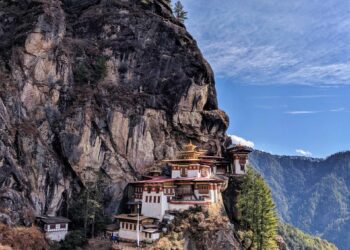

In recent years, Bhutan has emerged as an unexpected player in the global cryptocurrency landscape, leveraging its unique economic framework to embrace the burgeoning world of digital finance. In an article by the Financial Times, it is highlighted that the Himalayan kingdom has adopted Bitcoin reserves as an integral part of its monetary strategy, challenging conventional notions of currency and finance. Bhutan’s pioneering approach not only reflects its commitment to lasting development and technological innovation but also positions the nation at the forefront of a global dialogue about the future of money. This article delves into Bhutan’s motivations for integrating Bitcoin into its economy, the implications for its citizens, and the potential lessons other nations might learn from its bold experiment.

Impact of Bitcoin Reserves on Bhutan’s economy

The integration of Bitcoin reserves into Bhutan’s economy marks a significant evolution in the country’s financial landscape.As more businesses and individuals adopt cryptocurrency for daily transactions, the nation is experiencing a shift towards a decentralized financial future. This transformation facilitates both local and international trade, with companies embracing Bitcoin to bypass traditional banking fees and expedite cross-border payments. The benefits of this paradigm shift include:

- Increased Financial Inclusion: cryptocurrencies provide access to financial services for those previously unbanked.

- Stability in Economic Transactions: bitcoin’s decentralized nature mitigates the impacts of local currency fluctuations.

- Attraction of Foreign Investment: A tech-savvy reputation bolsters bhutan’s appeal to global investors.

However, this adoption is not without its challenges. The volatility inherent in cryptocurrencies poses risks to economic stability. Policymakers must balance innovation with regulation to ensure consumer protection and financial security. Recent discussions in the National Assembly have focused on establishing a regulatory framework that includes measures such as:

| Regulatory Measure | Description |

|---|---|

| Licensing Framework | Creating a system for crypto-businesses to operate legally within Bhutan. |

| Consumer Protection Laws | Ensuring that users have rights and protections when using cryptocurrencies. |

| Taxation Policies | Implementing tax guidelines for crypto transactions to prevent illicit activities. |

Regulatory Framework: navigating Cryptocurrency Legislation

The regulatory landscape surrounding cryptocurrencies like bitcoin is rapidly evolving, especially in innovative markets such as Bhutan. As the nation embraces digital currencies, understanding the legislative framework becomes essential for stakeholders. The government is actively establishing guidelines that foster the growth of this new financial ecosystem while ensuring consumer protection and financial stability. Key components of this framework include:

- Licensing Requirements: Cryptocurrency exchanges must obtain a license from regulatory authorities, ensuring compliance with local laws and international best practices.

- taxation policies: Clear tax guidelines are being developed to address the treatment of cryptocurrency transactions, capital gains, and business revenues.

- Consumer Protection Measures: Initiatives are in place to safeguard users from fraud and market manipulation, enhancing trust in cryptocurrency dealings.

Furthermore, Bhutan’s approach to embracing cryptocurrencies serves as a case study for balancing innovation with regulation. by collaborating with experts in the field, policymakers can adjust their strategies to accommodate future advancements. To illustrate this balanced approach,the following table highlights the main regulatory bodies and their respective roles:

| Regulatory Body | Role in Cryptocurrency Regulation |

|---|---|

| Royal Monetary Authority | Oversees the implementation of financial regulations and licensing for crypto businesses. |

| Ministry of Finance | Develops tax policies related to crypto transactions and investments. |

| Information Dialogue and Media Authority | Ensures consumer protection against misinformation and scams in the digital asset space. |

Adoption Challenges: Infrastructure and Public Awareness

The rapid integration of bitcoin reserves into Bhutan’s economy presents notable infrastructure challenges that must be addressed to ensure sustainable adoption. The country’s existing financial architecture requires significant enhancements to support the secure transactions and storage of cryptocurrency. Key areas that need attention include:

- Digital Payment Systems: Upgrades to the current payment systems are essential for facilitating seamless bitcoin transactions.

- Cybersecurity Measures: Strengthening cybersecurity protocols to protect against potential threats and ensure user confidence.

