In a significant escalation of trade tensions, China has retaliated against former President Donald Trump’s tariffs by implementing its own set of trade measures aimed at key exports. This latest advancement underscores the ongoing friction between the two economic powerhouses, as Beijing responds to Washington’s policies with strategies that could reshape global trade dynamics. As the ramifications of these tariffs ripple through international markets, analysts are closely monitoring the possible impacts on global supply chains and economic stability. This article delves into the specifics of China’s response, examining the targeted sectors, potential economic consequences, and the broader implications for U.S.-China relations in an increasingly polarized trade habitat.

china’s Strategic Response to US Tariffs: Analyzing the Impact on Global Trade

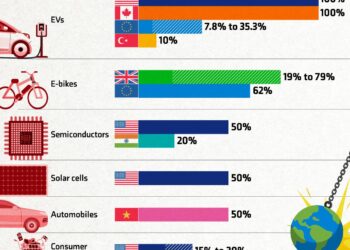

In retaliation to the tariffs imposed by the United States,China has initiated a multifaceted approach aimed at mitigating the adverse effects on its economy while reinforcing its position in global trade. The Chinese government has responded by introducing its own set of tariffs, targeting American goods across various sectors, including agriculture, automotive, and consumer electronics. Additionally, Beijing has enacted stricter controls on key exports such as rare earth minerals, which are critical for technology manufacturing, thereby leveraging its manufacturing capabilities as a bargaining tool in trade negotiations. Analysts suggest that these measures could lead to a significant shift in supply chains, with global businesses now seeking option markets to avoid dependency on either superpower.

The broader implications of China’s strategic response could reshape global trade dynamics and impact various stakeholders. Countries heavily reliant on either U.S. or Chinese markets may find themselves navigating increased uncertainty. Furthermore, the evolving landscape may foster deeper trade relationships among nations seeking to capitalize on the disruption in conventional trade flows. Key factors of interest include:

- The emergence of new trade blocs as nations reevaluate their alignments.

- Potential price increases on goods affected by tariffs, leading to inflationary pressures globally.

- Opportunities for domestic producers in economies less affected by the trade tensions.

Key Exports Under Scrutiny: Understanding China’s Limitations and Their Ramifications

As the trade war escalates, China’s limitations on key exports have become a focal point of global economic discourse. among the most scrutinized are critical components such as rare earth metals, essential for the manufacturing of high-tech products, and agricultural commodities, which significantly affect food supply chains globally. These exports are now under increased scrutiny due to their strategic importance not only in the Chinese market but also in determining competitive advantages internationally. The potential restrictions on these exports could lead to a ripple affect, impacting industries ranging from electronics to green energy.

The ramifications of China’s limitations on exports extend far beyond immediate economic concerns. In the international arena, this situation may catalyze a shift towards increased self-sufficiency in other countries. As nations reevaluate their dependencies, we may witness investments in domestic capabilities to produce alternative materials and technologies. For instance,several countries are already exploring options to source rare earths from outside of China,aiming to buffer against similar geopolitical tensions in the future. The economic landscape is shifting, and businesses must be agile to navigate these changes while anticipating how new tariffs and export controls could reshape their strategies.

Navigating the Trade Turmoil: Recommendations for Businesses Facing Uncertainties

In the face of escalating trade tensions and the imposition of tariffs, businesses must adapt swiftly to sustain their competitive edge. Diversification emerges as a crucial strategy, allowing companies to mitigate risks associated with over-reliance on a single market or supply chain. By exploring new markets or alternative suppliers, businesses can enhance resilience. Additionally, investing in local production capabilities can reduce dependency on imports and capitalize on domestic opportunities, especially in markets that are less affected by international trade disputes.

Furthermore,companies should consider prioritizing supply chain transparency to better understand the origin of their materials and the potential impacts of tariffs.Implementing advanced technologies like blockchain can facilitate this visibility. Engaging in active scenario planning is also essential; businesses should prepare for various outcomes by outlining strategic responses to potential disruptions in trade relations. the table below summarizes key actions that companies can take to navigate current uncertainties:

| action | Description |

|---|---|

| diversification | Expand into new markets and diversify suppliers. |

| local Production | Invest in domestic manufacturing to reduce reliance on imports. |

| Supply Chain Transparency | Utilize technology to track material sources and disruptions. |

| Scenario Planning | develop strategies for multiple potential trade outcomes. |

In retrospect

China’s strategic response to recent tariffs imposed by the Trump administration underscores the escalating trade tensions between the two economic powerhouses. By implementing its own tariffs and placing restrictions on vital exports, Beijing signals its readiness to protect its economic interests and assert its position in the global market. as both nations navigate this complex landscape of trade negotiations and retaliatory measures, the continuing developments will undoubtedly have significant implications for global trade dynamics. Stakeholders across industries will be closely monitoring the situation, as the repercussions of these actions extend far beyond national borders, potentially reshaping international relations and economic policies for years to come.