in a significant escalation of trade tensions between the world’s two largest economies, China has taken decisive measures against the United States by implementing new tariffs and imposing tighter regulations on American companies operating in the contry. This latest round of retaliation comes in response to a series of U.S. trade policies that Beijing views as detrimental to its economic interests. The moves reflect an ongoing struggle for dominance in global markets and underscore the complexities of a relationship that has become increasingly fraught wiht grievances. As businesses brace for the implications of these actions, analysts warn that the ongoing trade conflict could have far-reaching consequences not only for bilateral relations but for the global economy at large. This article examines the recent developments, their context within the broader trade landscape, and potential repercussions for both nations.

China’s Strategic Tariff Response to U.S. Trade Policies

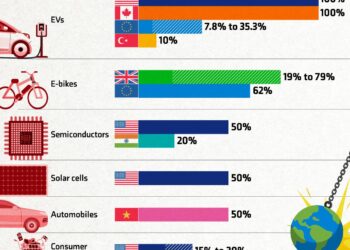

In a calculated move against U.S. economic policies, China has implemented a series of strategic tariffs and regulatory controls targeting American businesses operating within its borders. These measures serve not only as a retaliation for U.S. tariffs but also as a means to assert China’s economic influence and stability amidst ongoing trade tensions. The Chinese goverment has outlined specific sectors that will be impacted, indicating a focused approach to balancing trade discrepancies. Key areas affected include:

- Agricultural Products: Tariffs on soybeans and pork imports in response to U.S. agricultural subsidies.

- Technology: Increased scrutiny on American tech firms,especially those involved in sensitive sectors.

- Luxury Goods: Heightened tariffs on American brands,affecting the broader consumer market.

In addition to tariffs, Beijing has enacted new regulations that may curb operations of U.S. companies in the country. This approach is designed to enhance domestic business resilience while simultaneously sending a message to American corporations.Recently unveiled measures encompass:

| Measure | description |

|---|---|

| enhanced compliance Checks | increased frequency of audits for U.S. companies operating in China. |

| Licensing Requirements | New licensing protocols for foreign companies in key industries. |

| Data Localization Policies | Mandating the storage of data on domestic servers. |

These initiatives reflect a robust response intended to undermine U.S.positions in the global market while promoting China’s self-sufficiency in various sectors. As both nations navigate this complex economic landscape, the repercussions will likely influence trade negotiations and bilateral relations for the foreseeable future.

Impact on U.S. Businesses Operating in China

The recent escalation in trade tensions between the U.S. and China, marked by retaliatory tariffs and increased scrutiny of American companies operating within Chinese borders, has started to reshape the landscape for businesses in both nations. U.S. corporations may now face a multitude of challenges, including higher operational costs due to tariffs on imported goods, and a potential decline in market access as Chinese regulators intensify their oversight. As these companies attempt to navigate the complexities of the evolving regulatory environment, they must also consider the impact on their supply chains, consumer relationships, and overall profitability.

Along with tariffs, U.S.firms might encounter stricter regulations and a more cumbersome bureaucratic process. This has heightened the risk for businesses considering investments or expansions within China. Key factors that companies need to evaluate include:

- Compliance Costs: Increased spending to meet new regulatory requirements.

- Market Conditions: Potential shifts in consumer behavior and preferences due to nationalistic sentiments.

- Long-term Viability: Assessing the sustainability and growth potential amidst geopolitical tensions.

Many organizations are now reevaluating their strategic operations, leading to a push for diversifying supply chains and seeking opportunities in other markets to mitigate their risks stemming from the unstable U.S.-China relationship.

Navigating Supply Chain Disruptions Amid Tariff Increases

As the geopolitical landscape evolves, businesses face unprecedented challenges due to escalating tariffs and stricter controls imposed by China on U.S. companies. These disruptions not only inflate costs but also complicate supply chain management,compelling businesses to reassess their operational strategies. To effectively navigate this tumultuous environment, companies shoudl consider the following approaches:

- Diversification of Suppliers: Identify alternative suppliers in different regions to mitigate risks associated with regional disruptions.

- Local Sourcing: Shift to local suppliers to reduce reliance on imports that are subject to tariffs.

- Supply Chain Flexibility: implement agile practices that can quickly adjust to changes in supply and demand.

- Inventory Management: increase safety stock levels to buffer against supplier delays and tariff-related price increases.

