In a meaningful progress regarding the ongoing examination into a fraud case linked to U.S. servers in Singapore, officials have disclosed that the servers in question may contain chips manufactured by Nvidia, a key player in the semiconductor industry. The revelation has raised critical questions about the involvement of advanced technology in fraudulent activities and the regulatory challenges that accompany it. Singapore’s Minister for Home Affairs made thes remarks in a recent briefing, emphasizing the need for greater scrutiny in the face of rapidly evolving tech landscapes. This article delves into the implications of the minister’s statement, the potential ramifications for Nvidia and other technology firms, and the broader context of cybersecurity and financial fraud in an increasingly interconnected world.

US Servers in Singapore Fraud Case Potentially Utilize Nvidia Technology

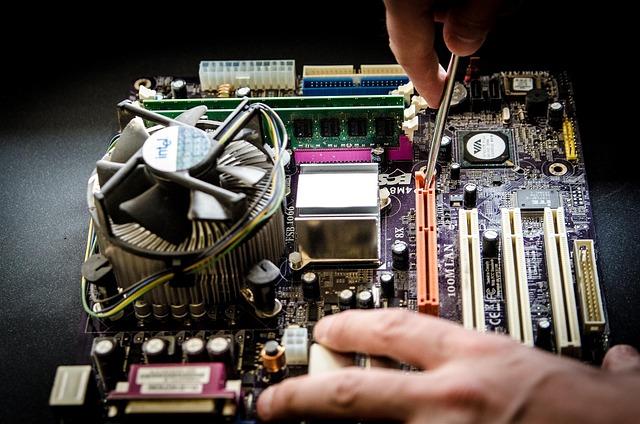

The ongoing investigation into the fraud case that has captured international attention is revealing more details about the technology potentially involved in the scandal. According to a senior official in singapore, the servers used in this case may incorporate Nvidia chips, which are known for their advanced processing power. This raises significant implications for the broader context of cybersecurity and the responsibilities of tech companies in preventing such illicit activities. As the investigation unfolds, authorities are assessing the role of these chips in facilitating or obscuring fraudulent operations.

While the specifics of how Nvidia technology was allegedly employed remain unclear, it highlights a pattern where powerful hardware could be misused in various ways. Potential avenues of misuse may include:

- Data manipulation: Enhancing the capacity to alter or fabricate facts quickly.

- Network infiltration: Leveraging high-performance GPUs to bypass security measures.

- Scaling up operations: Utilizing the servers’ capabilities to manage larger data sets for fraudulent activities.

To better understand the impact of this technology in the case, a comparison table detailing Nvidia’s chip specifications against typical server requirements is presented below:

| Specification | Nvidia Chips | Standard Server Chips |

|---|---|---|

| Processing power | High (up to 32 TFLOPS) | Moderate (up to 3 TFLOPS) |

| Parallel processing | Excellent (thousands of CUDA cores) | Limited (fewer cores) |

| AI Capabilities | Advanced | Basic |

Implications of AI Chips in Financial Misconduct Investigations

The incorporation of AI chips, such as Nvidia’s, into data processing systems plays a pivotal role in the realm of financial misconduct investigations. As these chips dramatically enhance computational capabilities, they allow investigators to sift through vast amounts of data with unprecedented speed and efficiency. This technological leap equips law enforcement and regulatory agencies with the tools necessary to trace complex financial transactions, identify patterns indicative of fraudulent activities, and analyze anomalies that might otherwise go unnoticed. The surge in AI adoption in financial investigations signifies a shift towards more proactive and predictive approaches in combatting fraud.

Moreover, the implications of using advanced AI chips extend beyond mere data analysis. they foster a dynamic surroundings for real-time monitoring, enabling institutions to detect and respond to suspicious activities as they unfold. such capabilities raise questions regarding data privacy and the ethical use of AI in sensitive investigations. Key considerations include:

- The accuracy of AI algorithms: Ensuring that the technology used does not produce misleading results due to biased data.

- Transparency and accountability: Establishing protocols to govern how AI-driven insights are interpreted and acted upon.

- Impact on employment: The potential displacement of customary roles in financial monitoring and investigation.

Considering these advancements, regulatory frameworks must evolve concurrently to address the challenges posed by AI technology, promoting both innovation and the safeguarding of citizens’ rights.

Regulatory Scrutiny on Tech Firms Amid fraud Allegations

The recent fraud allegations involving US servers located in Singapore have intensified the scrutiny surrounding major tech firms, drawing significant attention from regulatory bodies. As officials investigate claims that these servers might potentially be harboring Nvidia chips, analysts are concerned about the compliance and operational integrity of multinational technology companies. Regulatory authorities are ramping up efforts to ensure that technology companies adhere to strict guidelines, especially in light of the evolving landscape of data security and fraudulent practices.

