In the complex landscape of international trade relations, China’s strategies frequently enough blend technological advancement with geopolitical maneuvering. The recent discussions surrounding TeslaS Full Self-Driving (FSD) technology have unveiled a potential new layer in the ongoing economic chess match shaped by the U.S.-China trade war. As both nations navigate tariffs, supply chain disruptions, and competition in the electric vehicle market, industry insiders suggest that China may leverage Tesla’s autonomous driving capabilities as a bargaining chip in negotiations. this article delves into the implications of such a maneuver, examining how China’s interest in Tesla’s FSD technology could influence trade dynamics and impact both companies and consumers in the long run.

China’s Strategic Positioning in Global Trade and Technology

Amid escalating tensions between the United States and China, the dynamics of global trade and technology are shifting in significant ways.China’s burgeoning advancements in artificial intelligence, highlighted by its strategic intent to leverage technologies such as Tesla’s Full Self-Driving (FSD), underscore its intent to reclaim a competitive edge in the tech arena. With electric vehicles increasingly becoming central to energy transition discussions and smart city initiatives, the potential for China to use Tesla’s technology as a bargaining chip in trade negotiations is both tactical and symbiotic. This move not only aims to bolster China’s technological realm but could also grant leverage in securing favorable trade terms amidst the ongoing trade war.

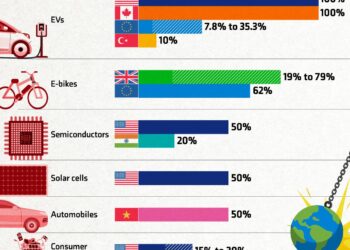

The intricacies of this positioning become even more pronounced when examining the broader implications for global markets. Chinese companies may unlock various economic incentives or partnerships in exchange for access to cutting-edge technologies like FSD. Key factors shaping this strategic positioning include:

- Access to Advanced Technologies: Securing exclusive contracts and collaborations in tech sectors.

- Market expansion: Utilizing foreign tech to enhance local manufacturing capabilities.

- Influence on Global Standards: Steering technological standards and practices in electric vehicles.

As countries worldwide navigate the ramifications of this technological tug-of-war, the pursuit of innovation and trade mastery will undoubtedly influence geopolitics and economic landscapes in unprecedented ways.

The Implications of Tesla’s Full Self-Driving Technology in Trade Negotiations

Tesla’s full Self-Driving (FSD) technology could play a pivotal role in the ongoing trade negotiations between the United States and China. As both nations grapple with economic power dynamics,the implications of FSD extend beyond market competition and into the realm of international diplomacy. China may leverage tesla’s FSD capabilities as a strategic bargaining chip to negotiate favorable terms with the U.S.government. Such a maneuver could allow China to present itself as a leader in autonomous vehicle technology while emphasizing its commitment to innovation and advancement in the automotive sector. This scenario is particularly crucial as Tesla stands as a symbol of American technological prowess, making it an attractive target in trade talks.

Moreover, the potential for collaboration or competition concerning FSD may redefine the landscape of global trade agreements. By positioning Tesla’s advancements as a marker of economic supremacy, China could manipulate discussions around tariffs, regulations, and market access. Key implications could include:

- Increased funding for autonomous technology initiatives from both countries to ensure competitive parity.

- Regulatory adjustments to foster collaboration between American and Chinese companies in the FSD domain.

- Shifts in consumer demand driven by the perception of advanced technology affordability and availability.

Additionally, a potential table outlining the current state of FSD technology in both nations could help visualize the competitive landscape:

| Country | FSD Technology Development | Market Readiness |

|---|---|---|

| United States | Leading with advanced algorithms | Beta testing with high consumer interest |

| China | rapid development with significant investments | Government-supported trials ongoing |

analyzing the Trade War: How FSD Could Shift Economic Power

The ongoing trade tensions between the U.S. and China have spurred various strategies from both nations as they seek to gain leverage over one another. Tesla’s full Self-Driving (FSD) technology has emerged as a significant asset in this geopolitical chess game. With its potential to revolutionize transportation, the technology could serve as a bargaining chip in future negotiations. Shoudl China seize control of this technology, it could shift not only the power dynamics in the automotive industry but also influence broader economic relations. as the world’s largest automotive market, China’s investment in Tesla’s FSD may provide the country with the capacity to dictate terms in trade discussions.

by leveraging advanced technologies like FSD, the Chinese government may attempt to negotiate favorable tariffs or trade conditions that benefit its domestic industries. This situation could create a ripple effect through global markets.Key considerations may include:

- Innovation Control: Holding advanced technology can empower China to dictate international standards.

- Market Access: Utilizing FSD as a bargaining tool might grant China better access to U.S. markets.

- Competitive Edge: Mastering FSD could enhance China’s competitive stature in evolving industries.

As the complexities of these negotiations unfold, stakeholders in both countries will be closely watching how technological advancements, along with geopolitical strategies, shape the future of economic power balances globally.