The impact of tariffs extends beyond immediate financial implications,affecting long-term strategic planning. Organizations must prioritize risk assessment and scenario planning to prepare for potential shifts in the market.It can be useful to monitor trade policies and financial implications regularly. Here’s a simplified table highlighting the key factors companies should consider:

| Factor | Consideration |

|---|---|

| Cost of Goods | Evaluate the impact of tariff increases on pricing strategies. |

| Regulatory Compliance | Stay informed about compliance requirements in both markets. |

| Market Trends | Analyze shifts in consumer behavior resulting from economic pressures. |

Future Outlook: The Evolving U.S.-China Trade Relationship

The trajectory of the U.S.-China trade relationship is increasingly characterized by a complex interplay of economic strategies and diplomatic maneuvers.as both nations respond to each other’s tariffs and restrictions, a pattern of reciprocal actions is emerging. In the face of China’s recent retaliatory measures, including heightened tariffs and stricter controls on American companies, the global trade landscape is poised for significant change. This escalating economic confrontation might not only redefine bilateral trade policies but could also engender an environment of uncertainty for businesses on both sides. Analysts foresee a potential shift towards a more fragmented global supply chain, which may favor regions outside these two economic superpowers.

As policymakers navigate these turbulent waters,the implications extend beyond mere financial metrics into broader aspects affecting international relations and technological advancements. Key factors to consider include:

- Investment Shifts: Increased scrutiny and potential divestments may catalyze a reallocation of investments away from traditional markets.

- Supply Chain Diversification: Companies might explore alternatives to mitigate risks, driving them towards markets in Southeast Asia and beyond.

- Technological Rivalry: Both nations are likely to ramp up efforts in technology innovation, creating a race for dominance that could lead to advancements in AI, 5G, and green technologies.

As the U.S. and China recalibrate their economic strategies,it remains to be seen how these developments will shape not only trade policy but also geopolitical alliances in the coming years. The resilience of global markets,adaptability of corporations,and the enduring nature of bilateral dialogues will be critical in defining the future of this intricate relationship.

Recommendations for U.S. Companies Facing new Regulatory Challenges

As U.S. companies navigate an increasingly complex regulatory landscape, strategic adaptability becomes essential. Companies should consider implementing a comprehensive risk assessment framework to evaluate their exposure to regulatory changes. This includes regularly monitoring both domestic and international regulatory updates, assessing the potential impacts on their supply chains, and adapting their compliance strategies accordingly. Engaging in open dialogue with legal and regulatory experts can further enhance understanding and anticipatory action regarding changing regulations.

In addition, diversifying supply chains may prove beneficial for reducing vulnerability to tariffs and export controls. Companies should explore alternative sourcing strategies, which might include localizing production or establishing partnerships with suppliers in more favorable jurisdictions. Furthermore, investing in technology and innovation can bolster resilience, offering businesses a competitive edge even within stringent regulatory environments. Effective interaction with stakeholders, including customers and investors, will also play a critical role in maintaining trust and transparency during these transformative times.

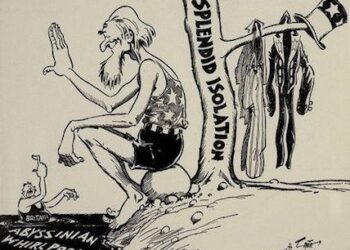

The Role of International Alliances in Mitigating Trade Tensions

International alliances play a crucial role in navigating the complexities of global trade tensions, particularly in light of recent retaliatory measures taken by China against U.S. companies. Through diplomatic collaboration, nations can foster an environment where trade disputes are addressed multilaterally rather than unilaterally. Such alliances not only enhance the negotiating power of member countries but also provide a platform for sharing best practices and strategies.Key benefits of international alliances include:

- Enhanced Negotiation Power: Countries banding together can leverage collective influence.

- Shared Intelligence: Members can exchange details on trade policies and economic forecasts.

- Conflict Resolution: Alliances often have established mechanisms for resolving disputes peacefully.

moreover, international coalitions can impose collective economic pressure on nations that engage in unfair trade practices, thereby deterring aggressive actions like tariffs and restrictions. For instance, when states unified in condemnation of trade malpractices, it creates a formidable front that complicates the decision-making process for offending nations. A notable example of this is the coordinated response from several economic powerhouses in addressing issues concerning China’s trade policies. The following table illustrates recent collaborative efforts to counterbalance unilateral trade actions:

| Allied Countries | Response Type | Description |

|---|---|---|

| U.S., EU, Japan | Joint Tariffs | Imposed sanctions on certain exports to counter unfair pricing. |

| Canada, Australia | Diplomatic engagement | Initiated dialogues to address trade grievances directly. |

| India, South Korea | Regulatory Revisions | Evaluating trade agreements to strengthen economic ties. |

Insights and Conclusions

China’s recent imposition of tariffs and tighter regulations on U.S. companies marks a significant escalation in the ongoing trade tensions between the two global superpowers. As both nations navigate the complexities of economic interdependence and national interests, the ripple effects of these retaliatory measures are expected to extend beyond bilateral trade, potentially impacting global supply chains and economic stability. The responses from businesses, policymakers, and investors in both countries will be closely monitored as they adapt to this evolving landscape. As the situation develops, stakeholders will need to balance strategic interests with the broader implications for international relations and global economic health. Moving forward, dialogue and negotiation might potentially be critical in finding pathways to de-escalate tensions and foster mutual economic cooperation.