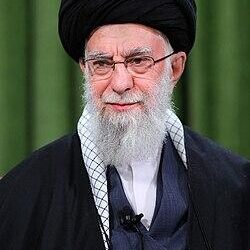

In a meaningful move aimed at curbing iran’s nuclear ambitions and regional influence, the United States has unveiled a fresh set of sanctions targeting the country’s oil trade. Designed too restrict the flow of revenue that supports Iran’s contentious activities, these measures are part of a broader strategy to exert pressure on the Iranian government. The announcement, which comes amid ongoing tensions between Washington and Tehran, underscores the U.S. commitment to holding Iran accountable for its actions while also signaling its determination to safeguard global energy security. As international stakeholders respond to these developments, the implications for both the Iranian economy and the global oil market remain to be seen. This article delves into the particulars of the new sanctions, their potential impact on Iran’s oil exports, and the reactions from key players both within the region and beyond.

US Sanctions Aimed at Disrupting Iran’s Oil Exports

The latest round of sanctions imposed by the United States specifically targets Iran’s vital oil sector, aiming to undermine the country’s economic capabilities. These measures include restrictions on key Iranian entities and individuals involved in oil production, trade, and transportation. The Biden governance’s decision to intensify its stance reflects ongoing concerns regarding Tehran’s nuclear program and its regional activities. Notably, the sanctions have potential repercussions not only for Iran but also for global oil markets, as countries and companies may reconsider their engagement wiht Iranian oil considering the increased risks.The nuances of this strategy include:

- Asset Freezes: Targeting financial assets linked to Iranian oil officials.

- Trade Restrictions: Prohibiting specific trade relations that involve Iranian oil exports.

- Secondary Sanctions: Threats of penalties against third-party nations doing business with Iran.

As the US seeks to exert maximum pressure on Iran, the effects of these sanctions could lead to a ripple effect in the global energy market. Countries dependent on oil imports are being urged to diversify their energy sources to avoid complications stemming from US sanctions. A swift response from the Iranian government is anticipated, likely involving adjustments to its oil export strategies. The implications of these actions may be summarized in the following table:

| Sanction Type | Target | Potential Impact |

|---|---|---|

| Asset Freezes | Iranian Oil Officials | Disruption of operations |

| Trade Restrictions | Foreign Buyers | Market uncertainty |

| Secondary Sanctions | Third-Party Nations | Strained diplomatic relations |

Impact on Global Oil Prices and Market Stability

The recent sanctions imposed by the US on Iran’s oil trade are poised to create significant ripples in the global oil market. as iran is one of the largest oil producers,any disruption in its supply can lead to considerable fluctuations in oil prices. Industry analysts are closely monitoring the situation,anticipating the potential for increased volatility in the market. Key factors influencing the scenario include:

- Reduced Supply: A decline in Iranian oil exports can tighten global supply, contributing to higher prices.

- Geopolitical Tensions: Escalating tensions in the Middle East could destabilize other oil-producing regions, further straining supply chains.

- Responses from Other Producers: how other major oil producers like Saudi Arabia adjust their output in response to these sanctions can significantly impact market stability.

Market reaction to similar sanctions in the past has frequently enough seen an initial spike in prices, followed by corrections as traders adjust their expectations. The current situation could fuel speculative trading activities, leading to more unpredictable price movements. A number of market implications could unfold:

- Increased Price Volatility: Short-term spikes accompanied by prolonged fluctuations may become the norm.

- Demand Shifts: Countries dependent on Iranian oil may seek choice sources, possibly altering global trade dynamics.

- investment Uncertainty: Investors may become wary of committing funds to oil markets perceived as unstable.

Responses from Iran and Potential Countermeasures

Iran has vehemently condemned the latest round of US sanctions aimed at its oil sector,labeling them as a form of economic warfare that seeks to undermine its sovereignty. Government officials have expressed their determination to resist these measures, emphasizing that the country will utilize all available resources to safeguard its economic interests. In response, Iran could adopt a multi-faceted strategy, including:

- Enhancing Oil Trade with allies: Strengthening ties with nations like china and Russia to bypass restrictions.

- Boosting Domestic Production: Increasing local oil production capacity to reduce foreign dependency.

- Utilizing Alternative Payment Systems: Developing cryptocurrencies or barter systems to facilitate trade.

furthermore, Tehran might also resort to countermeasures aimed at disrupting global oil markets in retaliation for the sanctions. This could manifest as:

- Sabotaging Shipping Routes: Increasing risks in the Persian Gulf to deter vessels headed to US allies.

- Targeting US Interests Abroad: Engaging in cyber operations against US energy infrastructure.

