Iran’s oil exports have surged to their highest levels since the era of the Joint Comprehensive Plan of Action (JCPOA), signaling a significant shift in the country’s energy sector amid evolving geopolitical dynamics. According to reports from the West Asia News Agency (WANA), Tehran’s increased shipments reflect both renewed market access and strategic maneuvers in response to ongoing international negotiations and sanctions. This development marks a noteworthy moment for global oil markets and regional politics, as Iran seeks to reassert its role as a major energy supplier.

Iran’s Oil Shipments Surge to Peak Levels Since JCPOA Implementation

Iran’s oil exports have surged dramatically, reaching levels unseen since the inception of the Joint Comprehensive Plan of Action (JCPOA). This uptick signals a significant shift in Tehran’s energy sector dynamics amidst easing international restrictions. Industry analysts attribute this growth to a combination of increased production capacity and restored access to key global markets. As a result, Iran is strategically positioning itself to regain its former status as a major oil supplier on the world stage, despite ongoing geopolitical uncertainties.

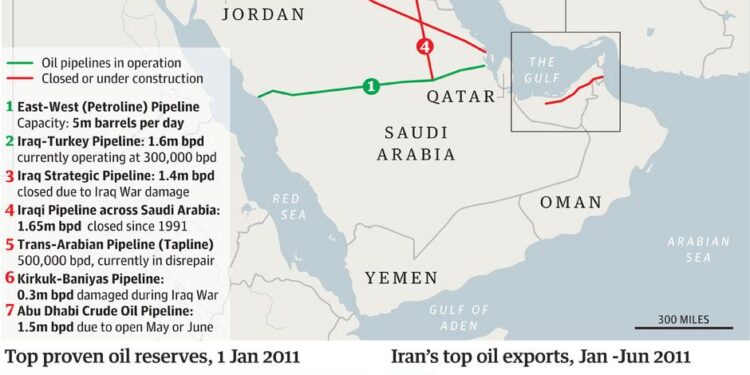

Recent data highlight a remarkable recovery in Iran’s crude shipments, with volumes climbing steadily over the past several months. The country’s top export destinations now include:

- China, maintaining its role as the largest importer

- India, which has increased purchases post-sanction relief

- Turkey, emerging as a growing regional buyer

Below is a snapshot of Iran’s monthly oil export volumes (in million barrels per day) since early 2023:

| Month | Export Volume (mbpd) |

|---|---|

| January 2024 | 2.3 |

| February 2024 | 2.6 |

| March 2024 | 2.9 |

| April 2024 | 3.1 |

Implications for Global Energy Markets and Regional Geopolitics

Iran’s recent surge in oil shipments marks a pivotal shift in energy supply dynamics, directly impacting global markets. As the country ramps up exports, it challenges the dominance of traditional suppliers in the Middle East and beyond, potentially stabilizing or even lowering crude prices amid persistent volatility. Key consumer nations, particularly in Asia and Europe, may find new leverage in negotiating energy contracts, diversifying their supply sources away from geopolitical hotspots. This renewed flow of Iranian oil also injects fresh momentum into global oil trading hubs, which could stimulate heightened competition among traders and refineries.

On the geopolitical front, increasing Iranian exports carry significant strategic weight. Regional powers are likely to recalibrate their alliances and policy stances to adapt to the shifting energy landscape. Notably:

- Gulf Cooperation Council (GCC) countries may intensify diplomatic efforts to counterbalance Iran’s growing economic influence.

- Energy-importing nations could seek closer ties with Tehran, fostering new regional partnerships or easing tensions.

- Global energy security frameworks might be reshaped, with Iran becoming a more central player in multilateral discussions.

| Aspect | Potential Impact | Key Stakeholders |

|---|---|---|

| Energy Pricing | Increased supply may lower global oil prices | Importers, OPEC+ |

| Regional Alliances | Shift in diplomatic relations and trade partnerships | Iran, GCC, Asian importers |

| Market Competition | Sharp rise in trading activities and contract negotiations | Oil traders, refiners |

Strategic Measures for Stakeholders Amid Increasing Iranian Oil Exports

With Iran’s crude oil shipments hitting their highest levels since the JCPOA period, industry players and regional stakeholders must recalibrate their approaches to market dynamics and geopolitical risks. Energy firms should enhance supply chain resilience by diversifying sourcing options and reinforcing partnerships in alternative markets to mitigate potential disruptions stemming from increasing Iranian exports. Additionally, policy makers need to monitor trade flows closely and adapt tariff frameworks and sanctions policies to address the shifting landscape effectively.

Financial institutions and investors are encouraged to reassess their exposure to Middle Eastern energy markets while boosting compliance protocols to navigate the complex regulatory environment. Engaging in transparent risk assessments and deploying advanced analytics tools can help forecast the implications of Iran’s rising oil volume on global pricing and regional stability. Below is a concise overview of strategic focus areas for stakeholders:

- Supply chain diversification to reduce dependency risks

- Real-time market intelligence for agile decision-making

- Regulatory compliance enhancement amid evolving sanctions

- Geopolitical risk monitoring for proactive strategy adjustment

- Investment portfolio optimization balancing risk and return

| Stakeholder | Primary Focus | Actionable Strategy |

|---|---|---|

| Energy Firms | Supply Stability | Diversify providers, reinforce logistics |

| Policy Makers | Market Regulation | Adjust tariffs, monitor trade flows |

| Investors | Risk Management | Portfolio diversification, compliance audits |

| Financial Institutions | Regulatory Compliance | Enhance screening, upgrade analytics |

In Retrospect

As Iran’s oil shipments reach their highest level since the JCPOA era, the development signals a potential shift in regional energy dynamics and international trade patterns. Observers will be closely monitoring how these increased exports influence geopolitical relations, global oil markets, and the ongoing discourse surrounding Iran’s nuclear program. Further updates are expected as Tehran continues to navigate the complex intersections of diplomacy and commerce.