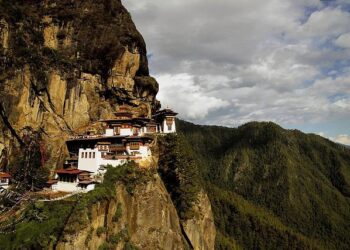

In a groundbreaking development within the global cryptocurrency landscape, Bhutan is emerging as one of the latest nations exploring Bitcoin as a tool to combat poverty and stimulate economic growth. Once known primarily for its commitment to Gross National Happiness and environmental sustainability, the Himalayan kingdom is now gaining attention for its innovative approach to leveraging digital currencies. This shift marks a significant chapter in Bhutan’s ongoing efforts to enhance financial inclusion and diversify its economy amidst global challenges. As Bitcoin continues to gain traction worldwide, Bhutan’s experiment offers valuable insights into how developing countries might harness decentralized finance to address long-standing socio-economic issues.

Bhutan’s Innovative Approach to Bitcoin Adoption and Economic Growth

Bhutan is making headlines with a bold strategy that leverages Bitcoin to stimulate its economy and break free from traditional financial constraints. By embracing cryptocurrency, the Himalayan kingdom aims to attract foreign investment, increase financial inclusivity, and create new income streams beyond its largely agrarian economy. This forward-thinking approach prioritizes technology-driven economic diversification, enabling Bhutanese citizens to participate in the global digital economy. The government has also initiated pilot programs that integrate Bitcoin payments in local businesses, providing real-world use cases that promote currency adoption while safeguarding against volatility.

Key components of Bhutan’s Bitcoin initiative include:

- Education campaigns to boost awareness and digital literacy about cryptocurrency

- Public-private partnerships to build blockchain infrastructure

- Regulatory frameworks that balance innovation with consumer protection

- Incentives for startups focusing on crypto-based financial services

| Indicator | Before Adoption | Projected Impact |

|---|---|---|

| Access to Banking | 45% population | 75% population |

| Foreign Investment | Low | Moderate to High |

| GDP Growth Rate | 3.5% | 5.2% |

| Startup Launches | 10 annually | 30+ annually |

Challenges and Opportunities in Integrating Cryptocurrency into Bhutan’s Rural Communities

Adopting cryptocurrency within Bhutan’s rural areas reveals a complex blend of hurdles and potential breakthroughs. Key challenges include limited internet connectivity and low digital literacy rates, which restrict the effective use of Bitcoin and other digital currencies. Many villagers rely primarily on traditional barter and cash-based systems, making the shift to decentralized digital finance a steep learning curve. Additionally, regulatory ambiguity around cryptocurrency transactions raises concerns for both users and local officials, slowing down broad acceptance and integration.

Despite these obstacles, opportunities abound. Cryptocurrency offers a promising solution for financial inclusion by providing rural communities with access to global markets and remittances without intermediaries. Micro-entrepreneurs and farmers, armed with mobile wallets, can bypass the traditional banking system’s constraints, potentially increasing profits and economic resilience. The government’s cooperation with fintech startups to deploy user-friendly platforms could accelerate this transformation. Below is a snapshot of potential benefits and barriers:

| Opportunities | Challenges |

|---|---|

| Financial Inclusion through easy access to digital assets | Infrastructure gaps in internet and smartphone availability |

| Lower Transaction Costs for cross-border remittances | Regulatory Uncertainty affecting adoption and trust |

| Empowerment of local entrepreneurs with new capital flow | Awareness Deficit leading to misinformation and fear |

Policy Recommendations for Sustainable Bitcoin Utilization to Combat Poverty in Bhutan

To harness the full potential of Bitcoin as a tool against poverty in Bhutan, it is imperative that policymakers prioritize educational initiatives aimed at increasing digital literacy, particularly in rural areas. Expanding access to reliable internet infrastructure will empower marginalized communities to engage confidently with cryptocurrency platforms. Moreover, establishing clear regulatory frameworks can provide both protection for users and incentives for sustainable investment, reducing risks often associated with volatile markets.

Strategic partnerships between government agencies, local fintech startups, and international blockchain organizations could foster innovation and trust. Below are crucial policy measures to consider:

- Incentivize Renewable Energy for Bitcoin mining to align with Bhutan’s commitment to environmental sustainability.

- Introduce Microfinance Solutions integrating Bitcoin for low-income entrepreneurs to access capital quickly and transparently.

- Implement Consumer Protection Laws tailored for crypto-users to ensure transparent transactions and dispute resolution.

- Promote Public-Private Collaborations to develop scalable blockchain-based social welfare programs.

| Policy Area | Expected Impact |

|---|---|

| Digital Literacy Programs | Increased Adoption & User Confidence |

| Renewable Energy Incentives | Sustainable Mining Practices |

| Microfinance Integration | Empowered Small Businesses |

| Consumer Protection Legislation | Enhanced Trust & Market Stability |

| Public-Private Blockchain Initiatives | Innovative Social Welfare Solutions |

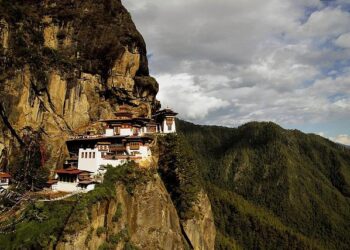

The Way Forward

As Bhutan continues to explore the potentials of Bitcoin amid its ongoing efforts to alleviate poverty, the nation’s experiment offers a compelling case study on the intersection of cryptocurrency and economic development. While challenges remain, Bhutan’s embrace of digital currency reflects a broader global trend where emerging economies seek innovative financial tools to foster inclusion and growth. Observers and stakeholders alike will be watching closely to see whether Bitcoin can become a viable path toward sustainable prosperity for Bhutan and other countries facing similar economic hurdles.