Export of Coal from Kyrgyzstan to China Sees Dramatic Decline in Early 2025

In a meaningful shift within the regional energy market, the export of coal from Kyrgyzstan to China has plummeted by a staggering four times during the first two months of 2025, as reported by AKIpress. This sharp decline raises important questions about the underlying factors contributing to this downturn, including the impact of geopolitical dynamics, fluctuating demand in China, and the evolving energy landscape within Central Asia. As both nations navigate complex economic challenges, this trend not only highlights the vulnerabilities within Kyrgyzstan’s export strategy but also underscores the broader implications for trade relations in the region. In this article, we delve into the reasons behind this dramatic drop in coal exports and its potential ramifications for both countries moving forward.

Impact of Geopolitical Tensions on Kyrgyzstan’s Coal Trade with China

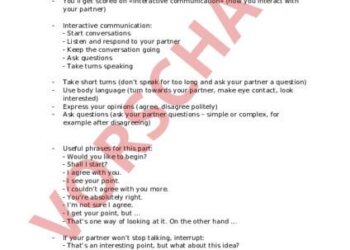

The decline in coal exports from Kyrgyzstan to China during the initial months of 2025 is a significant indicator of the broader implications of ongoing geopolitical tensions in the region.With relations between china and several Central Asian nations becoming increasingly strained,especially amid rising international sanctions and trade disputes,Kyrgyzstan has found itself in a precarious position. The complexities of these geopolitical dynamics have led to:

- Increased shipping costs: Heightened tension often results in logistical challenges, raising transportation expenses.

- Market fluctuations: Uncertainties in global energy markets can negatively affect demand for coal.

- Regulatory barriers: new restrictions and checks introduced by both countries have contributed to delays and reduced trade volumes.

as Kyrgyzstan’s coal trade faces a dramatic downturn, it is essential to analyse the effects on local economies and the nation’s energy strategy. The current situation necessitates a reevaluation of trading partnerships beyond China, potentially looking towards other markets. The recent data highlights the magnitude of the trade drop:

| Month | Coal Exports (in tons) | Comparison to Last Year |

|---|---|---|

| January 2025 | 1,500 | ↓ 75% |

| February 2025 | 2,000 | ↓ 70% |

The drop in coal exports poses questions about future economic stability and energy independence for Kyrgyzstan. Without strategic interventions, the nation risks long-term repercussions on its coal sector and overall economic health.

Analysis of Market Trends Leading to decreased Coal Exports

The significant decline in coal exports from Kyrgyzstan to china can be attributed to a confluence of market dynamics and geopolitical factors. One pivotal element is the increased competition from option energy sources. with the global shift towards lasting energy practices, the demand for coal, particularly from environmentally conscious markets, has dwindled. Additionally,China’s domestic policies aimed at reducing carbon emissions have led to a decrease in coal consumption,impacting import quotas and reducing the need for foreign coal supplies.This shift is further exacerbated by the rise of renewable energy technologies, such as solar and wind, which have become more economically viable and attractive for investment.

Economic considerations also play a crucial role in this downturn. The global fluctuation of coal prices has made it less profitable for exporters like Kyrgyzstan to engage in coal trade, especially when production costs remain high. Moreover, transportation challenges, including fluctuating freight costs and logistics issues on critical delivery routes, have compounded the difficulties in maintaining steady export levels. Trade relations between Kyrgyzstan and China are undergoing evaluation, with an increasing focus on diversifying export commodities away from coal toward more sustainable and economically favorable products, thus reshaping the future of trade relations between the two nations.

Economic Consequences for Kyrgyzstan’s Mining Sector

The significant decline in coal exports from Kyrgyzstan to China during the first two months of 2025 has raised eyebrows across the mining sector. The reduction of fourfold not only affects the export revenues but also poses a risk to the economic stability of local mining companies and the overall economy of the country. The reasons behind this downturn are multifaceted, including increasing competition from other regional coal exporters, tighter regulations imposed by china on imported coal, and fluctuations in global energy prices.

As the mining industry grapples with these challenges, several key economic consequences are anticipated:

- Decreased Revenue: the drop in exports directly translates to a significant loss in income for the mining sector.

- Job Losses: With reduced demand, mining companies may reduce their workforce, leading to higher unemployment rates in mining communities.

- Investment Retracement: Decreased export volumes may deter foreign and local investments, stalling growth and technological advancements within the sector.

| Indicator | Impact |

|---|---|

| Export Volume | Decreased by 75% |

| Mining Revenue | projected significant declines |

| Workforce Size | Possible reductions imminent |

To navigate this precarious situation, stakeholders in Kyrgyzstan’s mining sector may need to innovate and adapt by exploring new markets, improving operational efficiencies, or diversifying into other minerals and resources. Without swift action, the implications of this downturn could extend beyond the immediate economic metrics, affecting social stability and growth in the long term.