- Propagating Misinformation: Launching campaigns to effect international public opinion on US policies.

| Potential Countermeasures | Implications |

|---|---|

| Enhancing Oil Trade with Allies | May reduce economic impact of sanctions. |

| Boosting Domestic Production | Strengthens self-sufficiency. |

| Utilizing Alternative Payment Systems | Minimizes reliance on US dollar. |

| Sabotaging Shipping Routes | Potentially increases global oil prices. |

Geopolitical Ramifications and Regional Security Concerns

The recent sanctions imposed by the United States on Iran’s oil trade are poised to carry significant implications for geopolitical dynamics in the Middle East. As the U.S. aims to curb Iran’s revenue sources, particularly following heightened tensions surrounding its nuclear program and military activities, the sanctions can lead to an escalation of conflict in the region. This financial pressure not only affects Iran but also influences other countries that rely on Iranian oil or have economic ties with Tehran, prompting potential shifts in alliances and trade relations. Key players may need to reevaluate their positions as they navigate the complex landscape of diplomacy and trade.

The ripple effects of these sanctions are expected to heighten regional security concerns among neighboring countries. Bilateral relations could become strained as nations face pressure to align with U.S. policies or risk losing access to American markets. In particular, the potential for increased hostilities or retaliatory actions by Iran could threaten stability in the Gulf region, prompting a stronger military presence from the U.S. and its allies.As states reassess their security strategies, the broader implications for regional cooperation and conflict resolution mechanisms may surface, necessitating a multifaceted approach to address the evolving geopolitical realities. This situation underscores the interconnectedness of global energy markets and international relations.

| Key Implications | Potential Responses |

|---|---|

| Increased Tensions | Military Presence |

| Realignment of Alliances | Economic Sanctions |

| Trade Relations Disruption | Diplomatic Initiatives |

Recommendations for US Policy Adjustments and Diplomatic Engagement

To effectively address the complex dynamics around Iran’s oil trade, it is essential for the US to undertake a multifaceted approach that balances sanctions with constructive diplomatic engagement. Firstly, the US should consider establishing a clear framework for dialogue that includes not only Iran but also regional allies and stakeholders. This approach can help create a unified front against illicit oil trading while fostering cooperation on broader issues such as security and economic stability. Additionally, the US could enhance its intelligence-sharing capabilities with partners to monitor and disrupt networks involved in Iran’s oil exportation.

moreover,re-evaluating existing sanctions is crucial. The US must ensure that these measures do not disproportionately affect the Iranian populace while targeting specific sectors linked to the regime’s illicit activities.Implementing a strategy that includes:

- Conditional Sanctions Relief: Provide incentives for compliance with international agreements.

- Partnerships with European Allies: Collaborate closely to maintain a unified stance against Iran’s oil trade.

- Humanitarian Exemptions: Allow for exceptions in critical sectors like medicine and food to reduce civilian suffering.

These recommendations could pave the way for a more effective policy framework that not only curtails Iran’s oil revenue channels but also promotes regional stability and opens avenues for dialogue.

Future Outlook for Iran’s Oil Industry Amid Sanctions

The ongoing sanctions imposed by the United States continue to challenge Iran’s oil industry, drastically reshaping its economic landscape. As global energy markets undergo shifts in response to geopolitical developments, Iran faces significant hurdles in exporting oil, leading to a potential increase in domestic reliance on energy resources. key factors influencing the future trajectory of its oil trade include:

- Increased Competition: With alternatives such as U.S. shale oil,Russia,and OPEC members adapting to the market,Iran may struggle to maintain its previous levels of market share.

- Emerging Markets: Iran is highly likely to turn to non-western markets, particularly in Asia, as a means to circumvent sanctions.

- Technological Deficits: Lack of access to advanced drilling technology could hinder enhancements in oil production efficiency.

Despite these challenges, there could be avenues for Iran to adapt and innovate within the constraints of the sanctions. for instance, fostering partnerships with allied nations can lead to a reimagined export strategy. Iran might look to utilize alternative payment systems and strengthen trade relationships with countries willing to bypass U.S.-led sanctions. Key considerations for this transitional phase include:

| Focus Area | Potential Impact |

|---|---|

| Partnerships | Enhanced resource sharing with allied nations |

| Trade Routes | Development of alternative supply chains |

| Domestic Investment | Boost in local enterprises related to oil technology |

Final Thoughts

the recent sanctions imposed by the United States on Iran’s oil trade mark a significant escalation in the ongoing efforts to curtail the Iranian government’s financial resources and limit its influence in the region. By targeting key sectors of the economy, particularly oil exports, which are vital to Iran’s revenue, the U.S. aims to apply increased pressure amid ongoing geopolitical tensions and nuclear negotiations. As global markets brace for the potential ripple effects of these sanctions, the situation remains fluid. Analysts will be closely monitoring not only Iran’s response but also the reactions of other key players in the international arena.This development underscores the intricate balance of diplomacy,economic strategy,and security concerns that continue to shape U.S.-Iran relations and the broader Middle East landscape. As events unfold, it will be crucial to assess the implications of these sanctions on both regional stability and global oil markets.

![ISWK[Cambridge] Students Bring Glory to Oman at the 2nd Asian Yogasana Sport Championship! – Times of Oman](https://asia-news.biz/wp-content/uploads/2025/05/165927-iswkcambridge-students-bring-glory-to-oman-at-the-2nd-asian-yogasana-sport-championship-times-of-oman-120x86.jpg)