In the intricate landscape of global trade, Japan’s automotive market has long been recognized for its unique blend of innovation and regulatory complexity. Despite its reputation as a coveted destination for manufacturers, the presence of non-tariff barriers often complicates the entry of foreign automakers. This challenge has not deterred companies like BYD, China’s electric vehicle (EV) powerhouse, which has made meaningful inroads into the Japanese market. In a striking progress, BYD appears to have navigated these obstacles with relative ease, demonstrating both resilience and adaptability. As the competition intensifies in the burgeoning EV sector, this article delves into the non-tariff barriers prevalent in Japan and explores how BYD has seemingly sidestepped these challenges, reshaping perceptions of cross-border commerce in the automotive industry.

Understanding Japan’s Nontariff Barriers and Their Impact on Foreign Automakers

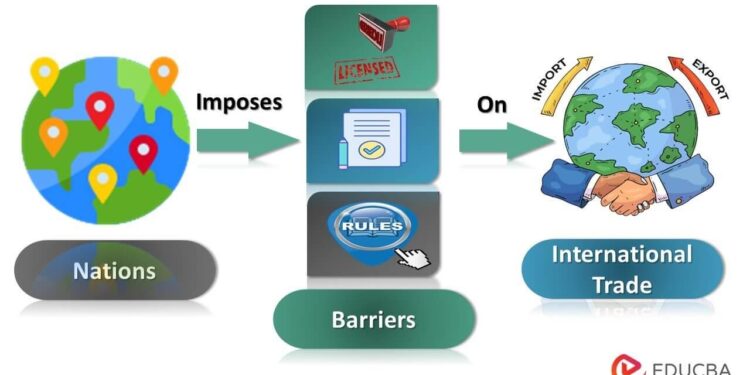

Japan’s intricate framework of nontariff barriers presents a formidable challenge for foreign automakers looking to penetrate the market. These barriers are various regulations and standards that can impede the free flow of goods without resorting to conventional tariffs. Notable aspects contributing to this environment include:

- Safety and Emission Standards: Japan enforces some of the world’s strictest automotive safety and emissions regulations, which can pose significant hurdles for manufacturers unfamiliar with the Japanese standards.

- Certification Processes: The lengthy and rigorous approval processes for new vehicles mean that foreign companies may face delays in bringing their products to market.

- Distribution Networks: Established domestic networks often marginalize foreign players, making it challenging to gain market visibility and consumer trust.

These barriers not only restrict access but can also lead to increased operational costs for foreign brands.As an example, BYD, China’s electric vehicle giant, has appeared to bypass many of these hurdles effectively, capitalizing on Japan’s growing demand for electric mobility. A closer analysis reveals key strategies taken by BYD, including:

- Localized Production: By establishing production facilities within Japan, BYD benefits from reduced logistics costs and compliance with local regulations.

- Strategic Partnerships: Collaborating with Japanese companies for distribution and marketing, thus gaining credibility and easier access to the market.

| Strategy | Description |

|---|---|

| Localized Production | Setting up factories in japan to meet local standards. |

| strategic Partnerships | Alliances with Japanese firms for distribution. |

| Tailored Marketing | Customized campaigns to resonate with Japanese consumers. |

BYD’s Challenges in Navigating Japan’s Regulatory Landscape

As BYD, China’s leading electric vehicle manufacturer, sets its sights on expanding into Japan’s competitive market, the company faces a myriad of regulatory hurdles that could stymie its ambitions. Unlike traditional trade barriers, which often involve tariffs, japan presents a complex web of nontariff barriers that include stringent safety standards, certification processes, and bureaucratic inquiries. The meticulous nature of Japan’s regulatory framework means that even a slight oversight in product compliance can lead to significant delays in market entry, crafting a daunting scenario for newcomers like BYD.

To effectively penetrate the Japanese market, BYD must adapt its operational strategy while proactively engaging with local regulators. This includes familiarizing itself with:

- Japan’s unique automotive standards

- Environmental regulations specific to EVs

- Local consumer preferences that influence certification success

The company will need to invest in local partnerships and legal expertise to navigate this intricate landscape, ensuring that it complies with domestic laws while meeting consumer expectations. To illustrate the situation, the table below outlines BYD’s potential compliance challenges in Japan:

| Challenge | Impact | Actions needed |

|---|---|---|

| Safety Standard Certification | Delays in vehicle launch | Pre-emptive compliance testing |

| Local Content Rules | Increased production costs | Outsourcing parts to local suppliers |

| Environmental Regulations | Potential fines and penalties | Thorough environmental impact assessments |

Strategic Recommendations for Electric Vehicle Manufacturers Entering Japan

Electric vehicle manufacturers eyeing the Japanese market must navigate a complex landscape characterized by nontariff barriers that could impede entry and expansion.success in this competitive environment requires a multifaceted approach that aligns with local regulations and consumer expectations. Manufacturers should focus on the following strategic actions:

- Local Partnerships: Collaborate with Japanese automotive firms or technology companies to leverage local expertise and improve market acceptance.

- Adaptation to Standards: Invest in understanding japan’s unique automotive regulations and safety standards to avoid compliance issues.

- Cultural Customization: Tailor products and marketing strategies to resonate with Japanese consumers, emphasizing reliability and technological innovation.

- Infrastructure Development: Engage in partnerships to expand charging infrastructure,which plays a crucial role in boosting consumer confidence in EV adoption.

Moreover, manufacturers should prioritize transparency and dialog with Japanese regulators and consumers alike. Understanding regional preferences is key to effectively positioning electric vehicles in a market that appears resistant to foreign brands. The following tactics can enhance credibility and foster goodwill:

| Focus Area | Proposal |

|---|---|

| Market Research | Conduct surveys and focus groups to comprehend local consumer preferences. |

| Brand Perception | Develop targeted Public Relations campaigns to enhance brand recognition. |

| Innovation Showcase | Host events to demonstrate cutting-edge EV technology to stakeholders. |

In Conclusion

the ongoing challenges posed by nontariff barriers in Japan remain a significant hurdle for foreign automakers seeking to penetrate the highly competitive Japanese market. BYD’s experience underscores the complexities of navigating these obstacles, despite its remarkable rise as a leader in the electric vehicle sector. As global demand for EVs continues to surge, stakeholders will be watching closely to see if japan reassesses its regulatory landscape to foster a more inclusive environment for international players. The future of automotive innovation may depend on overcoming these barriers, enabling a more dynamic exchange of ideas and technologies between nations. As the industry evolves, the ability of companies like BYD to adapt and thrive in diverse markets will be critical to their global strategy and the wider transition toward lasting mobility.