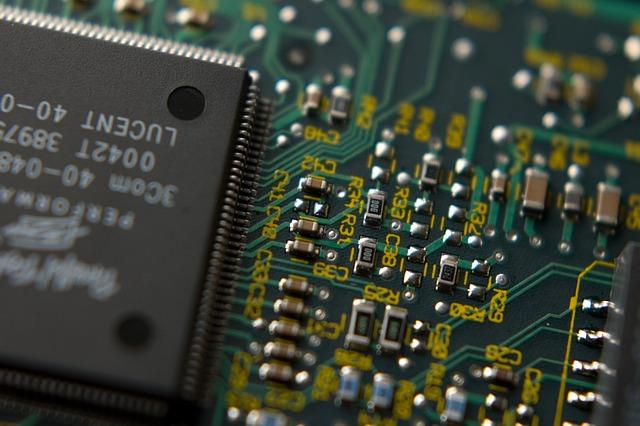

As the global‚ÄĆ technology sector remains in a state of flux, a ‚ĀĘsignificant challenge‚ĀĘ looms on the‚Ā£ horizon: the impending‚Ā§ ‘China shock’ in‚Äč the mature semiconductor ‚Äćchip market.‚Äč Wiht China’s rapid advancements in semiconductor manufacturing and increasing self-sufficiency,industry analysts and market ‚Ā§leaders ‚Ā£are closely‚Ā§ monitoring the‚Äč potential ramifications for established players‚Äć in‚ĀĘ the tech ‚ÄĆecosystem.‚Äč Nikkei Asia reports that this‚Äć unexpected shift has raised concerns about supply chain stability, competition dynamics, ‚ĀĘand the future‚Äć landscape of the ‚Äćglobal semiconductor industry. As companies ‚ĀĘstrategize‚Ā§ too navigate this potential ‚Ā£disruption, understanding the implications of China’s push‚Ā£ into mature chip production becomes crucial not just for manufacturers, but also for consumers and economies ‚Ā§tied to the advancements‚Äć in technology. ‚Ā§This article delves into the factors driving‚Ā§ this ‚Ā§shift, its‚Äć impact on the global tech industry, and the responses from key stakeholders facing this new reality.

Impact of‚Äč China’s Semiconductor ‚ÄčAdvancements ‚Ā£on Global Supply Chains

The rapid progression of China’s semiconductor technology is stirring significant‚Äć shifts in global supply chains, especially in the domain of mature chips. As Chinese firms invest‚ĀĘ heavily ‚Äčin R&D and production capabilities, they are poised to ‚Ā§challenge customary players in‚Äć the semiconductor ‚Äćsector. This growth is‚Ā§ likely to lead to a domino ‚Ā§effect, compelling global tech companies to reassess their procurement strategies. ‚Ā§Companies dependent on mature node chips,which are essential for various electronic devices,must brace for potential disruptions as China’s output expands. as an inevitable‚ĀĘ result, businesses may need to diversify their suppliers and ‚Ā§consider option sourcing routes to mitigate risks associated with an over-reliance on ‚ÄĆany single region.

The implications of these advancements extend beyond‚Äč just market competition. Several factors can reshape the ‚Äčlandscape of semiconductor supply‚Äć chains‚ĀĘ worldwide:

- Cost Efficiency: China’s scale and ‚Ā§investment can lower production costs, impacting‚Ā§ pricing strategies across the globe.

- Market‚ÄĆ Dynamics: ‚Ā§ Increased availability of mature chips from China ‚Ā£could shift demand patterns, influencing how companies ‚Äćapproach‚ÄĆ product development and innovation.

- Regulatory Challenges: Governments might impose restrictions ‚Äčon technology ‚Äćtransfer and export controls, which could ‚Ā§further‚Ā£ complicate the supply chain landscape.

Strategies for ‚Ā§Companies to Mitigate‚Äč Risks Associated ‚Ā£with China Shock

as the global tech industry navigates the ‚Ā§implications ‚ĀĘof the “China shock,” companies can adopt several strategies‚Ā§ to reduce their exposure and safeguard their operations. Diversifying supply chains is one ‚Äćof the most ‚Ā§effective approaches, ‚Äčenabling firms to shift their reliance away from Chinese manufacturers. By‚ÄĆ identifying‚ÄĆ and qualifying alternative suppliers in different regions, ‚Ā§such as Southeast Asia or Eastern Europe, companies can create a ‚ĀĘmore resilient supply network. Additionally, investing in ‚Äć local‚Ā§ manufacturing ‚ÄĆcapabilities can provide the‚Ā§ competitive edge needed to mitigate disruptions‚ĀĘ caused ‚ÄĆby ‚ĀĘfluctuating geopolitical dynamics.

