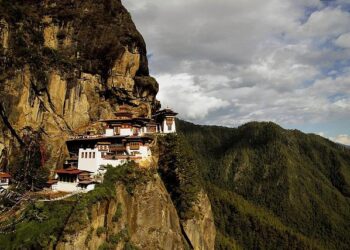

Bhutan’s Bold Bitcoin Strategy: A New Era in National Cryptocurrency Policy

In a groundbreaking development within the cryptocurrency sector, Bhutan’s government has reportedly allocated $63 million in Bitcoin across three distinct digital wallets. This significant action, reported by Cointelegraph, highlights the growing involvement of governments worldwide in the expanding cryptocurrency arena. By managing such a considerable sum in Bitcoin, Bhutan is actively investigating blockchain technology and its potential to transform its financial landscape. As regulations surrounding digital currencies continue to adapt, this strategic decision may set a precedent for other nations contemplating similar initiatives.

Bhutan’s Crypto Initiative Signals a New Direction in National Finance

The recent transfer of $63 million worth of Bitcoin into three separate wallets by Bhutanese authorities marks a crucial turning point for the country’s approach to cryptocurrencies.This move not only reflects an increasing interest in digital assets but also suggests that more structured regulatory measures may be on the horizon. As countries around the globe navigate the complexities associated with cryptocurrencies, Bhutan seems poised to establish itself as an influential player within this evolving domain—potentially leading to comprehensive national policies that harmonize innovation with security.

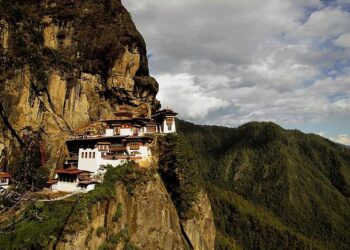

Several key factors underpin Bhutan’s proactive engagement with cryptocurrency:

- Enduring Practices: Utilizing hydropower resources for Bitcoin mining aligns seamlessly with Bhutan’s commitment to renewable energy sources.

- Attracting Investments: The nation aims to draw foreign direct investment through favorable regulations tailored for crypto innovations.

- Cohesive Regulatory Framework: Establishing clear guidelines designed to safeguard investors while nurturing a secure habitat for digital transactions.

Impact of Bhutan’s Bitcoin Diversification on Global Markets

The strategic diversification of approximately $63 million into three separate wallets has captured attention from both investors and analysts alike. This initiative not only emphasizes Bhutan’s commitment towards utilizing cryptocurrencies as viable financial instruments but also positions it as an essential participant in the ongoing transformation of digital currencies. Such diversification serves multiple critical functions including enhancing risk management, bolstering security measures, and ensuring adherence to emerging global regulatory standards.

The ramifications of this decision could resonate throughout the global cryptocurrency market, potentially influencing market behaviors and regulatory frameworks internationally. As more governments explore investments in digital assets, Bhutan’s wallet diversification might inspire other nations toward adopting comparable strategies. Key considerations include:

- Burgeoning Institutional Participation: Increased engagement from nation-states could lead to heightened institutional investment levels.

- Pioneering Regulatory Models: The actions taken by Bhutan may encourage other countries to develop clearer regulatory environments surrounding cryptocurrencies.

- A More Stable Market Environment: A diversified asset strategy can help reduce volatility and create a more stable investment atmosphere.

Lessons for Developing Nations: Adopting Insights from Bhutan’s BTC Approach

Buckling down on economic strategies like those seen in Bhutan can provide valuable insights for emerging economies looking at cryptocurrency adoption as part of their growth plans. The recent allocation of $63 million into various BTC wallets underscores how digital currencies can enhance fiscal stability while driving economic progress forward. By emulating such strategies, developing nations can leverage blockchain technology effectively—creating transparent financial systems that attract foreign investments while decreasing dependence on conventional banking infrastructures.

This accomplished integration serves as an exemplary model emphasizing bothsophisticated asset management and risk mitigation in today’s unpredictable crypto environment .

Tapping into lessons learned from Bhutans BTC strategy requires emerging economies consider implementing these essential practices :

- < strong >Tailored Policy Development : Craft regulations suited specifically towards local economic conditions whilst encouraging innovation .

- < strong >Strong Technological Infrastructure : Invest heavily into tech advancements & education supporting widespread blockchain adoption across society.

- < strong >Collaborative Partnerships : Engage local & international stakeholders sharing knowledge/resources fostering community around digitized currency usage . Â

Â

Â

Â

Â

Â

Â  Â

Â

Â