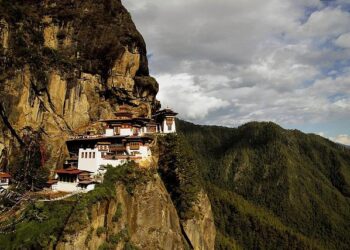

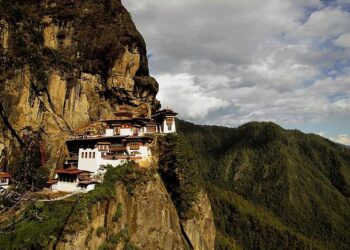

Tata Power has taken a significant step to expand its renewable energy portfolio by signing agreements to acquire a 40% stake in a special purpose vehicle (SPV) focused on hydropower projects in Bhutan. The move underscores the company’s commitment to sustainable energy investments and regional cooperation in South Asia. Following the announcement, Tata Power’s shares experienced a modest uptick, reflecting investor optimism about the strategic acquisition and its potential to enhance the firm’s long-term growth prospects.

Tata Power Expands Renewable Portfolio with Strategic Stake in Bhutan Hydropower Project

Tata Power has taken a significant step towards strengthening its renewable energy capabilities by signing definitive agreements to acquire a 40% stake in a special purpose vehicle (SPV) dedicated to a major hydropower project in Bhutan. This move aligns with Tata Power’s strategic vision to diversify its energy mix and enhance cross-border collaborations in clean energy. The hydropower project, known for its substantial capacity and environmental benefits, is poised to contribute significantly to the region’s clean energy landscape, providing sustainable electricity generation with minimal carbon footprint.

Market response to the announcement was positive, with Tata Power’s shares edging higher amid investor confidence in the company’s long-term growth prospects. The acquisition brings key advantages:

- Enhanced renewable portfolio: Access to Bhutan’s abundant hydropower resources.

- Strategic regional partnership: Strengthening India-Bhutan energy ties.

- Long-term revenue visibility: Stable returns from hydropower generation.

The collaboration positions Tata Power as a front-runner in sustainable energy development, underpinning India’s commitment to achieving its ambitious renewable energy targets.

| Project Attribute | Details |

|---|---|

| Hydropower Capacity | Approx. 600 MW |

| Stake Acquired | 40% |

| Estimated Investment | â‚ą1,200 Crores |

| Expected Commissioning | 2027 |

Implications of Tata Power’s Investment for Regional Energy Collaboration and Market Position

Tata Power’s strategic acquisition of a 40% stake in the Bhutan hydropower SPV is a significant move towards strengthening regional energy ties. This investment not only amplifies cross-border cooperation between India and Bhutan but also fosters a more integrated power grid, facilitating smoother electricity trade and enhanced energy security in South Asia. The project demonstrates the potential of leveraging Bhutan’s abundant hydro resources to meet the rising energy demands of India, promoting sustainable and renewable energy development in the region. Experts foresee this partnership accelerating knowledge exchange, infrastructure development, and policy alignment, which are critical for scaling up clean energy projects across neighboring nations.

Beyond regional collaboration, this deal positions Tata Power firmly on the competitive map of the renewable energy sector. By securing a significant foothold in Bhutan’s hydropower landscape, Tata Power diversifies its portfolio and strengthens its leverage in the evolving energy market. Key implications include:

- Enhanced market presence: Expanding asset base in hydroelectric power boosts the company’s profile as a leading renewable energy player.

- Improved financial stability: Long-term power purchase agreements from Bhutan can lead to steady revenue streams.

- Potential for future collaborations: Sets precedent for partnerships in other emerging markets within the region.

| Aspect | Expected Impact |

|---|---|

| Cross-border Energy Trade | Streamlined, increased volume |

| Renewable Energy Contribution | Expanded by 40% in hydropower sector |

| Regional Diplomacy | Strengthened India-Bhutan energy ties |

| Market Competitiveness | Improved positioning among peers |

Analysts Recommend Monitoring Share Performance Amid Growing Renewable Energy Commitments

Market watchers are advised to keep a close eye on Tata Power’s share trajectory as the company progresses in expanding its renewable energy portfolio. The recent agreement to acquire a 40% stake in the Bhutan hydropower special purpose vehicle (SPV) highlights Tata Power’s aggressive push into clean energy markets. This strategic move is expected to bolster the company’s generation capacity and diversify its asset base, factors that analysts suggest could lead to upward momentum in share prices over the medium term.

Key considerations for investors include:

- Growing demand for renewable energy assets amid global decarbonization efforts

- Potential for long-term stable cash flows from hydropower projects

- Increased government support and favorable policies in India and Bhutan

| Metric | Current Value | Analyst Outlook |

|---|---|---|

| Share Price Movement | +3.2% (post-announcement) | Positive |

| Renewable Capacity Addition | 1,200 MW (target 2025) | Strong Growth |

| Stake in Bhutan SPV | 40% | Strategic Advantage |

The Conclusion

The acquisition marks a significant strategic move for Tata Power as it expands its footprint in the renewable energy sector and strengthens its presence in the South Asian market. With the deal now signed, industry watchers will be closely monitoring the company’s next steps and the potential impact on Bhutan’s hydropower development. Following the announcement, Tata Power’s shares showed a positive response, reflecting investor confidence in the company’s growing portfolio and future prospects.