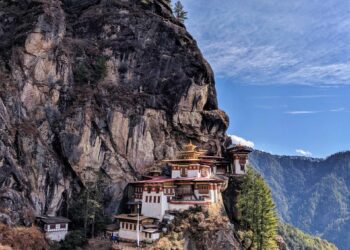

In a remarkable turn of events, the Kingdom of Bhutan has emerged as an unexpected player in the world of cryptocurrency, amassing a staggering $750 million in Bitcoin holdings over recent years. This significant investment positions Bhutan not only as a pioneer among nations embracing digital assets, but also as a case study in strategic financial diversification for smaller states. Despite its relatively low profile in the global economic arena, bhutan’s calculated approach to cryptocurrency reflects a growing trend among nations to leverage the potential of decentralized finance. as leaders and investors examine the implications of such a bold move, this article delves into how Bhutan navigated the complexities of the cryptocurrency market and the broader significance of its Bitcoin accumulation on the international stage.

Bhutan’s Strategic Investment in Bitcoin and Its Global Implications

Bhutan’s unexpected foray into the world of cryptocurrency is not just a financial maneuver; it stems from a calculated strategy aimed at positioning itself as a progressive player on the global economic stage. The Himalayan kingdom has amassed a remarkable $750 million in Bitcoin holdings without drawing significant attention from the international community. This stealth investment is part of a broader initiative to harness the country’s unique advantages, including an abundance of hydropower and a commitment to environmental sustainability. By leveraging its renewable energy resources, Bhutan seeks not only to secure a financial future but also to set a precedent for green energy utilization in the crypto mining sector.

The implications of Bhutan’s strategic investment in Bitcoin resonate far beyond its borders. As countries grapple with the regulatory environment surrounding cryptocurrencies, Bhutan’s approach could inspire a new wave of nation-states to explore digital assets. Key points of consideration include:

- innovation in Finance: Bhutan’s example could lead to financial innovation in developing nations.

- Environmental Responsibility: Prioritizing sustainable mining practices could challenge the conventional energy-intensive models.

- Geopolitical Shift: Smaller countries could gain influence in the cryptocurrency space traditionally dominated by larger economies.

| Aspect | Bhutan’s Approach | Global Impact |

|---|---|---|

| Resource Utilization | Hydropower for mining | Encourages green energy focus |

| International Perception | Low-profile investment | Redefines small nation roles |

| Financial Strategy | Long-term holding of Bitcoin | Influences emerging market trends |

Understanding the Financial Landscape: How Bhutan Leveraged Cryptocurrency

In a surprising twist in the global finance narrative, Bhutan has strategically positioned itself as a hidden player in the cryptocurrency market, amassing a remarkable portfolio of Bitcoin worth $750 million. This mountainous kingdom, known for its emphasis on Gross National Happiness over GDP, has harnessed the power of digital currency to bolster its economy. By leveraging its rich hydropower resources, Bhutan has established a unique model where excess energy is funneled into Bitcoin mining operations, allowing for a sustainable and profitable venture. This move not only aligns with the nation’s eco-amiable ethos but also serves as a catalyst for technological advancement within its local workforce.

the Bhutanese government had taken a calculated approach in navigating the cryptocurrency landscape, focusing on regulatory measures that ensure the safe and responsible use of digital currencies. The key elements to its accomplished integration include:

- Regulatory Framework: Establishing laws to govern cryptocurrency operations.

- Investment in Infrastructure: Enhancing tech capabilities for mining operations.

- international Partnerships: Collaborating with foreign investors and companies.

As a result, bhutan not only gains financial stability but also positions itself as a leader in the sustainable use of cryptocurrency, paving the way for othre nations to explore similar pathways. The ongoing developments reflect an enterprising vision,setting an example of how small nations can engage meaningfully in the global financial ecosystem.

Recommendations for Countries Exploring Digital Asset Investments

As nations consider venturing into the realm of digital asset investments, several strategic recommendations can enhance their chances of harnessing the benefits of cryptocurrencies while mitigating risks. First and foremost, regulatory clarity is crucial.Governments must establish a coherent legal framework that not only safeguards investors but also fosters innovation. This includes defining cryptocurrency’s status under existing laws,implementing tax guidelines,and setting out anti-money laundering (AML) protocols.Additionally, investing in public education about digital currencies can empower citizens and stakeholders to make informed decisions regarding their investments.

Moreover, countries should prioritize the development of technological infrastructure that supports blockchain and cryptocurrency technologies. This could involve collaborating with tech companies to establish robust platforms for trading and blockchain applications. Emphasizing security measures is also essential; countries must engage in constant monitoring of their digital asset markets to thwart cyber threats. By encouraging partnerships between governments, fintech startups, and established financial institutions, nations can create a diversified ecosystem that nurtures investment opportunities while safeguarding against volatility.

Wrapping up

As Bhutan continues to navigate the complexities of cryptocurrency and its role in the global financial landscape,the nation’s substantial investment in Bitcoin underscores a deliberate strategy aimed at leveraging the potential of digital assets. With a remarkable $750 million in holdings, Bhutan’s approach reflects a forward-thinking perspective that balances tradition with innovation. As governments and financial institutions worldwide grapple with the implications of cryptocurrencies, Bhutan’s case offers a engaging glimpse into the future of digital finance. The nation’s unique journey highlights the potential benefits and risks that lie ahead in an ever-evolving economic environment, prompting further exploration of how smaller nations can carve out their own paths in the burgeoning world of blockchain technology. As developments unfold, stakeholders from both the public and private sectors will be keen to monitor Bhutan’s progress, which may well serve as a bellwether for the adoption of cryptocurrency in emerging markets.