In recent developments highlighting the complex interplay between China’s government and global investment strategies, the nation has intensified it’s criticism of Li Ka-shing’s port advancement deal in Panama, which involves the influential investment firm BlackRock. This escalated rebuke underscores Beijing’s increasing scrutiny of foreign investments within its sphere of influence, notably in critical infrastructure projects. The friction surrounding this high-profile agreement raises questions about the future of foreign investment in China and its strategic interests abroad. As tensions mount, this article explores the implications of China’s stance on Li ka-shing’s project, the broader context of its investment policies, and the potential ripple effects for international investors navigating an increasingly unpredictable landscape.

China’s Strategic Response to Li Ka-shing’s Panama Port Deal

China’s response to Li Ka-shing’s Panama port deal,in collaboration with BlackRock,has been characterized by a marked intensification of diplomatic rhetoric and a calculated pushback against perceived foreign encroachment. The Chinese government, along with state-owned enterprises, has articulated concerns over the sovereignty implications tied to such investments in strategically vital regions. Issues surrounding national security and the potential for increased foreign influence are now at the forefront of China’s geopolitical agenda, prompting Beijing to reassess its engagement strategies within Latin America.

The reaction from officials has involved a multi-tiered strategy aimed at preserving Chinese interests while simultaneously countering foreign investment endeavors seen as detrimental. This has included:

- Heightened Surveillance: Increased monitoring of foreign operations within Chinese-adjacent territories.

- Strengthening Partnerships: Building alliances with local governments in Panama and neighboring countries to ensure favorable immigration and trade agreements.

- Public Communication: Launching campaigns to highlight the benefits of Chinese investments in contrast to those from Western firms.

| Action | Description |

|---|---|

| Diplomatic Engagement | Increased dialog with regional leaders to secure pro-China sentiments. |

| Investment Adjustment | Diversifying investments to mitigate vulnerabilities from external dealings. |

Analyzing the Implications of BlackRock’s Involvement in Maritime Investments

BlackRock’s foray into maritime investments, particularly through its partnership with Li Ka-shing for the Panama port deal, raises meaningful geopolitical and economic questions. The implications stretch far beyond mere financial gain, as this collaboration could reshape global trade routes and power dynamics. As one of the world’s largest asset managers, BlackRock’s involvement signals a shift in investment patterns that prioritize strategic assets within critical infrastructure environments. Key impacts to consider include:

- Increased Influence: blackrock could leverage its capital to influence maritime regulations and international trade policies.

- Geopolitical Tensions: China’s intensified opposition to the deal highlights potential frictions which could develop around maritime control and influence.

- Market Reactions: The financial markets may respond to the implications of BlackRock’s investment strategy, affecting stock prices in the logistics and shipping sectors.

Moreover, the deal’s ramifications extend to regional economies and local investment climates. With infrastructure investments of this magnitude, the potential for revitalizing job markets and boosting local economies appears promising, yet it poses challenges related to labor conditions and environmental concerns. A brief assessment of pertinent factors is illustrated below:

| Factor | Potential Impact |

|---|---|

| Job Creation | Short-term boost in local employment |

| Environmental Regulation | Need for stringent oversight due to potential ecological risks |

| Trade Efficiency | Improvement in logistics and transportation channels |

The Economic Ramifications of China’s Reproach for International Partnerships

The recent intensification of China’s criticism toward international financial collaborations, particularly the disapproval of Li Ka-shing’s Panama port agreement with BlackRock, signals a potential shift in the global economic landscape. Analysts suggest that this rebuke is not merely a reaction to specific deals but reflects broader concerns regarding sovereignty and economic domination. As China seeks to fortify its international position, the implications for foreign investment could be significant, leading to a reconsideration of how international deals are structured and negotiated moving forward. This could result in heightened scrutiny of foreign investments, which may deter future opportunities for global partnerships.

Furthermore, the ramifications of this geopolitical tension extend beyond immediate investment concerns. The shaping of trade and economic policies may encourage nations to reevaluate their alliances and dependencies. Stakeholders in international finance should take note of the following potential outcomes:

- Increased protectionism: Countries may adopt more stringent regulations to safeguard local interests.

- Shifts in funding flows: Investment patterns may lean towards more compliant or strategic partnerships driven by geopolitical stability.

- Emergence of alternative markets: Investors may seek opportunities in regions less susceptible to geopolitical friction.

As the global economy navigates these complexities,the focus will likely shift towards a more cautious approach to international collaborations. understanding the motivations behind such reproach is essential for businesses looking to thrive in this evolving landscape.

Strategic Recommendations for Global Investors Navigating Geopolitical Risks

In light of escalating tensions surrounding China’s recent condemnation of Li Ka-shing’s Panama Port deal with BlackRock, global investors are urged to adopt a proactive stance in navigating these turbulent geopolitical waters. As regulatory environments shift and countries assert their influence over critical infrastructure, investors should consider the following strategic actions:

- Diversify Investments: Spread capital across various regions and sectors to mitigate risks associated with geopolitical hotspots.

