East Timor is positioning itself as a burgeoning hub for the gaming industry in Asia, aiming to emulate Malta’s success as a global gaming center. As the nation advances its online gaming sector with plans to potentially expand into land-based operations, it seeks to attract investment and regulatory expertise to carve out a unique niche in the competitive Asian market. This strategic move is drawing attention from industry stakeholders and analysts, eager to see how East Timor’s regulatory framework and market development will unfold in the coming years.

East Timor Positions Itself as Asia’s Next Gaming Hub with Ambitious Online Sector Expansion

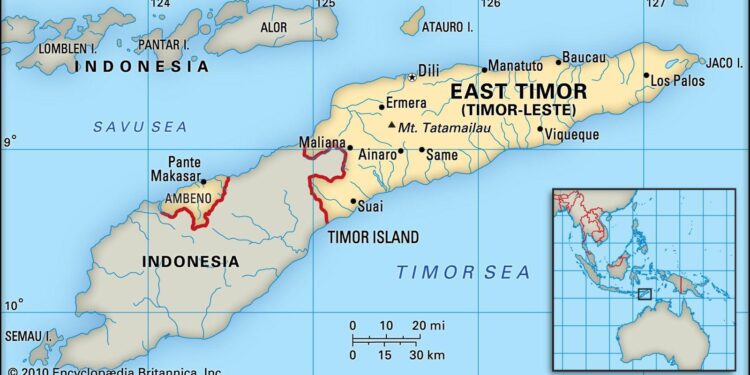

East Timor is rapidly emerging as a focal point for the online gaming industry in Asia, capitalizing on its strategic location and newly developed regulatory framework. The government has introduced progressive legislation aimed at attracting global gaming operators, promising a transparent and investor-friendly environment. Among the key incentives offered are competitive licensing fees, tax benefits, and streamlined approval processes, designed to emulate the success of Malta’s gaming ecosystem in Europe.

Key factors driving East Timor’s gaming ambition include:

- Robust digital infrastructure improvements supporting seamless online operations

- Commitment to responsible gaming through strict compliance and monitoring systems

- Potential for future development in land-based casinos to complement the online sector

- Growing skilled workforce keen to engage with emerging tech-driven industries

| Aspect | East Timor | Malta |

|---|---|---|

| Licensing Fee | Moderate | High |

| Tax Rate on Revenues | 10% | 5-15% |

| Infrastructure | Developing | Established |

| Market Focus | Asia-Pacific | Europe & Beyond |

Government Policies and Infrastructure Developments Driving Growth in East Timor’s Gaming Industry

East Timor has taken bold strides in shaping its regulatory landscape to foster a competitive gaming sector. The government has enacted comprehensive policies that prioritize transparency, player protection, and investment incentives, creating a fertile ground for both local and international operators. Key legislative moves include streamlined licensing processes and tax frameworks designed to attract online gaming providers, positioning the nation as a hub for responsible and sustainable gaming activities in Southeast Asia.

Complementing these policies are targeted infrastructure investments that enhance digital connectivity and operational capabilities. The rollout of high-speed internet networks across key urban centers and economic zones has been pivotal, enabling seamless online gaming experiences. Furthermore, preliminary plans for land-based gaming resorts are backed by government-backed infrastructure projects, such as improved transport links and utility services, signaling East Timor’s ambition to not only capture the online markets but also establish physical entertainment destinations.

- Tax Incentives: Reduced rates for gaming revenues to encourage market entry

- Licensing Reform: Faster approval timelines and flexible permit categories

- Digital Infrastructure: Expansion of fiber-optic networks and data center investments

- Public-Private Partnerships: Collaborative initiatives for gaming resort development

| Policy Measure | Impact | Timeline |

|---|---|---|

| Online Gaming License Modernization | Attracts international operators with lower entry barriers | Completed 2023 |

| Infrastructure Upgrade Program | Enables reliable broadband across strategic regions | Ongoing (2022-2025) |

| Gaming Resort Feasibility Studies | Sets groundwork for future land-based developments | Initiated 2024 |

Strategic Recommendations for Investors Navigating East Timor’s Emerging Land-Based and Digital Gaming Markets

Investors entering East Timor’s burgeoning gaming sector should prioritize partnerships with local entities to navigate the evolving regulatory landscape and cultural nuances. Given the government’s proactive stance on positioning the country as a competitive hub, early engagement with regulatory bodies can secure favorable licensing conditions and operational clarity. Moreover, diversifying portfolios across both land-based and digital platforms offers resilience against market volatility, especially as infrastructure development accelerates and digital adoption rises.

Key focus areas for investment consideration include:

- Aligning with government incentives aimed at boosting foreign direct investment

- Investing in scalable digital platforms that cater to emerging mobile gaming demographics

- Evaluating land-based gaming opportunities in nascent urban centers poised for tourism growth

- Prioritizing compliance with responsible gaming standards to build long-term market trust

| Investment Domain | Opportunity | Risk Profile |

|---|---|---|

| Digital Gaming | Rapid user growth, tech integration | Regulatory shifts, infrastructure delays |

| Land-Based Casinos | Tourism-driven demand, government backing | High capital expenditure, market maturity |

Concluding Remarks

As East Timor charts its course toward becoming “Asia’s Malta,” its strategic push into the online gaming sector-coupled with potential development of land-based facilities-signals a bold ambition to carve out a niche in the regional gaming landscape. While challenges remain, the country’s regulatory reforms and investment incentives position it as an emerging hub for operators seeking new opportunities in Southeast Asia. Observers will be watching closely to see whether East Timor can replicate Malta’s success and establish itself as a competitive player in Asia’s rapidly evolving gaming market.