In a significant move poised to reshape the digital payment landscape in China,American Express has announced its formal integration with Alipay,one of the country’s leading mobile payment platforms. This strategic partnership marks a pivotal step for American Express in enhancing its services for consumers and merchants in the world’s second-largest economy. As digital payments continue to gain traction among Chinese consumers, the collaboration not only underscores the growing importance of seamless and secure transaction methods but also reflects American Express’s commitment to expanding its footprint in Asia. This growth, reported by Reuters, will likely drive both competition and innovation in the rapidly evolving digital payment sector, transforming the way businesses engage with customers in China.

American Express Expands Its Global Reach Through Alipay Partnership

In a significant move to tap into the growing digital payment landscape in china, American Express has announced its partnership with Alipay.This collaboration marks a crucial step in Amex’s strategy to broaden its global footprint and cater to a diverse customer base. By integrating its services with Alipay, one of the largest digital wallets in the world, American Express aims to facilitate seamless transactions for both locals and travelers.This partnership will enable Amex cardholders to make purchases at a range of merchants across China, thus opening doors to a wider array of spending opportunities.

The partnership highlights the increasing importance of digital payment solutions in modern commerce. As consumers increasingly prefer cashless transactions, the alignment of American express with Alipay signifies a response to evolving consumer behavior. Some key benefits of this alliance include:

- Enhanced Accessibility: Cardholders can access a vast network of merchants using Alipay.

- Streamlined Transactions: effortless payment processes contribute to an improved customer experiance.

- Increased Local engagement: Better integration into local commerce for American Express users.

Both companies are poised to capitalize on the booming market, with alipay boasting millions of users and a strong presence in e-commerce. This partnership could possibly reshape the landscape of mobile payments in China, providing American express with a competitive edge.

| Feature | American Express | Alipay |

|---|---|---|

| User Base | 62 million cards issued | Over 1 billion users |

| Market Presence | Global | China and Asia |

| Transaction Type | Credit/Debit Payments | Mobile Wallet Payments |

Implications for American Consumers Using Alipay in China

The integration of American Express into alipay’s digital payment system presents several significant implications for American consumers traveling in China. as the world’s largest digital wallet platform, Alipay offers a seamless payment experience that can simplify transactions for U.S. travelers. By using Alipay, American consumers can enjoy the following benefits:

- Convenience: Instant access to funds without the need for cash or currency exchange.

- Familiarity: A recognizable brand like American Express provides trust and reassurance in foreign transactions.

- Rewards: Potentially accrue points or benefits from American Express while making purchases abroad.

Though, consumers should also be mindful of potential challenges that come with using Alipay. Understanding local regulations and the operational nuances of a foreign digital payment system is crucial. Key considerations include:

- Acceptance: While Alipay is widely accepted,some merchants may still prefer local payment methods.

- Fees: American Express may impose foreign transaction fees, altering the cost-benefit ratio of using the service.

- Privacy: Users should consider the implications of data sharing with foreign platforms and the associated privacy policies.

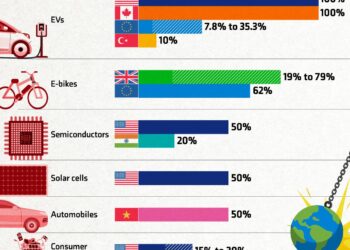

Understanding the Competitive Landscape of Digital Payments in China

The digital payment ecosystem in China has rapidly evolved, marked by intense competition among major players.Dominated by Alipay and WeChat pay, the landscape has transformed into a battleground for market share and technological advancement. In recent years, the entry of international brands like American Express into this vibrant market signals significant changes. As these entities align with local giants, partnerships are reshaping consumer access to payment solutions, catering to the increasing demands for seamless, secure transactions.The strategic alliances formed reflect a broader trend of collaboration that merges local expertise with international standards.

Understanding the competitive dynamics involves navigating several key factors:

- Consumer Trust: established Chinese platforms have built robust trust among users, which new entrants must earn.

- Regulatory Surroundings: Government regulations in China can shape operational capabilities and competitive strategies.

- Technological Integration: The ability to adapt and integrate advanced technologies, such as blockchain and AI, is crucial.

