan’s Crypto Adoption

Bhutan’s approach to integrating cryptocurrency into its financial ecosystem is deeply rooted in a cautious yet progressive regulatory framework. The Royal Monetary Authority (RMA) has been spearheading efforts to establish clear guidelines that aim to balance innovation with national security and economic stability. These regulations emphasize consumer protection, anti-money laundering (AML) compliance, and the prevention of illicit financial activities. Central to this framework is the licensing of crypto exchanges and wallet providers, ensuring that only vetted entities operate within the kingdom’s borders.

In parallel, Bhutan is deploying cutting-edge security measures to safeguard digital assets and transaction integrity. These include:

- Multi-layered encryption protocols across all blockchain interactions.

- Mandatory KYC (Know Your Customer) procedures to enhance transparency and traceability.

- Collaboration with international cybersecurity firms to strengthen network defenses.

| Regulatory Element | Implementation Status | Purpose | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Crypto Exchange Licensing | Active | Regulate market participants | |||||||||||||||

| AML Framework Update | In Progress | Prevent financial crimes | |||||||||||||||

| National Cybersecurity Alliance | Planned | Enh It looks like your table content was cut off at the end. Would you like me to help complete the last entry for the “National Cybersecurity Alliance” and provide a summary based on the existing information?

Policy Recommendations to Foster Sustainable Crypto Growth and Financial Inclusion in BhutanTo ensure a thriving ecosystem where cryptocurrencies contribute positively to Bhutan’s economy, it is essential to implement a regulatory framework that balances innovation with security. Clear guidelines on digital asset management and anti-money laundering practices will protect consumers and build investor confidence. Moreover, fostering collaboration between government bodies, financial institutions, and blockchain startups can accelerate responsible adoption. Encouraging educational programs and public awareness campaigns will empower citizens to engage safely with crypto technologies, mitigating risks of misinformation and fraud. Bridging the financial inclusion gap requires targeted efforts to integrate crypto services with Bhutan’s traditional banking infrastructure. Prioritizing affordable access to digital wallets and mobile payment platforms can bring unbanked populations into the formal economy. Additionally, incentivizing local entrepreneurs through grants and tax benefits to develop region-specific crypto solutions will spur innovation tailored to Bhutan’s unique socioeconomic landscape. The table below outlines key policy measures to guide sustainable growth and inclusion:

The Way ForwardAs Bhutan takes its first calculated steps toward integrating cryptocurrency into its national financial framework, OneSafe’s blueprint offers a compelling model of cautious innovation balanced with regulatory oversight. While challenges remain, the nation’s forward-thinking approach could set a precedent for other emerging economies navigating the complex intersection of digital assets and traditional finance. Observers will be closely watching Bhutan’s journey as it endeavors to harmonize technological advancement with economic stability in the evolving landscape of global finance. Denial of responsibility! asia-news.biz is an automatic aggregator around the global media. All the content are available free on Internet. We have just arranged it in one platform for educational purpose only. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials on our website, please contact us by email – [email protected].. The content will be deleted within 24 hours. ADVERTISEMENT |