- Monitor Political trends: Stay informed about policy changes and diplomatic relations that could impact investments in affected areas.

- Engage Local Experts: Collaborate with regional political analysts and economic advisors to gain insights into potential disruptions.

- Assess Risk Tolerance: Reevaluate portfolio allocations based on risk assessments tied to geopolitical developments.

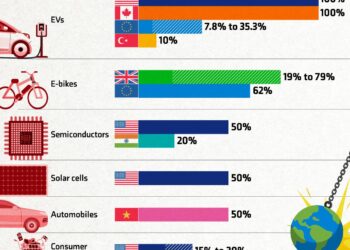

Evaluating infrastructure deals considering geopolitical ramifications is critical for sustained investment growth. To illustrate the shifting landscape,consider the following table that outlines potential impacts on investment sectors based on current geopolitical events:

| Sector | Potential Impact | Recommended Action |

|---|---|---|

| Infrastructure | Increased scrutiny and regulatory hurdles | Conduct thorough due diligence |

| Technology | Restrictive measures on trade | Diversify tech portfolios |

| Energy | Market volatility due to sanctions | Hedge against price fluctuations |

| Consumer Goods | Shifts in supply chain dynamics | Source from multiple suppliers |

Examining the Future of Infrastructure Investments in a Changing Regulatory Landscape

The recent controversy surrounding Li Ka-shing’s partnership with BlackRock on the Panama port project serves as a stark reminder of the complexities facing infrastructure investments in today’s regulatory surroundings. As nations increasingly assert control over strategic assets, investors must navigate a landscape shaped by geopolitical tensions and evolving public sentiment. The Chinese government’s amplified rebuke reflects a growing trend were significant investments are subject to heightened scrutiny and backlash, particularly when perceived as undermining national interests. investors must now consider factors such as:

- Local Regulatory Policies: Navigating changing laws and regulations that govern foreign investments.

- Geopolitical Considerations: Understanding the implications of partnerships with foreign entities.

- Public Perception: Gauging community response to large-scale projects, especially in sensitive areas.

To effectively adapt to this dynamic landscape, stakeholders must employ strategic foresight in evaluating potential investments. This includes assessing not just the financial returns but also the alignment with national priorities and regulations. A careful analysis of the risks versus rewards will be key in determining the viability of future infrastructure projects. Below are crucial considerations that investors may weigh:

| Factor | Significance |

|---|---|

| Regulatory Compliance | Ensures adherence to local laws, avoiding penalties. |

| Social Impact | Addresses community needs, enhancing project acceptance. |

| Political Stability | Reduces risk associated with changes in government priorities. |

The Role of National Interests in Shaping International Business Ventures

The recent back-and-forth over li Ka-shing’s Panama port deal with BlackRock underscores the intricate dance between national interests and international business ventures. As nation-states prioritize their strategic interests, companies like Li’s CK Hutchison Holdings and investment giants like BlackRock find themselves navigating a complex regulatory landscape shaped by geopolitical tensions. China’s government, as an example, may perceive such foreign investments in key infrastructure as potential threats to its economic sovereignty or regional influence. This kind of scrutiny illustrates the ways in which national policies can influence the viability and success of international business agreements, compelling companies to tread carefully and adjust their strategies in response to shifting political sentiments.

Moreover, the backlash against the port deal highlights the need for companies engaged in cross-border investments to integrate a thorough understanding of local political climates into their operational frameworks. A few key considerations for businesses operating internationally include:

- Assessing Regulatory Environments: Understanding local laws and regulations that impact foreign investments.

- Building Relationships with Governments: Engaging with national and local authorities to foster goodwill and navigate potential roadblocks.

- Monitoring National Sentiments: Keeping a pulse on public opinion regarding foreign investment to mitigate backlash.

With national interests at the forefront, businesses must adopt a proactive approach in anticipating and addressing potential concerns, often aligning their ventures with the strategic goals of host countries to ensure long-term sustainability and acceptance in the global market.

The Way Forward

the escalating tensions surrounding li Ka-shing’s Panama port deal,particularly in the wake of China’s intensified pushback,underscore the complex interplay between international business interests and geopolitical dynamics. BlackRock’s involvement adds another layer of intrigue,revealing how financial giants navigate the murky waters of regional politics. As China’s stance continues to evolve, stakeholders in both the public and private sectors will need to closely monitor these developments. The outcome of this situation not only impacts the parties directly involved but also signals broader implications for foreign investment in strategic industries within China and beyond. As we move forward, the implications of this deal will likely reverberate through the global marketplace, shaping the future landscape of international commerce and investment in a rapidly changing world.