This situation highlights the broader implications for the tech industry as regulatory bodies worldwide assess the need for tighter controls.As part of this scrutiny, several factors are being considered, including:

- Transparency in operational practices

- Accountability of technology providers

- collaboration with law enforcement agencies

Amid these developments, industry observers are closely monitoring the outcomes of these investigations, highlighting the need for a balance between innovation and regulatory compliance in the rapidly advancing tech landscape.

Recommendations for Enhanced Oversight of US Tech Deployments Abroad

As the global tech landscape continues to evolve, it becomes increasingly evident that the United States must implement stronger oversight mechanisms for its technology deployments abroad. this is notably crucial considering cases like the recent fraud instance involving US servers in Singapore that may incorporate Nvidia chips. To address potential risks and ensure that American technologies are deployed ethically and securely, several actions can be considered:

- Establish clear guidelines: create comprehensive policies that delineate the permissible uses of sensitive technology and establish clear consequences for misuse.

- Enhance collaboration: Work closely with international partners to monitor the deployment and utilization of US technology, ensuring compliance with ethical standards.

- Regular audits: Conduct routine audits of technology use abroad to identify potential vulnerabilities or misuse before they escalate into significant issues.

- Stakeholder engagement: Involve industry experts, civil society, and regulatory bodies in the decision-making process to foster accountability and transparency.

furthermore, the creation of a dedicated oversight body that focuses on tech deployments can help streamline these efforts.This body could be responsible for the following:

| Function | Description |

|---|---|

| Monitoring | Oversee technology implementations to ensure compliance with US regulations. |

| Reporting | Provide regular assessments to the government on the status of overseas deployments. |

| Advisory role | Advise policymakers on potential risks and recommended practices for future deployments. |

Future of International Cooperation in Cybercrime and Technology Regulation

The increasing complexity of cybercrime necessitates a collaborative approach among nations to ensure effective responses and enforcement strategies. As technology transcends borders, the traditional methods of law enforcement may struggle to keep pace. As a notable example, in cases involving international fraud and data manipulation, such as the one recently highlighted regarding US servers allegedly involved in fraudulent activities in Singapore, stakeholders must prioritize robust legal frameworks and mutual agreements to combat cyber threats. Key steps for fostering international cooperation include:

- Establishing cross-border task forces to address cybercrime efficiently.

- Creating uniform regulations that accommodate the rapidly evolving tech landscape.

- Enhancing information sharing across jurisdictions to facilitate quick responses to incidents.

Additionally, with major technology companies, like Nvidia, at the forefront of developments and implicated in crime investigations, the dialog around regulatory standards becomes even more urgent.It is critical to address the ethical and legal dilemmas posed by advanced technologies while ensuring that innovation does not come at the expense of security or trust. A potential framework for international dialogue might include:

| Focus Area | Objective | Stakeholders |

|---|---|---|

| Data Protection | Establish cross-border data flow regulations | Governments, Corporations |

| Cybersecurity Standards | Standardize security protocols | International Organizations, Tech Firms |

| Capacity Building | Train law enforcement in digital forensics | Law Enforcement Agencies |

The Role of Hardware in Facilitating Financial Fraud: An In-Depth Analysis

The growing sophistication of financial fraud has increasingly highlighted the critical role of hardware in facilitating illicit activities.In cases like the one surrounding US servers located in Singapore, the presence of high-performance Nvidia chips raises serious questions about the technological capabilities available to fraudsters. The computational power offered by such advanced hardware allows for the execution of complex algorithms that can streamline financial transactions and obfuscate illicit activities, making detection challenging for regulatory bodies.

Furthermore, the availability of robust processing units enhances a criminal’s ability to process vast amounts of data quickly, allowing them to react to market changes in real-time. This can lead to increasingly elegant scams, including phishing attacks and automated trading frauds that can manipulate stock prices in their favor.Key aspects of how hardware plays a role in these schemes include:

- Data Processing: Faster chips reduce the time needed for data analysis and execution.

- encryption and Obfuscation: Advanced hardware allows for stronger encryption methods to hide transactions.

- Simultaneous Operations: Multi-core processors enable running numerous operations concurrently, complicating tracking efforts.

| Hardware Type | Functionality | Impact on Fraud |

|---|---|---|

| Nvidia Chips | High-performance processing | Facilitates rapid financial data manipulation |

| ASICs | Specialized computing tasks | Optimizes specific fraud algorithms |

| GPUs | Parallel processing capabilities | Enables simultaneous actions to evade detection |

Final Thoughts

the ongoing investigation into the fraud case involving US servers in Singapore underscores the complex interplay between technology,international commerce,and regulatory oversight. As Minister of Finance Lawrence Wong highlighted, the presence of Nvidia chips in these servers could suggest deeper implications for the supply chain and potential vulnerabilities in cybersecurity frameworks. This case serves as a reminder of the critical need for vigilance in safeguarding technological integrity and ensuring compliance with international regulations. As authorities continue to unravel the intricacies of this situation, the global tech community and stakeholders will undoubtedly be watching closely for any developments that may arise.