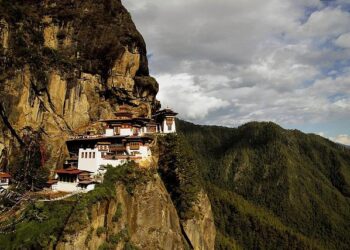

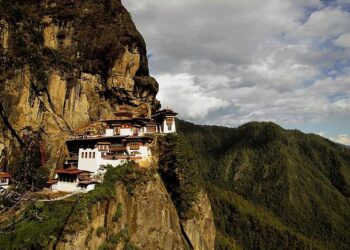

Bhutan’s sovereign wealth fund, though relatively small in scale, is making significant strides in the global investment arena by focusing on green energy initiatives and exploring opportunities within the cryptocurrency sector. This commitment to sustainability is evident in its diverse investment portfolio that emphasizes renewable energy sources such as hydroelectricity, solar power, and wind energy. By adopting this progressive strategy, the fund not only aims for consistent financial returns but also aligns with Bhutan’s overarching goal of achieving carbon neutrality, positioning itself as a key player in promoting environmentally sustainable growth.

Core Investment Focus Areas:

- Enhancing hydroelectric infrastructure to utilize Bhutan’s rich water resources.

- Investing in early-stage solar technology companies within the Himalayan region.

- Funding blockchain projects with an emphasis on Bitcoin mining operations powered by renewable resources.

| Investment Sector | Focus Area | Projected Outcomes |

|---|---|---|

| Hydropower Development | Infrastructure Growth | Revenue increase through clean energy exports | << tdstyle= " padding :10 px ;border :1 pxsolid#ddd;" >Initial Funding | << tdstyle= " padding :10 px ;border = "0" >Innovation & job creation locally |

<< / tr > << tr > << tdstyle = " padding = "0" >Bitcoin Mining | << tdstyle = " padding = ""0"" >Renewable Energy Operations | << tdstyle ="0">High yield potential & environmental benefits |

Strategic Bitcoin Investments Indicate a Shift Towards Digital Asset Integration

The Bhutanese sovereign wealth fund is making headlines by incorporatingBitcoin into its investment strategy while maintaining a strong focus on green energy projects. This trend reflects how smaller funds are increasingly utilizing digital assets not merely as speculative tools but as integral components of their diversification strategies. By investing in Bitcoin, the fund demonstrates confidence in the growing acceptance and maturity of digital currencies within institutional frameworks-showing that innovative approaches are not solely reserved for larger funds.

The traditional reliance on hydropower has long been central to Bhutan’s economic framework. However, this strategic pivot towards Bitcoin signifies an evolution towards a digitally integrated future. The leadership of the fund underscores its dual commitment to environmental sustainability and economic viability by balancing investments in clean energy with potentially lucrative returns from cryptocurrencies. Below is an overview of key asset allocations:

| Asset Category | |

|---|---|

- < li>Cross-sector synergy:Merging traditional investments with innovative digital assets.< li />< li/>Cautious innovation:A measured approach to Bitcoin exposure aimed at reducing volatility risks.< li />< li/>Sustainable vision:A dedication to balanced growth that meets both financial and ecological objectives.< li />

Policy Recommendations for Balancing Innovation and Financial Stability in Emerging Markets

An equally important aspect involves encouraging collaboration across sectors among government bodies , private innovators ,and international finance institutions . By creating platforms for knowledge exchange and incentivizing transparency , emerging markets can achieve a delicate balance between agility and caution . The table below outlines essential policy levers necessary for supporting this equilibrium :

| ‘Purpose’< th>‘Example Application’< th > |

|---|