In a striking move that underscores the ongoing tensions between the United States and China, former President Donald Trump has firmly signaled that he will not consider reducing the 145% tariffs imposed on Chinese goods as part of any efforts to rekindle trade negotiations. This declaration, made during a recent interview, reiterates Trump’s long-standing hardline stance on trade with Beijing, emphasizing a commitment to protecting American industries and workers. As trade talks remain stalled, experts are parsing the implications of Trump’s comments for the future of U.S.-China relations, especially in a geopolitical landscape increasingly fraught with economic rivalry.

Trump Stands Firm on Tariffs as Trade Negotiations with China Continue

In a firm statement regarding ongoing trade discussions, former President Donald Trump reiterated his commitment to maintain the imposition of tariffs on Chinese imports, emphasizing that the current rate of 145% is non-negotiable. Trump’s stance serves as a clear signal to Chinese officials that he is determined to protect American economic interests, even at the risk of straining diplomatic relations. This move comes in the backdrop of efforts aimed at addressing trade imbalances and intellectual property concerns that have long plagued U.S.-China relations.

Experts suggest that Trump’s unwavering position on tariffs could influence the dynamics of future negotiations. The following factors are pivotal in understanding the impact of these tariffs on both U.S. and Chinese economies:

- Consumer Prices: Higher tariffs may drive up costs for American consumers.

- Export Effects: U.S. exports to China may face restrictions due to retaliatory tariffs.

- Job Markets: Tariffs could protect certain industries, preserving American jobs, but at the potential cost of others.

Impact of High Tariffs on U.S.-China Relations and Global Markets

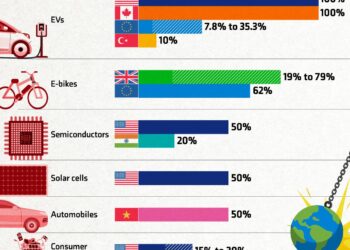

The ongoing trade tensions between the U.S. and China have been characterized by significant tariff impositions, which have reshaped the landscape of international trade. The 145% tariffs announced by the Trump administration in an effort to counter what is perceived as unfair trade practices by China have profoundly impacted bilateral relations. Analysts indicate that these high tariffs have led to a reduction in trade volumes between the two nations, creating a ripple effect that affects not just the U.S. and Chinese economies, but also global markets. The immediate implications include disruptions in supply chains and increased production costs, which may lead to higher consumer prices and economic uncertainty. As tariffs persist, businesses are increasingly wary of their investments in both countries, stemming from fears of retaliatory measures and a fragmented market environment.

Moreover, the staunch position taken by U.S. officials, particularly in light of Trump’s warning against lowering tariffs to facilitate trade talks, underscores a strategic shift in diplomacy and economic policy. This situation presents challenges for multinational corporations and other stakeholders who rely on stable U.S.-China relations for their operations. Key sectors such as technology, agriculture, and manufacturing are particularly feeling the strain. As these tariffs are likely to remain in place for the foreseeable future, experts suggest that businesses may need to reevaluate their strategies. The following points summarize the broader implications of high tariffs on international motives and market confidence:

- Increased production costs for companies relying on imported materials.

- Heightened economic uncertainty impacting consumer spending.

- Potential for retaliatory tariffs from China further complicating the landscape.

- Shift in trade alliances as countries reconsider their economic partnerships.

Strategic Recommendations for U.S. Trade Policy Amidst Ongoing Tensions

In light of the recent warning from President Trump regarding the steadfastness of the 145% tariffs on Chinese goods, it is vital for U.S. trade policy to adapt strategically to these ongoing tensions. One recommendation is to engage in bilateral discussions that prioritize transparent communication channels between the U.S. and China. Investing in diplomatic efforts could serve to ease trade frictions while maintaining a firm stance on critical issues such as intellectual property theft and currency manipulation. Additionally, leveraging international coalitions to present a united front on these matters is essential. This can enhance negotiating power and encourage compliance from China while safeguarding U.S. economic interests.

Furthermore, the U.S. should consider implementing targeted tariff adjustments, which would involve a comprehensive review of current tariffs to identify which are most effective in achieving desired outcomes and which might hinder growth. These adjustments could aim to reduce tariffs on sectors that are not pivotal to national security, thereby fostering growth in consumer goods and benefiting American families. A clear framework for evaluating these tariffs can be established, using criteria such as economic impact, domestic industry support, and consumer prices. This approach may catalyze renewed trade negotiations while still retaining leverage in critical negotiations with China.

Wrapping Up

In conclusion, former President Donald Trump’s recent statements underline his steadfast position on trade relations with China, as he firmly declared that he would not decrease the current 145% tariffs to facilitate discussions. This announcement comes at a critical time, with ongoing tensions between the two economic powerhouses impacting global markets and supply chains. As the landscape of international trade continues to evolve, all eyes will remain on the developments of U.S.-China relations, and whether Trump’s hardline approach will influence future negotiations. The ramifications of these tariffs extend beyond bilateral trade, resonating through economies worldwide, thereby raising questions about the long-term implications for American businesses and consumers alike. As we await further updates, the commitment to maintain these tariffs signals a significant stance in America’s trade policy strategy.