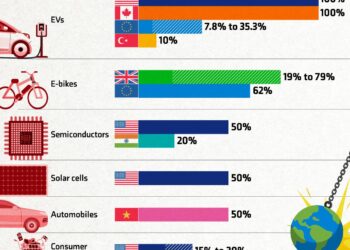

As the global economy grapples with a multitude of challenges, the question of whether China remains a viable investment destination resurfaces with increasing urgency. Once considered a powerhouse of growth and innovation, China’s economic landscape has undergone notable transformations, marked by regulatory crackdowns, geopolitical tensions, and shifting consumer behaviors. In this context, the Financial Times explores the current state of Chinese investments, assessing the implications of recent policy changes, market volatility, and the broader implications for international investors. As we dissect the evolving dynamics of China’s market, key insights into risk management, sector performance, and access to capital will inform whether the world’s second-largest economy can reclaim its status as an essential player in global finance.

Evaluating China’s Economic Recovery Post-Pandemic

China’s economic recovery in the aftermath of the pandemic has been a focal point for global investors, prompting a reevaluation of its attractiveness as a market. Key indicators, such as GDP growth rates, manufacturing output, and consumer spending, suggest a nuanced recovery trajectory. Key metrics that investors are closely monitoring include:

- GDP Growth: Analysts predict a rebound to 5-6% growth in the coming quarters.

- Manufacturing PMI: Recent figures indicate a slowly expanding manufacturing sector, signaling resilience.

- Retail Sales: Although lower than pre-pandemic levels,there has been a noticeable uptick in consumer confidence and spending.

The government’s policy response has played a significant role in shaping investor sentiment.With fiscal stimulus measures and monetary easing being primary strategies, the focus has shifted towards long-term structural reforms. however, challenges remain, such as potential regulatory crackdowns in various sectors and trade tensions. A straightforward comparison of foreign direct investment (FDI) and portfolio investment in 2023 vs. 2022 reveals an captivating trend:

| Investment Type | 2022 FDI (in billions USD) | 2023 FDI (in billions USD) | Change (%) |

|---|---|---|---|

| Foreign Direct Investment | 140 | 160 | 14.3 |

| Portfolio Investment | 90 | 78 | -13.3 |

Key Sectors Showing Promise for Foreign Investment

As the world continues to navigate the complexities of post-pandemic recovery, several sectors in China are attracting renewed interest from foreign investors. Technology and innovation stand at the forefront, propelled by government incentives and a burgeoning startup culture. Areas like artificial intelligence, renewable energy, and biotechnology not only promise significant returns but are also aligned with global shifts towards sustainability and health. The chinese government’s commitment to enhancing its technological prowess has established a favorable surroundings for investment in these high-growth areas.

Additionally, the consumer market in China remains a compelling sector for foreign capital.With a vast and increasingly affluent middle class, industries such as e-commerce, healthcare, and entertainment are experiencing explosive growth. coupled with the country’s expanding digital infrastructure, these sectors provide opportunities for innovative products and services that cater to evolving consumer preferences.The following table summarizes key sectors ripe for foreign investment:

| Sector | Investment Opportunities | Growth Drivers |

|---|---|---|

| Technology | Artificial intelligence,Renewable energy,Biotechnology | Government incentives,startup culture |

| Consumer Market | E-commerce,Healthcare,Entertainment | Affluent middle class,digital infrastructure |

Navigating Regulatory Challenges in the Chinese Market

Investors eyeing opportunities in China are confronted with a complex tapestry of regulations that can significantly impact market potential. The evolving landscape requires a deep understanding of government policies,compliance requirements, and industry-specific regulations. A few key areas to consider include:

- Foreign Investment Restrictions: Navigating the intricacies of the Negative List, wich outlines sectors off-limits to foreign capital.

- Data Privacy Regulations: Adhering to the Personal information Protection Law (PIPL) to ensure compliance in data handling and processing.

- Environmental and social Governance: Staying informed about China’s growing focus on sustainable practices and how these affect operational mandates.

Moreover, understanding local market dynamics is crucial. companies must adapt to the cultural nuances and consumer behavior shifts that shape demand across regions. Strategic partnerships with local firms can provide valuable insights while mitigating risks linked to compliance breaches. Consider the following table that outlines essential regulatory challenges and possible mitigation strategies:

| Regulatory Challenge | Mitigation Strategy |

|---|---|

| Complex licensing requirements | engage local legal counsel for guidance. |

| Unpredictable policy shifts | Develop resilience through diversified investments. |

| Intellectual property concerns | Implement robust IP protection strategies from the outset. |

Risk Factors to Consider for International Investors

International investors must navigate a complex landscape when considering investments in China,especially given the unique blend of political,economic,and regulatory challenges that can impact market dynamics. Geopolitical tensions remain a formidable risk, as trade wars and diplomatic disputes can lead to sudden shifts in policy that affect market access and regulations. Additionally, the openness of financial reporting and corporate governance standards is often questioned, possibly exposing investors to unexpected liabilities or mismanagement. This uncertainty can pose serious challenges for assessing the true value of investments and mitigating risks associated with major stakeholders.