Potential Outcomes: Scenarios for Tesla and the Automotive Market

The integration of Tesla’s Full Self-Driving (FSD) technology into the broader automotive market could greatly influence both the company’s trajectory and the global automotive landscape. If China leverages FSD in its negotiations during trade discussions with the U.S., several scenarios emerge. First,China might seek to enhance its own electric vehicle (EV) production by accessing Tesla’s proprietary technology,which could ignite a competitive edge in the burgeoning EV market. Second, if the U.S. retaliates by restricting technology transfers or imposing tariffs, such measures could inhibit Tesla’s growth prospects, possibly stalling innovation in the industry. The stakes are high as both economic powerhouses negotiate their future in an evolving market driven by advanced technologies and sustainability initiatives.

As these dynamics unfold, the implications for investors cannot be overlooked. A shift towards collaborative agreements on technology sharing could signal a significant pivot for the automotive market, fostering alliances that enhance R&D across borders. Conversely, prolonged trade tensions could result in a fragmented market where companies must adapt quickly to survive.To further illustrate these possibilities, the table below outlines potential shifts in consumer sentiment and company performance based on various trade scenarios:

| Scenario | consumer Sentiment | Impact on Tesla’s Stock |

|---|---|---|

| Technology Sharing Agreement | Positive | Potential Increase |

| Increased Tariffs | Negative | Potential Decrease |

| market Fragmentation | mixed | Volatile |

Investor Considerations: Navigating Risks and Opportunities in the Current Climate

As investors assess the implications of China’s potential strategy to leverage Tesla’s Full Self-Driving (FSD) technology in negotiations surrounding the Trump trade war, several key factors warrant consideration. China’s advancements in autonomous vehicle technology may spur both opportunities and risks for investors. This situation highlights the delicate balance between competition and collaboration in the automotive and tech sectors. The following aspects should be monitored closely:

- Regulatory Landscape: Changes in policy or trade regulations could impact Tesla’s operations in China, with ramifications for investor sentiment and stock performance.

- Technological Advancements: Developments in AI and automation from both Tesla and Chinese companies may influence the market dynamics and innovation timelines.

- Market Sentiment: Investors need to gauge the perception of Tesla’s FSD as a strategic asset—will it be seen as a bargaining chip or an essential component of Tesla’s value proposition?

Moreover, the strategic positioning of Tesla within the broader framework of U.S.-China relations can considerably alter investor risk profiles. Analysts are observing potential shifts in consumer demand influenced by national pride and local preferences, which could reshape Tesla’s market landscape. A closer look at the financial implications is essential, illustrated in the table below, which summarizes key performance indicators relevant to tesla’s operations in China:

| Indicator | Current Status | Q4 Projections |

|---|---|---|

| Market Share | 18% | 20% |

| Annual Revenue (China) | $7B | $8.5B |

| FSD Adoption Rate | 5% | 10% |

Conclusion: The Future of Trade Relations and Technological Innovation

The landscape of global trade relations is continually evolving, particularly as nations grapple with the implications of technological advancements. The intersection of trade policy and innovation, especially in sectors like automotive technology, will be critical for shaping future diplomatic interactions. With China eyeing Tesla’s full Self-Driving (FSD) technology as a potential bargaining chip in negotiations, we can expect an increase in diplomatic maneuvers that center around technology transfers, intellectual property rights, and regulatory changes. Critical areas of focus may include:

- Cross-border collaboration: Nations may seek partnerships to enhance technological capabilities.

- Investment opportunities: With technology being a key driver for economic growth, countries will likely pursue investments in tech sectors.

- Regulatory harmonization: Efforts to align regulatory frameworks could facilitate smoother trade in high-tech sectors.

As countries navigate these complexities, the emphasis on technological innovation will likely redefine competitive advantages in the global market. The role of governments in fostering environments conducive to innovation and protecting domestic industries will be paramount. The potential for collaborative frameworks to manage shared technological challenges presents a unique prospect for countries to leverage trade relations positively. A predictive analysis might showcase the following variables influencing future trade dynamics:

| Factors | Impact on trade Relations |

|---|---|

| Technological Advancements | Increased competition and collaboration |

| Regulatory Changes | Shifts in market access and barriers |

| Geopolitical Tensions | Impact on supply chains and partnerships |

the future of trade relations influenced by technological innovation stands at a crossroads, where strategic leverage and collaborative aspirations will play pivotal roles. as global dynamics continue to shift, the landscape will require agile and forward-thinking approaches from all stakeholders involved.

Wrapping Up

the intersection of Tesla’s Full Self-Driving technology and the ongoing trade tensions between the United States and China presents a complex landscape for investors and policymakers alike. As China navigates its economic ambitions and technological aspirations, leveraging cutting-edge innovations like FSD could serve as a pivotal bargaining chip in their negotiations with the U.S. Understanding this dynamic not only sheds light on the future of U.S.-China relations but also highlights the broader implications for the global automotive and tech industries. stakeholders will need to remain vigilant as this situation evolves, with potential ramifications that could reverberate across markets.As these developments unfold, investors and industry watchers are urged to stay informed to grasp the potential risks and opportunities that may arise from this geopolitical crossroad.