North Korea Surpasses El Salvador and Bhutan in Bitcoin Holdings Following $1.4 Billion Bybit Hack: arkham Analysis

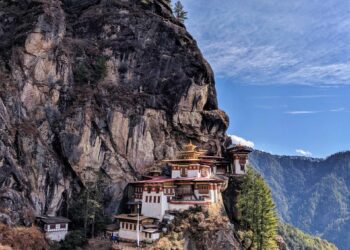

In a startling development in the world of cryptocurrency, North Korea has reportedly surpassed both El Salvador and bhutan in Bitcoin (BTC) holdings, a shift that has emerged in the wake of the staggering $1.4 billion hack of the Bybit exchange. According to a recent analysis by Arkham Intelligence, the hermit kingdom’s accumulation of digital assets is not merely a reflection of its geopolitical isolation but a strategic maneuver to bolster its economy amidst ongoing sanctions. As the global cryptocurrency landscape evolves, this revelation raises pressing questions about the implications of state-sponsored cybercrime and the increasing intersection of geopolitics and digital currencies.

North Korea Rises in Bitcoin Holdings after Major Bybit Incident

In a surprising turn of events, North Korea has significantly increased its Bitcoin holdings, overtaking nations like El Salvador and Bhutan in the crypto landscape. This surge follows the major Bybit security breach, which resulted in an estimated loss of $1.4 billion, prompting state-sponsored actors to capitalize on the opportunity. Analysts from Arkham Intelligence have reported that North korean operatives utilized the chaos to acquire substantial amounts of Bitcoin, strategically positioning the nation as a formidable player in the cryptocurrency arena.

The ramifications of this incident extend beyond mere fluctuations in digital currency rankings. As tensions escalate, various experts suggest that this bolstered cryptocurrency arsenal may afford North Korea not just financial leverage but also a means to circumvent international sanctions. The current landscape underscores a shift in the balance of power within the crypto space, highlighting the intricate relationships between national interests and digital assets. As the situation evolves,further monitoring will be essential to understand the full implications of this unexpected rise in Bitcoin holdings.

Analysis of the Bybit Hack and Its Impact on Global Cryptocurrency Landscape

The recent breach of Bybit, which resulted in a staggering loss of approximately $1.4 billion in Bitcoin, marks a important turning point in the ongoing saga of cybercrime in the cryptocurrency realm. Following this incident, reports indicate that North Korea has now surpassed both El Salvador and bhutan in terms of Bitcoin holdings. This shift raises critical questions regarding the implications of state-sponsored cyber activities and the geopolitical dynamics surrounding cryptocurrency adoption. The cryptocurrency market, already volatile, faces a further threat as hackers increasingly target exchanges, illustrating a growing trend where illicit activities are intertwined with national strategies for wealth accumulation.

The situation amplifies concerns among investors and regulators alike as nations like North Korea leverage these significant hacks to bolster their cryptocurrency assets amidst international sanctions. This newfound wealth not only poses challenges to global financial security but also threatens the integrity of the cryptocurrency ecosystem. Stakeholders must consider several factors:

- Regulatory Responses: How will regulatory bodies react to increased state involvement in cryptocurrency?

- Market Volatility: What impact will the growing reserves of countries like North Korea have on market stability?

- Investor Confidence: Will such breaches deter investor interest in the cryptocurrency space?

The Bybit hack serves as a reminder of the fragility of digital assets, emphasizing the need for enhanced security measures across platforms globally. The fallout from this incident could lead to a paradigm shift in how cryptocurrencies are perceived and regulated, making it essential for market participants to adapt swiftly.

recommendations for Securing crypto Assets Amidst Rising Cyber Threats

As the landscape of cryptocurrency continues to face unprecedented threats, particularly highlighted by the recent $1.4 billion hack of Bybit, securing digital assets has never been more crucial. Investors and institutions must adopt enhanced security measures to protect their holdings from elegant cyber attacks. Key strategies include:

- Implementing Multi-Factor Authentication (MFA): This adds an extra layer of security by requiring multiple forms of verification before accessing crypto accounts.

- Utilizing Hardware Wallets: These offline devices keep your private keys secure from online threats, making them less susceptible to hacking.

- Regular Software Updates: Keeping wallets and apps updated ensures that you benefit from the latest security patches and enhancements.

Moreover, staying informed about the latest cyber threats is paramount for crypto holders.Engaging with cybersecurity communities and following credible news sources can provide timely alerts about vulnerabilities and breaches. In addition, conducting regular audits and assessments of your crypto storage solutions will help identify potential risks and implement necessary safeguards. Consider maintaining a diversified portfolio across various wallets to mitigate the risk of a single point of failure.below is a simple comparison of potential storage solutions:

| Storage Solution | Security Level | accessibility |

|---|---|---|

| Hardware Wallet | High | Low |

| Software Wallet | Medium | High |

| Exchange Wallet | Low | Very High |

Final Thoughts

In the ever-evolving landscape of cryptocurrency,North Korea’s recent ascent in Bitcoin holdings—now surpassing both El Salvador and Bhutan—marks a significant shift in the geopolitical implications of digital assets. Following the massive $1.4 billion hack of Bybit, as reported by Arkham, the ramifications of this development extend beyond mere financial metrics, raising questions about security, regulation, and the use of cryptocurrencies by nation-states. As governments and regulatory bodies grapple with the rising influence of illicit actors in the crypto space, this situation underscores the urgent need for enhanced cybersecurity measures and international cooperation. Moving forward, the intersection of digital currencies and geopolitics will undoubtedly be a focal point for policymakers and analysts alike, as the world watches closely to see how these dynamics unfold.