Strategies to Revitalize Coal Export Trade to China

The significant decline in coal exports from Kyrgyzstan to China calls for immediate action and strategic planning. To reverse this downturn, stakeholders in the coal sector must consider various strategies that can rejuvenate trade. First and foremost, establishing robust bilateral agreements with Chinese importers can streamline processes, ensuring that both nations benefit economically. Furthermore, enhancing infrastructure at key transit routes and ports will facilitate smoother transportation of coal, ultimately lowering costs for exporters. Collaborating with freight companies to develop efficient logistics networks can also contribute to a more competitive export landscape.

Additionally, investing in sustainable mining practices can improve Kyrgyzstan’s international reputation and align with China’s growing focus on environmental sustainability. By adopting technologies that minimize the ecological impact of coal mining and emphasizing clean production methods, the Kyrgyz coal industry can appeal to environmentally conscious buyers. Moreover, establishing a marketing strategy that highlights the quality and reliability of Kyrgyz coal may engage potential Chinese customers. Hosting trade fairs and participation in energy sector expos can provide face-to-face engagement opportunities, fostering relationships that could lead to long-term contracts and partnerships.

Long-term Outlook for Kyrgyzstan’s Energy Sector and Future Opportunities

The significant decline in coal exports from Kyrgyzstan to China over the first two months of 2025 indicates a troubling trend for the energy sector, which heavily relies on this industrial corridor. This downturn may signal shifts in market demand and regulatory changes within China that prioritize cleaner energy sources. As Kyrgyzstan looks to stabilize its economic foundation and exploit its abundant natural resources, ther is a pressing need to adapt and diversify its energy portfolio to mitigate losses from customary exports. This could involve investing in renewable energy technologies, such as solar, wind, and hydroelectric power, to align with global trends moving towards sustainability.

In the wake of reduced coal exports, Kyrgyzstan can seize potential opportunities by focusing on regional partnerships and infrastructure development. Exploring avenues such as:

- Green financing for renewable project implementation

- joint ventures with neighboring countries to enhance cross-border energy trade

- Improving local grid infrastructure for energy efficiency

These initiatives could foster economic resilience and create a robust energy sector capable of withstanding fluctuations in global markets. moreover, aligning its energy strategies with international climate agreements positions Kyrgyzstan as a forward-thinking participant in the evolving energy landscape, which, in turn, opens doors to various international funding mechanisms aimed at sustainable development.

Recommendations for Policy Makers to Diversify Export Markets

In light of the significant decline in coal exports to China, policy makers in Kyrgyzstan must prioritize strategic diversification of export markets to mitigate economic vulnerabilities.Enhancing diplomatic relations with neighboring countries is crucial, and avenues such as regional trade agreements can be explored to solidify partnerships. Additionally, leveraging existing trade routes while establishing new ones can open opportunities in untapped markets. Certain regions such as Southeast asia and Europe present a goldmine for coal export potentials, which could counterbalance the downturn in chinese demand.

Moreover, to effectively reposition Kyrgyzstan as a competitive player in the global coal market, fostering a framework for sustainable practices in coal production is essential. Policy makers should consider investing in modern technologies that promote clean coal initiatives,which could appeal to environmentally conscious markets. Creating incentives for diversification within the mining sector,such as tax breaks for companies exploring new markets or investing in renewable energy resources,can stimulate resilient growth. This multifaceted approach will not only stabilize exports but also align with global trends towards sustainable energy practices.

| Action | Benefit |

|---|---|

| Enhancing Diplomatic Relations | Facilitates new trade agreements and partnerships. |

| Investing in Technology | Promotes cleaner production methods and attracts eco-amiable markets. |

| Incentivizing Market Diversification | Encourages exploration of alternative markets and reduces dependence on a single country. |

Key Takeaways

the significant decline in coal exports from kyrgyzstan to China during the first two months of 2025 highlights the shifting dynamics in the regional energy market. The reported fourfold decrease raises important questions about the factors driving this downturn, including potential regulatory changes, market demand fluctuations, and broader economic conditions. As both nations strategize their energy policies and trade agreements, the implications of this reduction may reverberate beyond statistics, affecting local economies and geopolitical relations. Stakeholders will need to monitor these developments closely, as they could dictate future trends in energy consumption and export strategies in Central Asia.