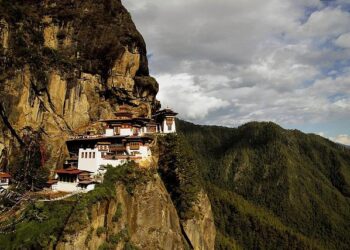

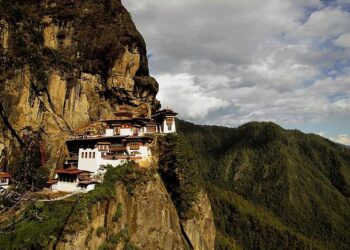

Transforming Banking in Bhutan: TCS and Bank of Bhutan’s Innovative Partnership

Tata Consultancy Services (TCS), a prominent player in IT services and consulting, has forged a notable alliance with the Bank of Bhutan, aiming to revolutionize the banking sector within the country. This partnership is set to enhance the bank’s digital infrastructure, which is vital for its operations, while together improving customer experiences for its expanding user base. As financial institutions globally shift towards digital conversion to cater to changing consumer preferences, TCS’s role highlights its dedication to fostering innovation in banking. This collaboration not only showcases TCS’s technological expertise but also reflects the Bank of Bhutan’s commitment to adopting state-of-the-art solutions, paving the way for a transformative era in regional banking.

Strategic Partnership for Digital Evolution

The alliance between Tata Consultancy Services (TCS) and the Bank of Bhutan signifies a major advancement towards modernizing banking practices in Bhutan. The initiative focuses on revamping the bank’s digital core by leveraging TCS’s cutting-edge technology capabilities to foster an agile and responsive banking habitat. Key objectives include:

- Elevating Customer Experience: A revamped digital core will enable faster services and customized banking options.

- Boosting Operational Efficiency: Automation tools will streamline processes, reducing manual errors while enhancing productivity.

- Strengthening Security Protocols: With TCS’s cybersecurity expertise, the bank will be better equipped against emerging threats.

This strategic collaboration aims not only at reinforcing the Bank of Bhutan’s promise of exceptional service but also positions it as a frontrunner in regional digital banking. By utilizing TCS’s established methodologies, this partnership sets forth on a path toward ongoing modernization that prepares the bank for future trends and customer expectations—ensuring competitiveness within an ever-evolving market landscape. Below is an overview comparing expected benefits before and after this transformation:

| Aspect | Status Before Collaboration | Status After Collaboration |

|---|---|---|

| Customer Response Time | Averaging 4 hours | Real-time responses anticipated |

| Transaction Processing Speed | Averaging 2-3 days |

Upgrading Digital Core Systems: Essential Features and Advantages for Banking Operations

The modernization of digital core systems is crucial for banks seeking enhanced operational efficiency alongside improved customer satisfaction. By integrating advanced technologies into their frameworks, financial institutions can deliver seamless experiences that align with evolving client needs. Notable features anticipated from upgraded systems include:

- Synchronous Data Processing: Facilitates immediate access to transaction data enabling swift decision-making.

- Unified Customer Relationship Management (CRM): Enriches personalized interactions leading to increased loyalty among customers.

- < strong >Sophisticated Analytics: Provides data-driven insights allowing banks to tailor offerings according to market demands.

- < strong >Scalability: Ensures future growth potential without extensive system overhauls required.< / li >

< / ul >The advantages derived from implementing an enhanced digital core extend beyond mere operational enhancements; they significantly impact customer experience and also competitive positioning within markets.Some key benefits are outlined below:

< strong >Benefit< / strong > < strong>Description< / strong >

< / tr >

< /thead >< strong >Enhanced User Experience< / strong > Simplified interfaces lead users through effortless transactions.< / td > < tr />

< strngfaster Service Delivery Reduced processing times improve responsiveness.< td /> < strngCost Efficiency Automation reduces routine task costs.< td /> < strngRegulatory Compliance Built-in compliance features mitigate regulatory risks.< td />

Improving Customer Experience Through Innovations & Technologies In Modern Banking

The collaboration between Tata Consultancy Services (TCS)and The Bank Of bhutan represents significant progress toward transforming conventional operations through advanced solutions aimed at enhancing efficiency while streamlining interactions with clients.This initiative aligns perfectly with their strategy focused on delivering seamless experiences tailored specifically towards tech-savvy consumers.

Key innovations slated include:

- Advanced Mobile Platforms: Implementation mobile applications providing users easy access anytime anywhere

- Real-Time Analytics: Utilization big data deriving actionable insights improving product offerings

- Automated Support Systems: Deployment AI chatbots offering round-the-clock assistance boosting satisfaction levels

Additionally,Tcs’ proficiency cloud technology enables more agile environments adapting quickly changing conditions ensuring higher engagement loyalty positioning them leaders industry regionally.

‘

‘

‘‘Step’‘

‘‘Objective’‘

‘‘

‘‘

‘<<'Current Assessment''Identify existing challenges opportunities'' '‘

‘< tr>‘

‘<<'Stakeholder Engagement''Ensure alignment collaboration'' '‘

<<'Phased Implementation''Minimize disruption during rollout'' <<'Employee Training''Equip staff effective use'' <<'Monitoring Evaluation''Facilitate continuous improvement''' '' ''

Denial of responsibility! asia-news.biz is an automatic aggregator around the global media. All the content are available free on Internet. We have just arranged it in one platform for educational purpose only. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials on our website, please contact us by email – [email protected].. The content will be deleted within 24 hours.ADVERTISEMENT