- Energy Supply: Ensuring reliable and sustainable energy sources to support the energy-intensive mining processes, which are vital for maintaining network integrity.

In addition to infrastructure,the success of bitcoin adoption heavily relies on public awareness and education. A lack of understanding about cryptocurrency can breed skepticism and hinder acceptance among locals. To foster a more informed populace, initiatives must include:

- Community Workshops: Organizing educational sessions to clarify what bitcoin is and how it functions.

- Government Campaigns: Implementing state-supported campaigns that highlight the benefits and risks of using cryptocurrency.

- Partnerships with Local Businesses: Collaborating with merchants and local entrepreneurs to promote practical use cases and real-world applications.

| Challenge | Solution |

| Limited Infrastructure | Investment in upgrade and security protocols |

| Lack of Public Knowledge | Educational workshops and campaigns |

| Energy Reliance | Developing sustainable energy sources |

Future prospects: Bitcoin’s Role in Bhutan’s Financial Landscape

The integration of Bitcoin into Bhutan’s financial ecosystem is predicted to pave the way for a more inclusive economic framework. With the government already recognizing the potential of digital currencies, Bhutan is uniquely positioned to harness the advantages of blockchain technology. Key trends that may shape Bhutan’s financial landscape include:

- Increased Financial Inclusion: By leveraging Bitcoin, Bhutan can enhance access to financial services for its rural population, enabling them to engage in the global economy.

- Tourism Revenue Surge: As a popular tourist destination, Bhutan could attract crypto-savvy travelers who prefer to spend Bitcoin over traditional currencies.

- Sustainable Investment Opportunities: the nation can utilize Bitcoin investments to fund green energy projects, aligning with Bhutan’s commitment to sustainable development.

As the country explores regulatory frameworks to accommodate cryptocurrencies, public education will become paramount. Stakeholders must emphasize understanding digital assets to mitigate risks associated with volatility. A collaborative effort between the government, financial institutions, and tech innovators will be essential in creating a secure environment for Bitcoin transactions. The table below outlines potential benefits and challenges that may arise as Bhutan embraces this digital frontier:

| Benefits | Challenges |

|---|---|

| boosted economic growth | Regulatory uncertainty |

| Enhanced remittance channels | volatility of Bitcoin |

| Innovative financial products | Security and fraud risks |

Recommendations for Sustainable Cryptocurrency Integration

As Bhutan embraces Bitcoin as part of its financial landscape, it sets an innovative precedent for Sustainable Cryptocurrency integration. This approach emphasizes aligning cryptocurrency practices with environmental and social governance principles. To foster sustainability, policymakers and stakeholders should consider the following strategies:

- Regulatory Frameworks: Establish clear guidelines for cryptocurrency mining that mandate the use of renewable energy sources to reduce carbon footprints.

- Incentives for Green Mining: Create tax benefits or subsidies for companies that adopt eco-friendly technologies in their mining operations.

- Public Awareness Campaigns: Educate citizens about the environmental impacts of cryptocurrency use and promote energy-efficient practices.

Moreover, collaboration between the government, private sector, and local communities is essential for creating a resilient cryptocurrency ecosystem.An integrated approach might include:

| Stakeholder | Role in Sustainability |

|---|---|

| Government | Implementing regulations and incentives. |

| Businesses | Adopting sustainable practices in mining and operations. |

| Community | Participating in local decision-making and education. |

By weaving sustainability into the fabric of cryptocurrency integration, Bhutan can not only secure its economic future but also set a global benchmark for environmentally responsible digital finance.”

Wrapping Up

Bhutan’s innovative approach to integrating bitcoin into its financial ecosystem marks a significant step in the evolution of digital currencies on a global scale. By leveraging its unique hydropower resources to mine bitcoin, Bhutan not only diversifies its economic portfolio but also positions itself as a potential leader in sustainable cryptocurrency practices. As the world observes this small Himalayan kingdom, the implications of its practices could inspire other nations contemplating the adoption of digital currencies. The intersection of tradition and technology in Bhutan serves as a compelling case study for the future of finance,highlighting both the opportunities and challenges that lie ahead in the integration of cryptocurrencies into mainstream economies. As Bhutan continues to navigate this uncharted territory, the global financial community will undoubtedly be watching closely, eager to understand the outcomes of this pioneering venture.