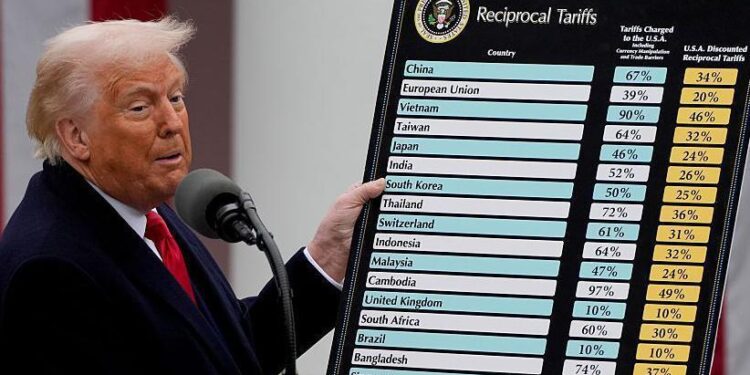

In a significant escalation of trade tensions, former President Donald Trump has announced the imposition of 25% tariffs on imports from Japan and South Korea. The New York Times is providing live updates on the developing situation, examining the potential economic and diplomatic repercussions of this move. The decision marks a notable shift in U.S. trade policy toward two longtime allies in the Asia-Pacific region, prompting responses from governments and markets worldwide.

Trump Imposes 25 Percent Tariffs on Japan and South Korea Impact on Global Trade and Diplomatic Relations

The recent imposition of 25 percent tariffs on imports from Japan and South Korea marks a significant shift in U.S. trade policy, intensifying tensions within the Asia-Pacific economic landscape. Industry experts warn that these tariffs could trigger retaliatory measures, disrupt established supply chains, and elevate costs for American manufacturers and consumers. The sectors most affected include automotive, electronics, and semiconductors, which rely heavily on cross-border collaboration and just-in-time inventory practices. Analysts have pointed out the immediate repercussions on export volumes and the potential for a broader trade conflict that may ripple across global markets.

Beyond economics, the move threatens delicate diplomatic relations between the U.S. and its longstanding allies. Government officials from Tokyo and Seoul have expressed strong disapproval, highlighting concerns that this approach may undermine decades of security cooperation and regional stability. Key points of contention include:

- Disruption of existing free trade agreements

- Impact on trilateral military alliances

- Strain on negotiations around North Korean denuclearization

| Country | Major Export to U.S. | Tariff Impact |

|---|---|---|

| Japan | Automobiles | High |

| South Korea | Semiconductors | Moderate |

Market Reactions and Economic Forecasts Following New Tariff Announcement

Global markets reacted swiftly to the 25% tariffs imposed by President Trump on imports from Japan and South Korea. Stock indices in both countries experienced immediate dips, with the Nikkei 225 falling by 3.2% and the KOSPI dropping 2.8% within hours of the announcement. Investors are growing cautious, shifting assets towards safer havens such as U.S. Treasury bonds and gold. Meanwhile, currency markets saw the Japanese yen strengthen against the dollar by 1.5%, as traders anticipated potential currency interventions by the Bank of Japan to stabilize the exporting economy.

- Automotive and electronics sectors faced the brunt of the initial selloffs.

- Supply chain disruptions are expected to cause short-term volatility across global markets.

- Government officials from Tokyo and Seoul have signaled intentions to seek negotiations or possible retaliation measures.

Economic forecasts now factor in a potential slowdown in growth for both countries in the coming quarters. Analysts predict GDP growth rates could decline by approximately 0.5% to 1% should tariffs remain in effect longer than anticipated. U.S. economic models also suggest possible inflationary pressures domestically, as import costs rise for consumer electronics and vehicles. Notably, the trade deficit with East Asia might see a temporary contraction, but this could come at the expense of broader economic harmony.

| Country | Pre-Tariff GDP Growth (2023) | Revised Forecast (2024) | Key Risk |

|---|---|---|---|

| Japan | 1.2% | 0.7% | Export decline |

| South Korea | 2.1% | 1.4% | Supply chain disruption |

| United States | 2.5% | 2.3% | Inflation spike |

Experts Advise Strategies for Businesses Navigating Increased Import Costs

With the newly imposed tariffs hiking import costs by 25%, industry specialists underscore that businesses must recalibrate their supply chain strategies to mitigate financial strain. Experts recommend prioritizing diversification of suppliers to reduce overreliance on markets now burdened by tariffs. Additionally, companies are encouraged to enhance inventory management, employing just-in-time practices to limit holding costs without risking stockouts.

Financial advisors also highlight the importance of cost transparency and pricing strategy adjustments. Among suggested tactics are:

- Passing selective cost increases to consumers while maintaining competitive positioning.

- Investing in local production to circumvent import duties and stabilize profit margins.

- Leveraging technology for enhanced forecasting and responsive product planning.

| Strategy | Expected Impact | Implementation Time |

|---|---|---|

| Supplier Diversification | Reduced tariff exposure | 3-6 months |

| Local Manufacturing Investment | Long-term cost stability | 12+ months |

| Advanced Inventory Management | Future Outlook

As this situation continues to develop, the international community is closely monitoring the economic and diplomatic repercussions of the newly imposed tariffs on Japan and South Korea. Stakeholders from government officials to global markets are weighing the potential impacts on trade relations and regional stability. The New York Times will provide ongoing coverage and analysis as more details emerge. Denial of responsibility! asia-news.biz is an automatic aggregator around the global media. All the content are available free on Internet. We have just arranged it in one platform for educational purpose only. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials on our website, please contact us by email – [email protected].. The content will be deleted within 24 hours. ADVERTISEMENT |