Bali’s Travel Tax: A Step Towards Sustainable Tourism

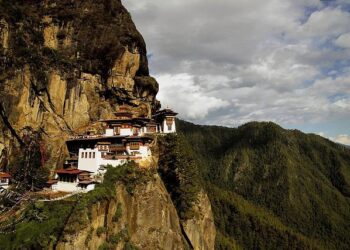

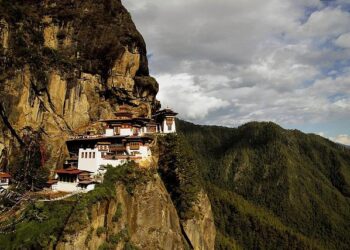

As global tourism continues to surge, the conversation surrounding sustainable travel practices is becoming increasingly relevant. Following the lead of nations such as Italy, Spain, Bhutan, Greece, and Thailand, Indonesia is now considering a travel tax aimed at managing the overwhelming number of visitors to its renowned destination‚ÄĒBali.This proposed tax not only aims to mitigate the effects of over-tourism but also seeks to generate revenue for infrastructure enhancements and environmental conservation efforts.With Bali facing notable ecological and social challenges due to its popularity, this potential tax underscores the urgent need for a more balanced approach that prioritizes both local communities and natural ecosystems.

Bali’s Travel Tax: A Solution to Mass Tourism Challenges

Known as the “Island of Gods,” Bali has become overwhelmed by its own allure, leading local authorities to consider a travel tax designed to regulate tourist numbers while promoting sustainable tourism practices. This initiative could provide essential funding for infrastructure upgrades, environmental protection initiatives, and community development projects that benefit both residents and their surroundings. Similar measures have been successfully adopted in countries like Bhutan and Spain as they combat the negative impacts associated with mass tourism.

The proposed travel tax in Bali includes several critically important elements:

- Tax Structure: A tiered fee system might potentially be introduced where charges vary based on accommodation type and duration of stay.

- Allocation of Funds: Revenue from this tax is intended for local projects focused on waste management systems, wildlife conservation efforts, and cultural heritage preservation.

- Community Involvement: Local stakeholders will play an active role in deciding how funds are allocated from this initiative ensuring that resident needs are prioritized.

The ongoing discussions about this travel tax represent a significant move towards achieving equilibrium in Bali‚Äôs tourism sector‚ÄĒone where both tourists’ experiences and locals’ well-being can thrive together. Stakeholders hope that implementing such a measure will not only reduce environmental strain but also enrich visitors‚Äô experiences while exploring Bali‚Äôs vibrant cultural landscape.

Global Comparison of Travel Tax Policies

The dialog around implementing travel taxes has gained traction globally as various destinations seek ways to manage mass tourism effectively. Countries like Italy and Spain have already established visitor taxes aimed at enhancing local infrastructure while preserving cultural heritage sites. Even though these taxes tend to be modestly priced per night stay or visit duration‚ÄĒthey can significantly contribute to regional economies. As a notable example, with its stunning landscapes and rich culture at stake,Bali is exploring similar strategies designed not just for limiting tourist numbers but also ensuring ecological sustainability remains intact.

A comparative analysis reveals diverse approaches across regions striving for economic growth alongside environmental stewardship:

- Fee Structures: These range from flat rates per night stayed or percentage-based fees depending on accommodation types.

- Purposeful Fund Allocation: Often earmarked specifically for enhancing infrastructure or supporting conservation initiatives.

- Tourist Engagement Strategies: Many locations involve community members actively during planning phases promoting transparency throughout processes involved with taxation policies.

| Your Destination | Your Proposed Travel Tax Rate | Your Fund Usage Purpose |

|---|---|---|

| Italy | ‚ā¨2 – ‚ā¨7 nightly | City services & maintenance |

| Spain | ‚ā¨1 – ‚ā¨3 nightly | < td >Local development & public transport|

| ‘Destination’‘ ‘ | ‘Proposed Fee’‘ ‘ | ‘Projected Allocation’‘ ‘‘ ‘bALI’ Denial of responsibility! asia-news.biz is an automatic aggregator around the global media. All the content are available free on Internet. We have just arranged it in one platform for educational purpose only. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials on our website, please contact us by email ‚Äst[email protected].. The content will be deleted within 24 hours. ADVERTISEMENT |

|---|