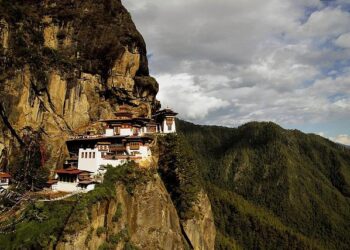

Several cryptocurrency wallets associated with Bhutan’s state-owned investment arm, Druk Holdings & Investments, have been identified as actively building a leveraged position in Ethereum (ETH). This strategic move signals a growing interest from sovereign entities in the world’s second-largest blockchain platform amid increasing institutional adoption. The development, uncovered through on-chain analysis, provides new insights into how government-linked portfolios are engaging with decentralized finance, potentially influencing both market dynamics and regulatory perspectives.

Wallets Associated with Bhutan’s Druk Holdings Accumulate Leveraged Ethereum Positions

Recent on-chain analysis reveals a notable surge in Ethereum holdings linked to wallets associated with Bhutan’s Druk Holdings. These wallets have been actively accumulating ETH through leveraged positions, signaling a strategic bet on the cryptocurrency’s short to mid-term performance. Blockchain data highlights that the leveraged exposure has been growing steadily over the past month, with a preference for long positions secured via decentralized lending platforms. This movement aligns with a broader trend of institutional players seeking higher yield through crypto derivatives, revealing increasing confidence in Ethereum’s upcoming network upgrades and scalability solutions.

Key observations include:

- Concentration of leveraged ETH in less than five primary wallets linked to Druk Holdings.

- Use of multiple DeFi protocols for borrowing and collateralization, indicating complex multi-platform strategies.

- Leveraged positions averaging 2x to 3x, suggesting a cautious but optimistic risk appetite.

| Metric | Value | Trend |

|---|---|---|

| Total ETH Leveraged | 15,400 ETH | +18% MoM |

| Primary Wallets | 4 | Stable |

| Average Leverage | 2.7x | +0.3x MoM |

Analysis Reveals Strategic Moves Amid Rising Crypto Volatility

In recent weeks, on-chain analytics have highlighted an assertive accumulation of leveraged Ethereum positions by wallets traced to Druk Holdings, Bhutan’s sovereign wealth entity. Despite the ongoing volatility buffeting the crypto market, these entities are strategically capitalizing on price fluctuations by increasing exposure to ETH through margin-based instruments. This move signals a calculated confidence in Ethereum’s mid to long-term value proposition, leveraging both market dips and rallies to optimize their portfolio strength.

Key findings indicate:

- A steady increase in leveraged ETH holdings by Druk-linked wallets over the past 30 days.

- Enhanced activity around options and futures contracts, indicating hedging tactics amidst price uncertainty.

- Selective timing aligning with broader macroeconomic trends influencing crypto asset valuations.

| Metric | Current Value | Change (Last 30 Days) |

|---|---|---|

| Leveraged ETH Position | 1,750 ETH | +45% |

| Open Futures Contracts | 320 Contracts | +30% |

| Average Entry Price | $1,620 | -5% |

Experts Advise Caution as Leverage Amplifies Exposure in ETH Markets

Market analysts are urging traders to exercise prudence as recent on-chain data reveals wallets associated with Bhutan’s Druk Holdings are increasingly utilizing leverage to amplify their exposure in Ethereum markets. While this strategy can lead to substantial gains during bullish phases, experts warn that it significantly magnifies downside risks. The combination of high volatility inherent to cryptocurrencies and leveraged positions raises concerns about rapid liquidation events that could ripple through the market.

Key considerations highlighted by professionals include:

- Heightened liquidation risk: Leveraged positions can trigger forced sales, exacerbating price declines.

- Market liquidity impact: Sudden unwinding of positions may strain liquidity, affecting price stability.

- Portfolio vulnerability: Amplified volatility exposure could adversely affect long-term asset allocation.

| Risk Factor | Potential Impact |

|---|---|

| Leverage Ratio | Up to 5x exposure noted |

| Liquidation Threshold | Price drop >20% |

| Position Size | Significant relative to wallet holdings |

Final Thoughts

As wallets associated with Bhutan’s Druk Holdings continue to amass a leveraged position in Ethereum, market observers will be closely monitoring the potential impacts on both the cryptocurrency landscape and Bhutan’s emerging digital asset strategy. This development underscores the growing intersection of sovereign wealth management and decentralized finance, hinting at a future where traditional institutions increasingly engage with crypto markets. Further updates are expected as more data emerges on Druk Holdings’ activities and their broader investment approach.