As the global energy landscape shifts towards cleaner alternatives, Qatar finds itself at a crossroads in the liquefied natural gas (LNG) market. The small Gulf nation has long enjoyed a dominant position as one of the leading suppliers of LNG, especially in Asia, where demand continues to surge. However, recent developments indicate that the competitive dynamics are changing.A new wave of flexible LNG suppliers, including the United States and various Australian producers, is emerging, challenging qatar’s market share and pricing power. This article delves into the factors driving this increasing competition,the strategic responses from Qatar,and the broader implications for the LNG industry in the region. As energy shortages and geopolitical tensions loom, understanding these shifts is crucial for stakeholders and policymakers navigating the evolving landscape of global energy supply.

Qatar’s LNG Market Dominance Under Threat from agile Competitors

Amidst growing competition in the LNG sector, Qatar’s established market stronghold is increasingly challenged by agile suppliers who promote versatility and adaptability in their sourcing strategies. Companies such as the U.S.and Australia leverage their ability to rapidly shift production and shipping routes, making them appealing to buyers in Asia who are looking for reliable and cheaper alternatives to Qatar’s more rigid supply agreements. These competitors are no longer just attracting budget-conscious buyers but are also courting established Asian markets traditionally dominated by Qatari exports.

As ASEAN countries and other parts of Asia demand greater energy security and diversity in suppliers, the advantages that once favored Qatar are waning. The trend highlights the importance of flexibility and responsiveness in the current LNG landscape. Key factors influencing this shift include:

- Dynamic pricing models: Competitors are offering more competitive pricing structures.

- Shorter contract terms: Many buyers prefer to avoid long-term commitments.

- Proximity to emerging markets: Agile suppliers can quickly meet regional demands.

Below is a brief comparison of Qatar’s traditional market approach against it’s emerging competitors:

| Feature | Qatar | Agile suppliers |

|---|---|---|

| Contract Duration | Long-term | Short-term and flexible |

| Price Structure | Fixed pricing | Market-based pricing |

| Supply Chain Adaptability | Rigid | Highly adaptable |

| Buyer Relationships | exclusivity | Diversity |

The Evolving Landscape of Asia’s Natural Gas Demand

The dynamics of Asia’s energy market are undergoing a meaningful change as countries in the region increasingly pivot towards natural gas as a cleaner alternative to coal and oil. Driven by rising energy demands and environmental commitments, nations such as China, India, and Southeast Asian countries are emerging as pivotal players in the global LNG market.This shift is spurred by several factors, including:

- Economic Growth: Rapid urbanization and industrialization are propelling energy needs.

- Environmental Concerns: Governments are prioritizing lower emissions and sustainability.

- Technological Advancements: Enhanced LNG shipping and regasification technologies are increasing accessibility.

As an inevitable result, traditional suppliers like Qatar face heightened competition from flexible LNG suppliers that can adapt to the varying demands of Asian markets. Countries such as the United States, Australia, and Russia are capitalizing on their ability to provide spot market contracts and shorter delivery times. To illustrate the shift, a comparison of key LNG suppliers showcases their adaptability:

| Supplier | delivery Flexibility | Market Entry Times |

|---|---|---|

| Qatar | Long-term contracts | Established |

| United states | Spot market availability | Rapid escalation |

| Australia | Flexible contracts | Growing presence |

| Russia | Pipeline and LNG flexibility | Emerging |

This evolving competitive landscape not only reshapes trade relationships but also influences pricing strategies and investment planning, prompting traditional suppliers to reassess their approach in catering to demands of the Asia-Pacific region.

Strategic Responses: How Qatar Can Reinforce Its LNG Position

in the face of increasing competition from flexible LNG suppliers in Asia, Qatar must adopt a multifaceted strategy to solidify its leadership in the global LNG market. Key measures could include enhancing infrastructure and logistics capabilities to improve delivery efficiency,thereby ensuring competitive pricing. Investing in technology to streamline operations may also boost production and increase the sustainability of its LNG supply chain. Some possible initiatives include:

- Partnerships wiht international shipping firms: Collaborating with shipping companies to secure more flexible transportation options.

- Investment in regasification facilities: Expanding partnerships in key importing countries to improve access and distribution.

