In a landscape marked by fluctuating trade dynamics, the ongoing tariff discussions between China and the United States have taken a pivotal turn, as articulated by Scott Bessent, a prominent figure in the world of economic strategy. In a recent interview with NewsNation, Bessent underscored China’s steadfast position on not engaging in negotiations over tariffs, a stance that could have far-reaching implications for global markets and diplomatic relations. As both nations continue to grapple with the aftermath of heightened trade tensions, this development raises critical questions about the future of economic cooperation and competition. With experts closely monitoring the situation, the ramifications of China’s refusal to negotiate could reshape the very fabric of international trade policy.

China’s Stance on Tariff Negotiations Signals Economic Implications for Global Trade

Recent statements from Scott Bessent have brought China’s position on tariff negotiations into sharper focus, highlighting a significant shift in the global economic landscape. China’s refusal to engage in tariff discussions with the United States raises concerns about the potential consequences for international trade dynamics. Experts suggest that this standoff could lead to increased tensions and uncertainty, impacting supply chains and market stability across various sectors. The ramifications of these decisions extend beyond just the two nations, as businesses worldwide may need to recalibrate their strategies in anticipation of prolonged trade friction.

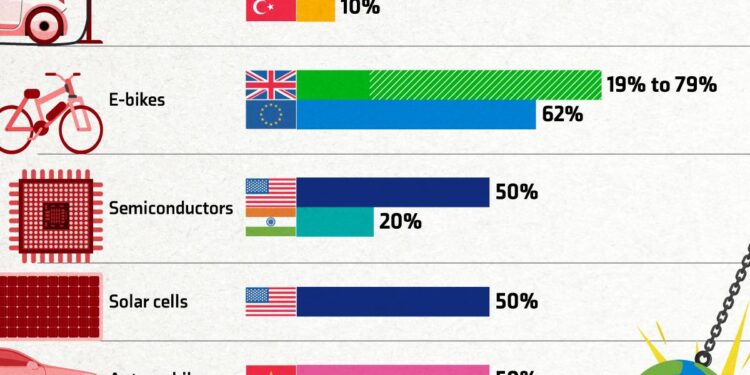

Furthermore, with tariffs serving as a pivotal tool for economic policy, China’s stance is likely to influence key players in the global economy. The following points illustrate the potential implications:

- Supply Chain Disruptions: Companies may face increased costs and delays, forcing them to seek alternative markets or suppliers.

- Inflationary Pressures: Higher tariffs could lead to increased prices for consumer goods, affecting spending power in various countries.

- Investor Sentiment: A lack of negotiations may lead to decreased confidence in economic stability, prompting shifts in investment strategies.

As the global marketplace reacts to these developments, analysts are keeping a close watch on how trade policies will evolve. In particular, the following table outlines potential economic shifts that could arise from sustained tariff impasses:

| Scenario | Potential Outcome |

|---|---|

| Prolonged Tariff Standoff | Further escalation of trade wars, affecting GDP growth. |

| Trade Realignment | Emerging markets may seize opportunities to fill gaps in global supply. |

| Consumer Backlash | Increased dissatisfaction with rising prices could lead to political shifts. |

Expert Analysis: Scott Bessent’s Insights on the Future of US-China Trade Relations

In his latest analysis, Scott Bessent offers a somber perspective on the state of US-China trade relations, emphasizing that China is currently unwilling to engage in tariff negotiations. This stagnation in discussions poses significant risks to both economies, particularly as global supply chains remain fragile. Bessent argues that the lack of dialogue could exacerbate existing tensions, leading to further economic repercussions. He highlights that without constructive engagement, the potential for growth diminishes, while uncertainty swells among investors and businesses alike.

Bessent identifies several key factors influencing the current landscape of trade relations, including:

- Geopolitical Rivalry: The ongoing competition between the US and China has raised barriers to open negotiation.

- Domestic Pressures: Both nations are facing internal political challenges that complicate foreign trade discussions.

- Technological Divides: Emphasis on self-sufficiency and technological supremacy makes concessions less likely.

These dynamics underline the fragile nature of current economic relationships, suggesting that without proactive measures aimed at fostering collaboration, the path ahead may be laden with obstacles. Bessent’s insights signal a call to action for policymakers to reconsider their approaches to trade negotiations amid a shifting global landscape.

Strategies for US Businesses in the Wake of Stalled Tariff Discussions

As US businesses grapple with the implications of stalled tariff negotiations with China, adapting to this new reality requires a multifaceted approach. Companies should consider diversifying their supply chains to mitigate potential disruptions. This strategy not only lessens dependence on Chinese imports but also opens avenues to explore emerging markets. Additionally, investing in local production facilities may provide a buffer against future tariff hikes, allowing businesses to remain competitive without incurring excessive shipping costs.

Furthermore, leveraging technology and automation can significantly enhance operational efficiency and reduce dependency on lower-cost labor markets. Firms should also advocate for clearer trade policies by engaging with policymakers and industry associations, ensuring their voices are heard in the negotiation process. To facilitate informed decision-making, businesses might benefit from regular assessments of their tariff exposure, guiding them in adjusting pricing strategies and maintaining profit margins amidst fluctuating costs.

Future Outlook

In conclusion, the impasse between China and the United States regarding tariff negotiations remains a significant obstacle in the complex web of international trade relations. Scott Bessent’s insights highlight the broader implications of this stalemate, suggesting that the absence of dialogue could further strain economic ties and impact global markets. As both nations grapple with their economic policies and strategic interests, the world watches closely, awaiting any signs of movement in these pivotal negotiations. Until then, understanding the implications of this ongoing situation will be crucial for policymakers, businesses, and investors alike. Stay tuned as developments unfold in this critical aspect of international trade.