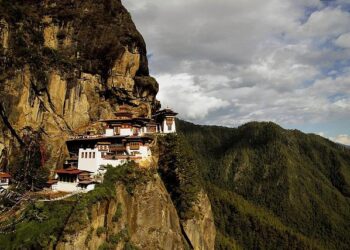

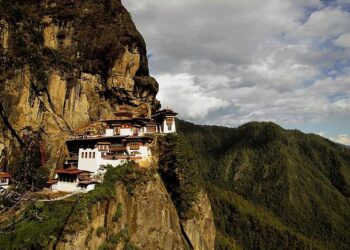

As Bhutan grapples with economic challenges exacerbated by the COVID-19 pandemic and declining hydropower revenues, the Himalayan kingdom is exploring unconventional solutions to revive growth. Among these, Bitcoin and cryptocurrency have emerged as a controversial but potentially transformative option. This article examines whether embracing Bitcoin could offer Bhutan a viable pathway out of its financial struggles, or if the risks outweigh the rewards for the small but deeply traditional nation.

Bhutan’s Economic Challenges and the Appeal of Cryptocurrency

Bhutan’s economy has long been characterized by its heavy reliance on hydropower exports and a modest tourism sector, both vulnerable to external shocks and climate variability. Recent global disruptions have exacerbated fiscal pressures, leading to decreased government revenues and rising unemployment. Compounding these challenges are limited avenues for foreign investment and a narrow industrial base that curbs economic diversification. In this context, cryptocurrency emerges not just as a speculative asset, but as a potential tool to inject liquidity and stimulate alternative economic activities within the kingdom.

Proponents highlight several key advantages:

- Enhancing financial inclusion among remote communities with limited banking access.

- Attracting global capital through crypto mining and blockchain-based startups.

- Reducing transaction costs and increasing transparency in government and business processes.

| Challenge | Current Impact | Crypto Potential | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Limited banking reach | Over 30% unbanked population | Wallet-based access, no physical banks needed | |||||||||||||||||||||||

| Trade dependency | Export-driven with hydropower | New revenue via crypto mining & investments | |||||||||||||||||||||||

| Government revenues | Analyzing Bitcoin Adoption as a Potential Economic Catalyst

Bitcoin’s integration into Bhutan’s economic framework represents a bold experiment in leveraging digital assets to stimulate financial growth. With its largely agrarian economy and limited access to global capital markets, Bhutan faces unique challenges that conventional development strategies have struggled to overcome. The prospect of Bitcoin adoption introduces multiple potential benefits:

However, the volatility of cryptocurrency markets and Bhutan’s regulatory environment present significant hurdles. The government’s cautious stance on digital currencies is compounded by a lack of technical expertise and the risk of exacerbating economic instability. Examining the data below shows a mixed outlook for Bitcoin’s impact on small economies:

Policy Recommendations for Integrating Digital Currency in Bhutan’s Financial SystemFirst and foremost, regulatory clarity is imperative. Bhutan’s government must establish a coherent legal framework that delineates the status of digital currencies within the financial ecosystem. This includes creating licensing protocols for exchanges, defining taxation policies, and ensuring consumer protections are in place to prevent fraud and illicit activities. Encouraging transparency while maintaining rigorous oversight will enable a more secure environment for both investors and everyday users. Furthermore, fostering digital literacy and infrastructure development is essential for nationwide adoption. Policymakers should prioritize initiatives that integrate blockchain education into financial literacy programs, targeting rural and underserved communities. Investments in internet connectivity and fintech partnerships will pave the way for seamless transactions and broaden access to digital wallets. Below is a summary of key policy priorities that could guide Bhutan’s integration efforts:

Concluding RemarksAs Bhutan navigates the complexities of a global economic downturn, the potential role of Bitcoin remains both promising and uncertain. While digital currencies offer an innovative avenue for economic diversification and financial inclusion, challenges such as regulatory frameworks, market volatility, and infrastructural readiness persist. Whether Bitcoin can truly serve as a catalyst for Bhutan’s economic recovery will depend on a careful balance of opportunity and risk, alongside the government’s strategic vision for integrating emerging technologies into the nation’s unique socio-economic fabric. Denial of responsibility! asia-news.biz is an automatic aggregator around the global media. All the content are available free on Internet. We have just arranged it in one platform for educational purpose only. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials on our website, please contact us by email ‚Äst[email protected].. The content will be deleted within 24 hours. ADVERTISEMENT |