Moreover, the recent economic downturn in China raises concerns about long-term growth prospects, fueled by a combination of declining consumer demand, higher debt levels, and shifts in global supply chains. Investors shoudl also be aware of the market volatility, influenced by stringent government interventions and fluctuations in key industries such as technology and real estate. Examining the following factors can help inform investment decisions:

- Currency fluctuations: The strength of the Chinese yuan can significantly impact returns.

- Regulatory landscape: Keeping abreast of changes in laws governing foreign investment is crucial.

- Sociopolitical climate: Public sentiment and government policies can influence market stability.

| Risk Factor | Impact Level | Mitigation Strategies |

|---|---|---|

| Geopolitical tensions | High | Diversify investments, monitor news closely |

| Regulatory changes | Medium | Consult legal experts, stay updated with local regulations |

| Market volatility | High | Use risk management tools, consider long-term investments |

Long-Term Outlook: Is China a Sustainable Investment Destination?

The long-term outlook for China as an investment destination is complex and multifaceted, shaped by various economic, political, and social factors. Investors are grappling with the implications of structural reforms and regulatory changes that could alter the investment landscape significantly. Key considerations include:

- Economic resilience: China’s ability to adapt post-pandemic and manage inflation is crucial for investor confidence.

- Regulatory Environment: Ongoing government crackdowns in sectors like technology and education have raised concerns about the unpredictability of future policies.

- Global Trade Relations: Tensions with Western nations could impact market access and supply chains, influencing long-term growth prospects.

Moreover, demographic shifts and environmental challenges pose additional risks to sustainability in investment. The aging population may lead to labor shortages and increased healthcare costs, while China’s aggressive goals for carbon neutrality by 2060 require substantial investment in renewable energy. To navigate these complexities,investors should consider:

- Sector Diversification: Focusing on industries poised for growth,such as clean technology and healthcare.

- Geographic Exposure: Balancing investments across various provinces to mitigate regional risks.

- Long-Term Vision: Maintaining patience and a strategic outlook amidst potential short-term volatility.

Strategies for Diversifying Within the Chinese Investment Landscape

Investors looking to navigate the complexities of the Chinese market can employ several strategies to mitigate risks while leveraging potential growth opportunities. Sector diversification is one of the most effective approaches. By spreading investments across various sectors such as technology, consumer goods, renewable energy, and healthcare, investors can reduce exposure to sector-specific volatility. Moreover, engaging in geographic diversification within China’s vast landscape allows investors to tap into emerging opportunities in tier-two and tier-three cities, which often exhibit higher growth rates than their more developed counterparts. This approach not only balances the portfolio but also captures local consumer trends that might be less affected by global economic fluctuations.

In addition to sector and geographic diversification, considering partnership with local firms can provide invaluable insights and mitigate operational challenges associated with regulatory landscapes. Utilizing platforms or funds that focus on foreign direct investment (FDI) can also serve as a strategic entry point into specific sectors of the Chinese economy. Furthermore, staying informed about government policies and market trends is crucial for making timely investment decisions. The following table outlines various strategies alongside their potential benefits:

| Strategy | Potential Benefit |

|---|---|

| Sector Diversification | Reduces sector-specific risks |

| Geographic Diversification | Taps into emerging growth markets |

| Partnership with local Firms | Insights into regulatory and market dynamics |

| investment in FDI Platforms | Access to curated investment opportunities |

| Staying Updated on Policies | Aids in informed decision-making |

To Wrap It Up

the question of whether China is investable again is nuanced, reflecting a landscape shaped by evolving geopolitical dynamics, economic recovery efforts, and regulatory transformations. As global investors weigh the risks and opportunities presented by the Chinese market, it is crucial to consider a holistic approach that incorporates local insights and rigorous analysis. While some indicators signal a potential resurgence in foreign investment interest, others caution against recklessness in navigating the complexities of this vast economy. Ultimately, the decision to invest in China should be guided by a thorough understanding of both macroeconomic trends and sector-specific developments. As the financial world continues to monitor these changes, ongoing dialog and strategic foresight will be essential for those seeking to engage with this pivotal market.

![ISWK[Cambridge] Students Bring Glory to Oman at the 2nd Asian Yogasana Sport Championship! – Times of Oman](https://asia-news.biz/wp-content/uploads/2025/05/165927-iswkcambridge-students-bring-glory-to-oman-at-the-2nd-asian-yogasana-sport-championship-times-of-oman-120x86.jpg)