European Stocks Show Resilience Amid US Market Decline

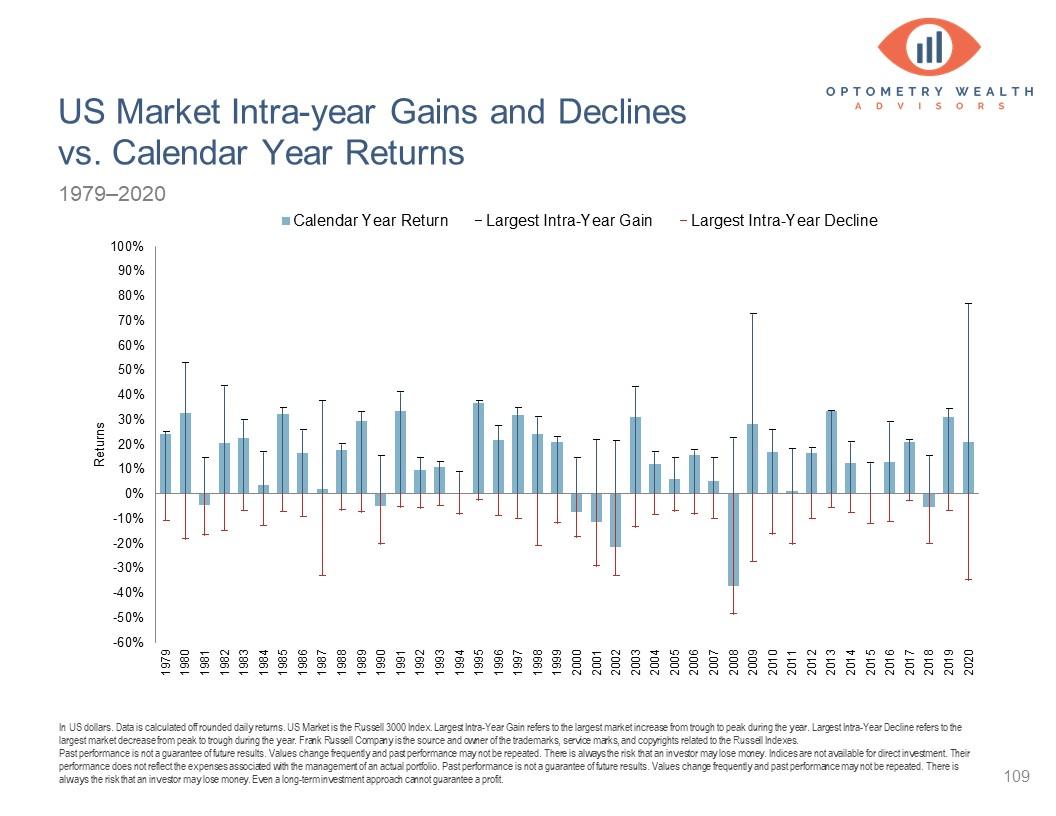

In light of a critically important downturn in the US financial markets, European stocks have demonstrated remarkable stability, managing to hold their ground despite investor apprehension. Following a steep drop on Wall Street, where major indices faced considerable losses, European markets opened cautiously, with key indices experiencing minor fluctuations during early trading sessions. Analysts are keenly observing the ramifications of these transatlantic market movements as geopolitical tensions and inflationary pressures persist. Despite the challenges posed by events across the Atlantic, European investors seem to be preparing for potential opportunities, indicating a nuanced blend of sentiment and strategy in response to global economic conditions. This article explores recent market dynamics and examines what factors contribute to the resilience of European stocks amidst US volatility.

US Market Decline and Its Effect on European Investor Sentiment

The recent upheaval in US markets has created waves that extend across the Atlantic Ocean, significantly influencing how European investors feel about their prospects. Following a marked decline in American stock indices, many analysts are scrutinizing how this downturn affects investment strategies and confidence levels within Europe. With concerns about potential contagion effects looming large, investors are carefully weighing their options which has led to increased caution regarding purchasing decisions. Several key factors contributing to this cautious atmosphere include:

- Economic Interdependence: Heightened worries about the health of the US economy may prompt a reassessment of essential values within European markets.

- Currency Variability: Fluctuations in dollar strength can significantly impact European firms with substantial exposure to American markets.

- Market Correlation: Historical data indicates an increased correlation between performance metrics for US and European stocks which amplifies investor anxiety.

In reaction to these market shifts,many investors across Europe are adopting diverse strategies aimed at risk mitigation. This includes reallocating investments towards emerging markets or sectors perceived as more resilient against economic shocks. Additionally, current market conditions have revealed opportunities within specific industries that show less dependence on US performance metrics. A comparative analysis of critical sectors illustrates this point:

| Sectors | Performance Outlook | Investor Sentiment | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Technology | Turbulent | Cautious | |||||||||||||||

|

< td >Stable | Positive | Analysis of Key Sectors in Europe Amid Global Volatility

The turbulence observed recently within U.S financial circles has not deterred all aspects of Europe’s stock landscape; rather it highlights an impressive resilience among certain sectors navigating through global volatility storms effectively. Analysts attribute this divergence largely due several influential factors affecting core areas within Europe’s economy:

Investment Strategies During Uncertain Times

Diving into turbulent waters requires astute navigation; hence many savvy investors increasingly turn towards diversified portfolios designed mitigate risks while seizing emerging opportunities available today . By spreading investments over various asset classes , they can protect capital against sharp declines whilst positioning themselves favorably recover when uncertainties arise .This approach typically encompasses balanced mixes including equities , fixed income securities , commodities along alternative assets ensuring resilience amidst abrupt shifts occurring throughout marketplace. Another effective tactic involves focusing defensive stocks known historically withstand economic downturns better than others such utilities healthcare staples maintaining steady demand irrespective prevailing circumstances . Furthermore employing techniques like dollar-cost averaging helps smoothen impacts caused by volatility experienced regularly nowadays . Below we present simple comparison highlighting characteristics associated different defensive sector types :

A s significant fluctuations occur within stock exchanges it becomes crucial both analysts &investors keep close tabs several economic indicators providing insights future trends likely emerge from current situations These metrics serve barometers gauging overall health economies frequently enough predicting shifts sentiments surrounding marketplaces Key indicators worth monitoring include :

Additionally central bank policies interest rate decisions play pivotal roles shaping prevailing conditions affecting entire marketplace participants should take note:

|