Is It Time to Back Japan? Analyzing Economic Prospects in Wealth Briefing Asia

As the global economy navigates a landscape marked by geopolitical uncertainties and shifting markets, Japan stands at a critical crossroads. With a recent resurgence in economic activity and a renewed focus on innovative growth strategies, observers are beginning to ask: is it time to back Japan? In this analysis, Wealth Briefing Asia delves into the forces shaping Japan’s economic landscape, exploring the potential for investment, the government’s fiscal policies, and the country’s ability to adapt to an ever-evolving global marketplace. As Asia’s third-largest economy seeks to redefine its position on the world stage, stakeholders must consider whether the Land of the Rising Sun is poised for a new era of prosperity.

Evaluating Japan’s Economic Resilience Amid Global challenges

Japan’s economic landscape continues to showcase a unique blend of resilience and adaptability, especially as the nation navigates through turbulent global economic currents. The recent depreciation of the yen may have raised some eyebrows, but it also presents an opportunity for exporters, allowing them to remain competitive. Key sectors such as technology, automotive, and tourism are demonstrating robust performance, even as inflationary pressures and supply chain disruptions test the country’s resolve. Some of the notable factors contributing to Japan’s economic stability include:

- Innovation and technology: Japan continues to invest heavily in R&D, notably in automation and green technology.

- Strong domestic consumption: The resilience of consumer spending amidst global inflation highlights the strength of the Japanese market.

- Stable governance: Political stability enhances investor confidence, thereby bolstering economic growth.

A closer examination of Japan’s fiscal policies reveals a proactive stance in addressing economic challenges. the government’s commitment to revitalizing the economy includes critically important infrastructure investments and incentives for businesses aiming to reduce their carbon footprint. Moreover, Japan’s demographic shift has prompted an increased focus on attracting foreign talent and investment, which could reinvigorate various sectors. The following table summarizes the indicators of Japan’s economic performance:

| Indicator | Value | Remarks |

|---|---|---|

| GDP Growth Rate | 1.8% | Projected for 2023 |

| Unemployment Rate | 2.6% | Stable labor market |

| Inflation rate | 3.0% | above target, but manageable |

Strategic Investment Opportunities in Japanese Markets

Amidst global economic fluctuations, Japanese markets present a compelling case for strategic investment. With the Bank of Japan maintaining an accommodative monetary policy and the Yen experiencing volatility, investors have the opportunity to explore a range of potential high-return sectors. Key drivers include:

- Technology Innovation: Japan continues to expand its prowess in robotics and AI, positioning itself as a leader in future technologies.

- Green Energy: amid rising climate concerns,investments in renewable energy solutions are gaining traction,ready to meet both domestic and international demands.

- Food and Agriculture: With a focus on enduring practices, this sector is ripe for innovation, particularly in agri-tech startups.

Moreover, the value of Japanese equities is attracting new attention, particularly as corporate governance reforms and shareholder engagement strategies enhance profitability and shareholder value.A recent analysis shows significant opportunities across various industries:

| Sector | Potential Growth (%) |

|---|---|

| Tech | 15-20 |

| Renewable Energy | 12-18 |

| Healthcare | 10-15 |

| Consumer Goods | 8-12 |

As the nation pursues structural reforms and revitalizes its economic engines, investment in Japanese markets may not only safeguard portfolios but also capitalize on robust long-term growth trends. The convergence of fiscal policies and market readiness suggests that the time to explore Japan’s vast potential may indeed be upon us.

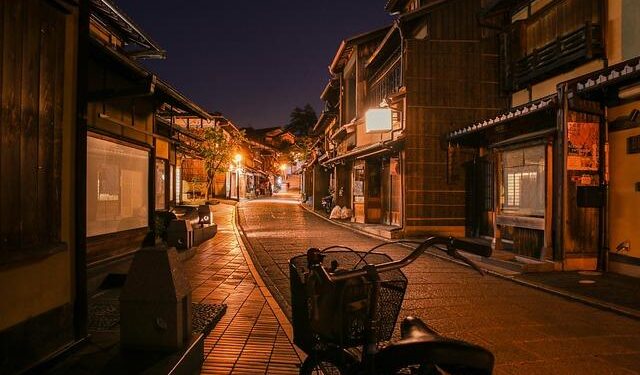

Navigating Cultural Nuances for Successful Engagement in Japan

Successfully engaging in the Japanese market requires a deep understanding of its unique cultural nuances. To foster meaningful relationships, whether in buisness dealings or social interactions, it is indeed essential to engage in practices that reflect respect and gratitude for japanese customs. This includes being aware of the meaning of hierarchy in professional settings,where age and experience often dictate social dynamics. Additionally, the art of ‘wa’ or harmony plays a crucial role; maintaining a collaborative atmosphere can enhance mutual trust and open avenues for deeper conversations. Key considerations include:

- Politeness: Use formal greetings and gestures, such as bowing, to acknowledge the importance of respect.

- indirect Dialog: Understand that much can be conveyed through silence or subtle cues, emphasizing the need for careful listening.

- Group Consensus: Decisions frequently enough emerge from group discussions, reinforcing the value of collective agreement.

Moreover, diverse regional practices across Japan may further influence engagement strategies. For instance, variations in local dialects and customs can affect interactions differently depending on whether one is in Tokyo or Osaka. Engaging with local partners who can provide insights into these regional idiosyncrasies is invaluable. Consider the following comparison of business etiquette in key cities:

| City | Business Etiquette | Common Practices |

|---|---|---|

| Tokyo | Emphasis on formality and hierarchical structure | exchanging business cards with two hands |

| Osaka | More relaxed but still respectful | Humor and informal conversation are more accepted |

| Sapporo | Warm hospitality with a focus on personal connections | Inviting business partners for local delicacies |

In Summary

As global markets continue to navigate uncertainty, the question of whether to back Japan emerges with increasing urgency. With the nation’s ongoing reforms,a commitment to economic stability,and a rich pool of investment opportunities,Japan is positioning itself as a formidable player in the Asian economic landscape. As investors weigh their options, the potential for capitalizing on the rejuvenation of Japan’s economy is undeniably appealing.

Though, the path to revitalization is not without its challenges. Factors such as demographic shifts, geopolitical tensions, and the lingering impact of the COVID-19 pandemic must be carefully considered. As we move forward, the strategic choices made by both domestic and international stakeholders will ultimately shape Japan’s financial future.

while the time may seem ripe to back Japan, due diligence and a nuanced understanding of the landscape are essential. As the nation strives to emerge stronger and more resilient, the global investing community will be watching closely to determine if now is indeed the moment to embrace japanese opportunities.