Another vital strategy involves enhancing risk management frameworks to better anticipate and respond to ‚Ā§market changes. Companies ‚Ā£should conduct regular risk ‚ĀĘassessments that evaluate both global trends and regional ‚Äčdynamics, allowing them to make informed decisions on revisions to ‚Ā£operations ‚Äćor investments.‚ÄĆ Moreover, engaging in collaborative‚ĀĘ partnerships with ‚ÄĆboth local and international ‚ÄĆfirms can ‚Äćfoster innovation and knowledge sharing, ‚Ā£leading to improved agility. Implementing real-time monitoring technologies to track supply chain performance will be crucial‚ÄĆ in quickly identifying potential issues and implementing corrective measures.

The ‚ĀĘRole of Government Policies‚Äć in Supporting‚ĀĘ domestic Chip Industries

The ‚Ā§global ‚Ā§semiconductor‚Ā§ landscape is undergoing rapid transformation, necessitating robust government intervention to bolster‚Äć domestic chip ‚Ā£industries. With the rising threat posed by a potential‚Ā§ dominance of ‚Ā£Chinese manufacturers in‚Ā£ mature chip technologies, ‚Äćnations are recalibrating their strategies and investing in local capabilities. Key government initiatives include:

- Financial Incentives: Subsidies and grants aimed ‚Ā§at manufacturers to‚ĀĘ encourage domestic production.

- Research and Development Funding: Increased funding for R&D projects in chip‚ÄĆ technology innovation.

- Strategic Partnerships: ‚Ā£ Collaborations with private‚Äč sector entities to‚Ā£ facilitate‚Ā§ knowledge transfer and technological advancements.

These policies not only aim to safeguard national security by‚Äč reducing dependence on foreign suppliers but also‚Äć to stimulate‚Äč economic growth and ‚Äćjob creation. As a notable ‚ÄĆexample, a study ‚Äčreleased by the Semiconductor Industry association highlighted that every $1 billion invested in the chip sector‚ĀĘ creates‚Äć approximately 5,000 jobs directly. In response to the looming “China shock,” several countries have laid out funding commitments, as ‚Ā£detailed in the table below:

| Country | Investment Plan (USD Billion) | Focus Areas |

|---|---|---|

| United States | 50 | Manufacturing, Research |

| European Union | 40 | Technology Partnerships |

| South Korea | 25 | Advanced ‚ÄćManufacturing Facilities |

| Japan | 20 | Sustainable Production |

Emerging Technologies and Their‚Ā§ Potential to‚ĀĘ Shift ‚Ā£Semiconductor ‚ĀĘMarket‚ÄĆ Dynamics

The semiconductor industry is on ‚ÄĆthe cusp of transformative ‚Ā§change, driven by a surge in‚ĀĘ emerging technologies poised to‚ÄĆ disrupt‚Äč existing market dynamics. Among these innovations, artificial intelligence (AI) ‚Äčand 5G connectivity stand ‚Äćout as critical drivers reshaping‚Ā£ demand for semiconductors. As AI algorithms necessitate ‚Äčfaster data‚Äć processing ‚Äčcapabilities, a shift towards advanced chip ‚Ā§architectures is becoming ‚ÄĆevident. Additionally, the implementation‚ÄĆ of 5G technology is not just increasing the need for semiconductors ‚ÄĆin ‚ÄĆmobile‚Äć devices but also paving the way for autonomous‚Äč vehicles, smart cities, and the Internet of Things‚ÄĆ (IoT). This rising dependency‚Äć indicates a heightened ‚ÄĆcompetition among tech giants ‚ÄĆto enhance their chip ‚ĀĘproduction, potentially shifting market power towards nations‚Äč or companies that can effectively leverage these technologies.

