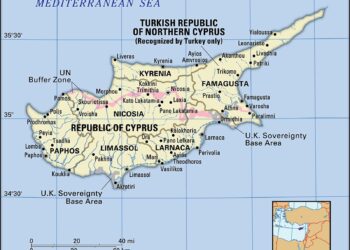

In a meaningful legislative move, the Cyprus parliament has approved an exemption for casinos from the country’s cash transaction limit, a decision that comes amidst growing concerns over potential money laundering risks. The controversial measure aims to bolster the island’s burgeoning gaming industry,which has seen substantial investment in recent years,including the establishment of a major integrated resort. Critics, though, warn that removing cash restrictions may inadvertently facilitate illicit financial activities, raising alarms among regulators and financial watchdogs. As the government seeks to enhance its economic landscape through expanded gaming operations, the implications of this exemption could reverberate through both local and international financial systems.

Cyprus Parliament’s Controversial Decision on Casino Cash transactions Amid Money Laundering Warnings

The recent decision by the Cypriot parliament to exempt casinos from the national cash transaction limit has raised significant concerns among anti-money laundering advocates. Lawmakers voted in favor of the exemption, arguing that the influx of tourism revenue and the need for a competitive gaming industry outweighed potential risks. Critics,however,warn that this could facilitate illicit financial activities,allowing large sums of cash to move unchecked. The European Union has been urging member states, including Cyprus, to tighten their regulations on cash transactions to combat money laundering and financial crime. This move is seen as a stark contradiction to those efforts.

Supporters of the exemption claim that it will enhance the attractiveness of Cyprus as a gaming destination, with potential benefits including increased employment and economic growth. However, skeptics fear that the growing trend of gambling might attract not only tourists but also individuals looking to exploit loopholes for laundering money. Key figures are demanding more stringent oversight measures to mitigate risks. Below is a summary of the main points raised:

| Pros of the Decision | Cons of the Decision |

|---|---|

| Boosts Tourism – Attracts more international visitors | Increased Crime Risk - Potential for higher money laundering activities |

| Economic Growth - Generates more jobs in the casino sector | Undermines Regulatory Framework – Conflicts with EU anti-money laundering directives |

| Competitive Edge – Keeps Cyprus competitive against other gaming hubs | unclear Oversight - Lack of robust regulation may lead to abuse |

Impact of Casino Cash Exemption on Financial Integrity and Regulatory Oversight in Cyprus

The recent decision by the Cyprus parliament to exempt casinos from the cash transaction limits raises significant concerns about the financial landscape in the country. By allowing casinos to operate without restrictions on cash transactions, the potential for money laundering activities increases, posing challenges to both financial integrity and regulatory oversight. The lack of stringent controls may facilitate illicit activities, making it easier for criminal enterprises to launder money through gaming operations. Stakeholders are apprehensive that this policy could undermine the progress made in establishing Cyprus as a reputable financial hub,particularly in the wake of increasing global scrutiny of financial practices.

Opponents of the exemption argue that it diminishes the effectiveness of existing anti-money laundering (AML) frameworks. Casinos are typically high-risk environments for financial crime, where vast sums of money change hands rapidly, giving rise to concerns about the robustness of regulatory mechanisms. The regulatory authorities may need to enhance their monitoring systems and develop tailored compliance strategies to mitigate these risks. Additionally, international bodies such as the Financial Action Task Force (FATF) will be vigilant, as the decision could have implications for Cyprus’s standing in the global financial community.

Strategic Recommendations for Strengthening Anti-Money Laundering Measures in the Gaming Sector

To enhance the effectiveness of anti-money laundering (AML) strategies within the gaming sector, particularly in light of the recent legislative decisions in Cyprus, stakeholders must adopt a multifaceted approach. the following measures should be prioritized:

- Implementation of Advanced KYC Procedures: Strengthening Know Your Customer (KYC) protocols to ensure comprehensive background checks and ongoing monitoring of high-risk clients.

- Integration of Technology Solutions: Utilizing artificial intelligence and machine learning for real-time transaction monitoring to detect unusual patterns indicative of money laundering.

- Mandatory Staff Training: Regular training programs for casino staff to recognise and report suspicious activities efficiently.

- Collaboration with Regulatory Bodies: Establishing partnerships with financial institutions and regulatory agencies to share intelligence on potential money laundering schemes.

Furthermore, the adoption of a obvious reporting framework will foster accountability within the sector. A proposed strategy includes:

| Strategy | Objective |

|---|---|

| Biannual Audits | Assess the compliance of gaming operators with AML regulations. |

| Public Disclosure of Violations | Enhance transparency and trust in the industry. |

| Customer Data Encryption | Protect client information while facilitating AML reviews. |

By adopting these strategic recommendations, the gaming sector can better safeguard against the risks of financial crime while ensuring compliance with both local and international regulations.

To Conclude

the recent decision by the Cyprus parliament to approve an exemption for casinos from the cash transaction limit has ignited a heated debate over the potential implications for financial oversight and money laundering prevention. While proponents argue that this measure could bolster the island’s tourism sector and stimulate economic growth, critics express concerns that it may create loopholes that could be exploited for illicit financial activities.As the government and stakeholders move forward, the balance between fostering economic progress and ensuring robust regulatory frameworks will be crucial. The full impact of this decision remains to be seen, and it will be essential for authorities to closely monitor the situation to safeguard Cyprus’s financial integrity.As developments unfold, the global community will be watching closely, given the broader implications for gambling regulations and money laundering controls in similar jurisdictions.