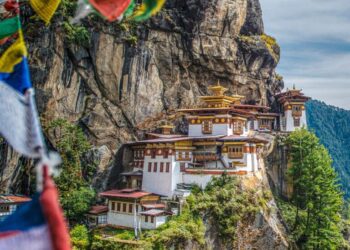

In a strategic move poised to reshape the banking landscape in bhutan, Tata Consultancy Services (TCS), a global leader in IT services and consulting, has secured a important partnership with the Bank of Bhutan. This collaboration aims to modernize the bank’s digital core, a critical component of its operational framework, and elevate the customer experience for its growing clientele. As financial institutions worldwide increasingly pivot towards digital conversion to meet evolving consumer demands, TCS’s involvement underscores its commitment to driving innovation in the banking sector. The agreement highlights not only TCS’s technological prowess but also the Bank of Bhutan’s dedication to enhancing its services through cutting-edge solutions, setting the stage for a new era of banking in the region.

TCS Partnership with Bank of Bhutan: A Strategic Move for Digital Transformation

The recent collaboration between Tata Consultancy services (TCS) and the Bank of Bhutan marks a significant leap towards modernizing the banking landscape in Bhutan. This initiative aims to transform the bank’s digital core, harnessing TCS’s advanced technological capabilities to create a more agile and responsive banking environment. The partnership focuses on introducing cutting-edge solutions that will enable the Bank of Bhutan to streamline its operations, enhance data management, and drive efficiency.Key areas of improvement include:

- Enhancing Customer Experience: With a modernized digital core, customers can anticipate quicker services and tailored banking solutions.

- Improved Operational efficiency: Automation and innovative tools will reduce manual processes, minimizing errors and increasing productivity.

- robust Security Measures: TCS’s expertise in cybersecurity will help fortify the bank against evolving threats.

This strategic partnership not only aims to reinforce the Bank of Bhutan’s commitment to providing extraordinary services but also positions it as a leader in digital banking within the region. by leveraging TCS’s proven methodologies, the bank is set to embark on a journey of sustained modernization. This initiative includes establishing a framework that will enable the Bank of Bhutan to adapt to future digital trends and customer expectations, ensuring it remains competitive in a rapidly evolving market. A brief comparison of the anticipated benefits pre- and post-transformation can be seen in the table below:

| Aspect | Before Partnership | After Partnership |

|---|---|---|

| Customer Response Time | Average of 4 hours | real-time responses |

| Transaction processing Speed | 2-3 days | Instantaneous processing |

| Security Protocols | Standard measures | Advanced cybersecurity frameworks |

Revamping Digital Core Systems: Key Features and Benefits for Banking operations

Modernizing digital core systems is essential for banks aiming to enhance operational efficiency and customer satisfaction. By integrating advanced technologies,financial institutions can create a seamless banking experience that meets the evolving needs of their clientele. Key features to look out for in a revamped digital core include:

- Real-time Data Processing: Enables immediate access to transaction data for quicker decision-making.

- Integrated Customer Relationship Management (CRM): Allows for personalized customer interactions, resulting in improved loyalty.

- Advanced analytics: Facilitates data-driven insights, helping banks tailor their services to market demands.

- Scalability: Supports future growth, enabling banks to expand their services without significant overhauls.

The benefits of adopting an enhanced digital core system extend beyond operational improvements. They can significantly influence customer experience and market competitiveness. Among the advantages are:

| Benefit | Description |

|---|---|

| Improved User Experience | Simplified interfaces lead to effortless banking interactions. |

| faster Service Delivery | Reduced processing times for transactions enhance responsiveness. |

| Cost Efficiency | Automation of routine tasks lowers operational costs. |

| Regulatory Compliance | In-built compliance features mitigate risks associated with regulations. |

Enhancing Customer Experience: Innovations and Technologies in Modern Banking

The collaboration between Tata Consultancy Services (TCS) and the bank of Bhutan marks a significant step towards transforming banking operations through advanced digital solutions. By modernizing the bank’s digital core, TCS aims to integrate innovative technologies that enhance efficiency and streamline customer interactions.This initiative is central to the bank’s strategy of delivering a seamless experience that resonates with tech-savvy customers. The use of artificial intelligence,machine learning,and data analytics will empower the Bank of Bhutan to understand customer preferences better,allowing for personalized services that align with the evolving financial landscape.

Among the key innovations set to be implemented are:

- Enhanced Digital Platforms: Adoption of mobile banking solutions that provide users with easy access to financial services anytime, anywhere.

- Real-time Analytics: Leveraging big data to derive actionable insights for improved product offerings and services.

- Automated Customer Support: Implementation of AI-driven chatbots to provide 24/7 assistance to customers, enhancing satisfaction and reducing wait times.

Additionally, TCS’s expertise in cloud technology will facilitate a more agile banking environment that can quickly adapt to changing market conditions. this holistic approach is expected to significantly boost customer engagement and loyalty, positioning the Bank of Bhutan as a leader in the region’s banking industry.