Furthermore, the proliferation of quantum‚Äć computing and edge computing is expected to redefine how semiconductors are designed and utilized across‚Äč industries. ‚Ā§Quantum ‚ÄĆcomputers, with their‚ĀĘ ability ‚Äćto process complex calculations beyond the reach‚Ā£ of traditional counterparts, are‚Äć pushing chipmakers ‚ĀĘto innovate more efficient, ‚ĀĘspecialized chips tailored for ‚Ā£quantum ‚Äčoperations. Simultaneously occurring, edge computing ‚Ā§creates a‚Äč demand for localized data processing capabilities, necessitating smaller, more powerful chips ‚ÄĆthat can operate in less centralized environments.‚Äč The urgency to innovate‚Äč and ‚Ā§adapt‚Äć to these trends could‚Ā§ trigger new partnerships, mergers, ‚ÄĆand ‚Ā£supply chain strategies, thereby realigning the competitive landscape of the global ‚Äčsemiconductor market.

Future Projections: Navigating‚Äć the Evolving‚Äč Landscape of‚Ā£ Mature Chip Production

The transition towards mature chip production ‚Äćis poised to redefine the‚Äč global ‚Ā§tech landscape as companies scramble to adapt to shifting ‚Ā£geopolitical dynamics. ‚Ā£With increasing‚ĀĘ capabilities in domestic manufacturing‚Ā£ within‚Äč china, industry leaders ‚Ā£must reassess their supply chains and consider ‚ĀĘthe implications of a ‚Äčpotential ‘China shock.’ The anticipated impacts include:

- Heightened‚ĀĘ competition: ‚ĀĘ As Chinese manufacturers ramp up production, they pose a significant challenge to established players, potentially disrupting traditional‚Äč pricing models.

- Supply chain reconfiguration: Companies may need to diversify ‚Ā§their supplier base beyond China to‚ÄĆ mitigate risks associated with dependency‚Ā§ on‚ĀĘ a single region.

- Innovation pressure: Firms will be under pressure to innovate rapidly to maintain‚Äć competitive advantage in a swiftly changing market.

To navigate this‚Ā£ evolving landscape, stakeholders must embrace‚Ā£ a proactive approach, utilizing strategic‚Ā§ foresight to‚Äć anticipate market ‚Ā£shifts. Collaboration and ‚ÄĆinvestment in technological ‚Äčadvancements can act as ‚Ā£catalysts for resilience.Key trends ‚Ā§to monitor include:

- Geographical diversification: expanding production facilities in regions like ‚Ā£Southeast Asia or‚ĀĘ Eastern Europe.

- Government policies: Monitoring international regulations and support from local governments‚Äč to encourage domestic chip manufacturing.

- Partnerships: Forming alliances with emerging tech firms to share resources ‚ĀĘand expertise‚Ā§ in mature chip technology.

| trend | Description |

|---|---|

| Geographical Diversification | Building production capacity‚ĀĘ outside ‚ÄĆof traditional hotspots. |

| Compliance and Regulations | Staying‚ĀĘ abreast of changing international trade policies. |

| Innovation Partnerships | Collaborating with startups‚Ā§ for cutting-edge solutions. |

Key Takeaways

As the global tech industry confronts ‚Äčthe looming ‘China shock’ in ‚Ā£mature chips, the implications for supply chains, innovation, and market dynamics are profound.‚Äć With major players accelerating ‚ĀĘtheir ‚ÄĆstrategies ‚Ā§to mitigate risks and ‚Äčsecure their positions, the landscape‚Ā£ of‚Ā£ semiconductor manufacturing is poised ‚Ā§for a significant‚Ā£ transformation. The shifting geopolitical climate, combined with advancements in technology, underscores a critical need for vigilance and adaptability among‚ĀĘ industry‚ÄĆ stakeholders.‚ÄĆ As countries ‚Ā§and companies navigate this ‚Äćcomplex habitat, the ability ‚Äćto respond effectively to these challenges will‚ĀĘ determine not‚ĀĘ only‚Ā£ their competitive edge but ‚Ā£also ‚Äćthe future of the global technology ecosystem.‚Äč The coming months‚ĀĘ will be crucial as the tech world grapples with the ‚Ā£realities of reliance on Chinese manufacturing and‚ĀĘ strives‚Äć to create a more ‚Äčresilient supply ‚ĀĘchain for mature‚Ā§ chip production.As we move forward, monitoring‚Ā§ these developments will ‚Äčbe essential for understanding the trajectories of‚Ā§ both the tech‚ĀĘ industry and the broader global economy.