- User Experience: Enhancing user interfaces and experiences is vital to stand out in this crowded market.

| Company | Market Share (%) | Key Feature |

|---|---|---|

| Alipay | 55 | Comprehensive ecosystem of services |

| WeChat Pay | 40 | Integrated social media payments |

| American Express | 5 | Global brand recognition and loyalty programs |

As American Express integrates with Alipay’s platform, it represents a unique possibility to leverage these elements in a densely populated market. This collaboration underscores the importance of understanding local consumer behavior and the nuances of digital finance in China,presenting both challenges and opportunities for growth. The future of digital payments in China will be defined by how these complex competitive interactions evolve.

Future Prospects for American Express in the Asian Market

The recent integration of American Express with Alipay signifies a proactive approach to expanding its footprint in one of the world’s most dynamic digital payment landscapes. This partnership opens up a multitude of possibilities for American Express, enabling its cardholders to access a broader array of payment options within China, a market known for its rapid evolution in fintech. By aligning with Alipay, American Express can leverage the platform’s extensive user base, enhancing its appeal among Chinese consumers and fostering increased transactions in a region where cashless payments are becoming the norm.

looking towards the future, American Express is poised to capitalize on several key trends in the Asian market, including:

- Growth of E-commerce: The ongoing rise of online shopping presents an excellent opportunity for American Express to attract new customers.

- Mobile Payment Adoption: With smartphone usage skyrocketing, the demand for mobile payment solutions will continue to grow.

- Partnerships with Local Financial Institutions: Collaborations with regional banks and fintech companies can expand service offerings and improve customer engagement.

Investing in the Asian market will necessitate an agile strategy, focusing on localizing services to cater to consumer preferences.To illustrate American Express’s potential trajectory, the table below highlights growth forecasts within the digital payments sector:

| Year | Projected Growth Rate (%) | Market Size (Billion USD) |

|---|---|---|

| 2023 | 18% | 150 |

| 2025 | 22% | 200 |

| 2027 | 25% | 300 |

Strategic Recommendations for American Express to Enhance Customer Experience

To further enhance the customer experience, american Express should consider implementing a range of initiatives that leverage digital tools and data analytics. First and foremost, it is indeed crucial to create a personalized user interface within the Alipay platform, allowing cardholders to access their benefits, rewards, and transaction history seamlessly.Key actions may include:

- Utilizing AI-driven algorithms to offer tailored recommendations based on user spending patterns.

- Integrating loyalty programs that reward customers for using Amex with local merchants in China.

- Establishing a robust customer feedback loop to continuously gather insights on user experiences and preferences.

Moreover, enhancing customer education about the new functionalities available through Alipay can significantly impact user satisfaction.This includes creating informative content such as video tutorials and step-by-step guides that demonstrate the benefits of using American Express in combination with Alipay.American Express may also consider establishing a customer support feature within the app, providing real-time assistance. Potential features could include:

| Feature | Description |

|---|---|

| 24/7 Chat Support | Instant help for users experiencing issues or seeking information. |

| exclusive Offers | Real-time notifications of offers unique to Alipay-AmeX users. |

| usage Tips | Regular updates on maximizing benefits when using Amex via alipay. |

In Retrospect

American Express’s recent integration with Alipay marks a significant development in the realm of digital payments in China, further underscoring the growing importance of collaboration between Western financial services and Asian digital ecosystems. With this partnership, American Express aims to enhance the payment experience for both local consumers and international travelers, offering seamless transactions that bridge two distinct markets. As the landscape of global finance continues to evolve,this move not only signifies a commitment to innovation but also highlights the increasing necessity for financial institutions to adapt to consumer preferences in an interconnected world. as American Express expands its footprint in China, industry observers will be closely monitoring how this collaboration influences competitive dynamics within the digital payment arena.

![ISWK[Cambridge] Students Bring Glory to Oman at the 2nd Asian Yogasana Sport Championship! – Times of Oman](https://asia-news.biz/wp-content/uploads/2025/05/165927-iswkcambridge-students-bring-glory-to-oman-at-the-2nd-asian-yogasana-sport-championship-times-of-oman-120x86.jpg)