Implementation Strategy: Steps Toward a Seamless Transition and Integration

Implementing a modern digital core for the Bank of Bhutan requires meticulous planning and execution. The following steps outline a extensive approach to ensure a seamless transition:

- Assessment of Current Systems: Conduct a thorough analysis of existing infrastructure to identify gaps and opportunities.

- Stakeholder Engagement: Involve key stakeholders from both TCS and the Bank of bhutan to foster collaboration and alignment on project objectives.

- Development of a Roadmap: Create a detailed roadmap that outlines timelines, deliverables, and milestones to track progress effectively.

- Phased Implementation: roll out the new digital core in phases to minimize disruption and allow for real-time adjustments based on feedback.

- Employee Training: Organize training sessions for bank staff to equip them with the necessary skills to utilize the new systems efficiently.

Monitoring and evaluation will play a crucial role in the transition process. TCS will implement a robust feedback mechanism that allows for:

- Performance Metrics: Establish key performance indicators (KPIs) to measure the system’s effectiveness post-implementation.

- Continuous Improvement: Adapt and refine processes based on user feedback and technological advancements.

- Customer Feedback Loop: Engage with customers to gather insights on their experiences, facilitating further enhancements in service delivery.

| Step | Objective |

|---|---|

| Current Systems Assessment | Identify existing challenges and opportunities |

| Stakeholder Engagement | Ensure alignment and collaboration |

| Phased Implementation | Minimize disruption during rollout |

| Employee Training | Equip staff for effective system use |

| Monitoring and Evaluation | Facilitate continuous system improvement |

Future Outlook: Implications for the Banking Sector in Bhutan and Beyond

The recent agreement between TCS and the Bank of Bhutan marks a pivotal shift in the digital banking landscape of Bhutan,with significant implications for both the local sector and the broader regional banking ecosystem. This collaboration exemplifies a growing trend where traditional banking institutions are increasingly prioritizing digital transformation to enhance operational efficiency and customer engagement. By modernizing their digital core, the Bank of Bhutan is setting a precedent that encourages other banks in the region to adopt similar innovations. As Bhutan continues to embrace technology, we may see a ripple effect across South Asia, where more banks will endeavor to enhance their services through digital tools designed to meet evolving customer expectations.

Furthermore, the push towards digital banking not only aims to improve user experience but also to ensure financial inclusion for underserved communities. The potential benefits of this modernization can be enormous:

- Improved Accessibility: Customers can access banking services from anywhere, encouraging a wider adoption of digital finance.

- Enhanced Security: Advanced technologies will help ensure safer transactions, fostering trust among consumers.

- Data-Driven Insights: Banks can leverage customer data to offer personalized services, stimulating customer loyalty.

In the long term, as banks across the region adopt similar strategies, we can anticipate a more competitive financial landscape, where innovation becomes key to survival, ultimately shaping the future of banking not only in Bhutan but also beyond its borders.

Recommendations for Other Banks Considering Digital Transformation initiatives

As banks navigate the complexities of digital transformation, there are several key strategies to consider that can enhance their initiatives. Emphasizing customer-centric design is paramount; understanding the specific needs and preferences of customers allows banks to tailor their services effectively. Investing in robust technology infrastructure is equally essential, allowing for scalable solutions that can adapt to changing customer demands and regulatory requirements. Additionally, fostering a culture of innovation within the organization can lead to more agile responses to market shifts and advancements.

Collaboration with technology partners can significantly expedite the transformation process. Establishing strategic alliances with fintechs and tech firms can bring in cutting-edge solutions and expertise. Moreover, banks should prioritize data-driven decision-making to leverage insights that enhance customer engagement and streamline operations. Training and development programs for staff will ensure that the workforce is equipped with the skills necessary to thrive in a digital landscape, fostering resilience and adaptability across the institution.

to sum up

tata Consultancy Services’ recent partnership with the Bank of Bhutan marks a significant step towards modernizing the financial landscape of the region. By implementing advanced digital core solutions, TCS is not only set to enhance the bank’s operational efficiency but also to elevate the customer experience to new heights. This collaboration underscores the growing trend of banks embracing technology to meet the evolving demands of their clientele, thereby ensuring they remain competitive in an increasingly digital world. As TCS continues to expand its footprint in the banking sector, the outcome of this initiative will likely provide valuable insights and benchmarks for financial institutions aiming to adopt similar transformations. The successful execution of this project coudl serve as a catalyst for further financial innovations in Bhutan and beyond, heralding a new era of digital banking across the region.

![Salzburg Azerbaijan House strengthens cultural ties with Austria through new guest visit [PHOTOS] – AzerNews](https://asia-news.biz/wp-content/uploads/2025/04/154928-salzburg-azerbaijan-house-strengthens-cultural-ties-with-austria-through-new-guest-visit-photos-azernews-120x86.jpg)