- Innovative marketing strategies: Promoting long-term contracts while offering short-term flexibility to attract a diverse customer base.

moreover, Qatar can leverage its geographical advantages and existing infrastructure to implement strategic pricing models that cater to the evolving demands of the Asian market.To do this effectively, Qatar should focus on collaboration with regional players, harnessing collective resources and expertise. A obvious pricing strategy could further maximize its competitive edge. The following table outlines potential collaboration opportunities that align with this strategy:

| Collaboration Area | potential Partners | Benefits |

|---|---|---|

| Logistics Management | International shipping companies | Improved shipment efficiency |

| Market Expansion | Regional LNG importers | Access to new markets |

| Technology Sharing | Global energy tech firms | Enhanced operational efficiency |

Innovative Technologies Shaping the Future of LNG supply

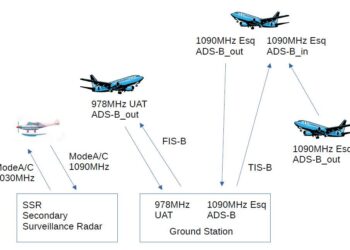

The liquefied natural gas (LNG) market is undergoing significant transformation as new technologies emerge, enabling a more flexible supply chain in response to rising demand in Asia. advances in floating LNG (FLNG) technology have revolutionized production methods, allowing companies to access natural gas reserves in remote or offshore locations. This flexibility helps reduce the time and investment needed for infrastructure development, meeting the urgent needs of rapidly growing markets. Additionally, innovations in LNG shipping logistics enhance operational efficiencies, ensuring timely delivery and reducing costs through optimized routing and scheduling.

Furthermore, digital technologies, such as IoT and AI, are playing a pivotal role in monitoring and managing LNG supply chains. These technologies facilitate real-time data analysis, enhancing decision-making related to inventory management and market forecasting.Companies are increasingly adopting automation and predictive maintenance strategies, minimizing downtime and operational disruptions. By integrating these innovative solutions, LNG suppliers can not only improve their competitiveness against traditional suppliers but also respond proactively to the dynamic shifts in consumer demand across Asia.

Diversification Strategies for Qatar in an Uncertain Market

Amidst the growing competitiveness from flexible LNG suppliers in Asia, Qatar recognizes the necessity of refining its diversification approach to sustain its market position. This involves a multi-pronged strategy focusing on enhancing technological innovation, expanding its global footprints, and fostering partnerships. Key areas for development include:

- Investment in Renewable Energy: As the global energy landscape shifts towards sustainability, Qatar can bolster its LNG portfolio by investing in renewable resources such as solar and wind energy.

- Market Expansion: Entering new markets in Europe and north America can definitely help mitigate risks associated with reliance on traditional markets.

- Technological Advancements: Incorporating advanced extraction and production technologies can increase efficiency and reduce emissions, thus enhancing competitiveness.

Furthermore, collaboration with international energy firms could yield strategic alliances that strengthen its supply chain.Qatar can explore joint ventures that enable sharing of resources and expertise, ultimately creating a more resilient operational framework. Additionally, tapping into data analytics for market assessment can considerably inform decision-making processes. With such strategies, Qatar can not only navigate the uncertainties in the LNG market but also emerge as a more robust player amidst evolving dynamics.

Building Partnerships: The Key to Sustaining Competitive Advantage in LNG

In the evolving landscape of the LNG market,forging strong alliances is increasingly vital for companies seeking to maintain their competitive edge. Partnerships enable organizations to enhance their operational efficiency, share technological advancements, and leverage resources effectively. By collaborating with local players, international giants can gain invaluable market insights that drive strategic decisions. key benefits of these partnerships include:

- access to new markets: Local partnerships can facilitate entry into previously untapped markets, providing a competitive advantage over rivals.

- Risk sharing: Joint ventures allow companies to distribute the financial risk associated with large investments and projects.

- Enhanced innovation: Collaborative efforts can lead to the development of cutting-edge technologies and enduring practices.

Furthermore, as the demand for flexible LNG supply options rises in Asia, the need for effective coordination between different stakeholders cannot be overstated. The LNG industry requires agility to respond to the fluctuating demands of energy markets, which can ofen be unpredictable. By establishing strategic alliances with suppliers, distributors, and even governments, companies can create a more resilient supply chain. A comparison table outlining potential partnership models illustrates the diversity of collaboration opportunities:

| Partnership Model | Description | Benefits |

|---|---|---|

| Joint Ventures | Shared investment in specific projects | Risk distribution, combined expertise |

| Strategic Alliances | Long-term relationships for mutual benefit | Resource sharing, increased market access |

| Supply Contracts | Long-term agreements for consistent supply | Price stability, guaranteed availability |

Key Takeaways

as Qatar navigates the evolving landscape of the liquefied natural gas (LNG) market, it must adapt to the dual challenges posed by increasing competition and shifting demand dynamics in Asia. Flexible LNG suppliers are emerging as formidable contenders, leveraging agility and innovative contracts to capture market share. While Qatar’s long-standing position as a leading LNG exporter is under threat, its response will be crucial in shaping the future of the regional energy market. As stakeholders monitor these developments, the importance of strategic investments, technological advancements, and diplomatic partnerships will be paramount for Qatar to maintain its competitive edge. The ongoing evolution of the LNG sector underscores the intricacies of global energy trade, making it essential for policymakers and industry leaders to stay ahead of the curve in this high-stakes habitat.