In the heart of South Korea lies a sprawling industrial hub known as the “steel city,” a term that encapsulates both the region’s ancient significance in steel production and its current economic challenges. As the global trade landscape continues to shift, the looming presence of Trump-era tariffs casts a long shadow over this vital sector. These tariffs, initially instituted in 2018 as part of a broader trade strategy, remain a pressing concern for South Korean manufacturers grappling with increased costs and competitive pressures. This article delves into the impacts of these tariffs on the steel industry in south Korea, examining the complexities of trade relations, the resilience of local businesses, and the broader implications for the economy in a city synonymous with steel production. As stakeholders seek solutions to navigate this turbulent environment, the future of South Korea’s steel city hangs in the balance.

Impact of Trump Tariffs on South Korea’s Steel Industry

The imposition of tariffs by the Trump management substantially reshaped the dynamics of south korea’s steel industry, especially affecting the operations in its historically notable steel city, Pohang. The punitive 25% tariff on imported steel created an environment of uncertainty for local producers, leading to a ripple effect in pricing and production strategies. South Korean manufacturers found themselves caught between the rising costs of raw materials and the pressures of international competition, risking their position in both domestic and global markets. As companies like POSCO adjusted their pricing strategies, the potential loss of contracts and market share in the U.S. became increasingly evident.

Several factors influenced the steel sector’s response to these tariffs:

- increased Production Costs: Tariffs escalated the financial burden on steel producers who relied on imported materials.

- Shift in Trade Relations: South Korea sought to diversify its export markets to mitigate the downturn in U.S. sales.

- Innovation and Adaptation: Local firms intensified efforts to innovate and produce higher-quality steel products as a competitive strategy.

| Impact Factor | Consequences |

|---|---|

| Market access | Reduced exports to the U.S. market |

| Collaboration | Increased partnerships within Asia-Pacific |

| Investment | Shift in focus towards domestic investments and technology |

Economic consequences for Incheon and its Workforce

The implementation of Trump tariffs poses significant economic challenges for Incheon, often referred to as South Korea’s ‘steel city.’ The restrictions on steel imports not only impact local manufacturers but also reverberate throughout the economy, affecting a myriad of industries dependent on steel production. As these tariffs create a barrier to entry for cheaper foreign steel, local companies may experience increased production costs, leading to potential layoffs and decreased investment in infrastructure.key sectors affected include:

- Construction: Higher steel prices may slow down development projects.

- Manufacturing: increased costs could reduce competitiveness in global markets.

- Retail: A rise in product prices may affect consumer spending habits.

Moreover, the workforce in Incheon faces uncertainty as job security diminishes. many employees in the steel industry worry about possible layoffs or reduced hours due to the economic strain imposed by these tariffs. To understand the scale of the impact, consider the following table that highlights potential job losses in key sectors due to rising steel prices:

| sector | Potential Job Losses |

|---|---|

| Steel Production | 1,500 |

| Construction | 800 |

| Manufacturing | 600 |

As global relationships and trade policies continue to evolve, it remains essential for both local government and businesses to strategize effectively to mitigate the repercussions of these tariffs and support the workforce in navigating this economic uncertainty.

Local Responses to Global Trade Challenges

The looming Trump tariffs have sparked a wave of reactions in south Korea’s industrial heartland,particularly in the city known for its steel production. Local manufacturers are grappling with uncertainties that threaten not only their profit margins but also the jobs of thousands of workers. Businesses are focusing on a mix of strategies to mitigate the impact, including:

- increased Efficiency: Factories are investing in modern technologies to reduce overhead costs and boost productivity.

- Diversifying Markets: Companies are actively seeking new international markets to distribute their products outside of the customary U.S. market.

- Collaborating with Government: Local industries are lobbying for government support in the form of subsidies or tax breaks to cushion the financial blow from the tariffs.

While some steel producers scramble to adapt, others are adopting a more innovative approach by focusing on quality over quantity. The emphasis on high-grade steel production has opened avenues for partnerships with tech firms and automotive companies, helping to ensure a sustainable future in a volatile market. To illustrate the varying responses by local companies, the table below summarizes key adaptation strategies:

| Company | Strategy | Target Outcome |

|---|---|---|

| SteelCo | Automation Upgrades | Increase Efficiency |

| Korean Metalworks | New market Exploration | Diversification |

| HanSteel | Quality Innovation | Premium Products |

Strategies for South Korean Manufacturers to Adapt

As the threat of Trump tariffs looms, South Korean manufacturers in the steel industry must rethink their operational strategies to safeguard their market position.One immediate approach is to diversify supply chains to reduce dependence on any single market.By sourcing raw materials and components from a wider range of suppliers, manufacturers can mitigate risks associated with tariff fluctuations.Additionally,investing in technological advancements will be critical; adopting automation and smart manufacturing practices can enhance efficiency and drive down production costs,allowing companies to maintain competitiveness in an increasingly challenging environment.

Moreover, fostering partnerships with local and global stakeholders is essential for long-term resilience. By building alliances with other manufacturers, trade associations, and governmental bodies, firms can collaborate on shared challenges and advocate for favorable trade policies. Innovation in product development, such as creating advanced steel products with unique properties, can open new revenue streams and markets. Manufacturers should also consider exploring option markets that may offer growth opportunities outside of the U.S. market,thereby spreading risk and ensuring a stable demand for their products.

Potential Long-Term Effects on Bilateral Relations

The imposition of Trump-era tariffs on South Korean steel poses a significant threat to the long-standing economic relationship between the United States and South korea. As both nations navigate these tariffs, several potential outcomes could reshape their diplomatic and economic ties. Increased tension could arise from retaliatory measures, leading to a climate of uncertainty that hampers trade negotiations. Stakeholders in the steel sector may find themselves caught in a web of heightened competition and shifting trade dynamics,affecting not just bilateral trade but also investment flows in related industries.

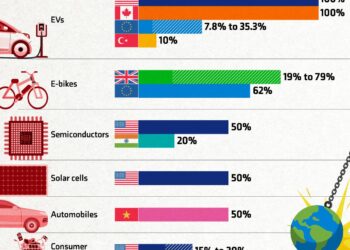

Moreover,this scenario could catalyze a rethink of trade alliances and economic strategies. Countries in the region may be prompted to forge new partnerships or strengthen existing ones in response to the unpredictable U.S.trade policies. As illustrated in the table below, the shifting landscape of steel tariffs could influence key players in the market, creating opportunities and challenges for South Korea, the U.S., and other global economies.

| Country | Current Steel Tariff Impact | Potential Long-Term Response |

|---|---|---|

| South Korea | High tariffs on exports | Diversification of markets |

| united States | Increased domestic steel prices | Encourage local production |

| china | Chance to fill market gaps | Expand export strategies |

| Japan | Stable tariff environment | Strengthen intra-regional trade |

Future Outlook: Navigating the Steel Market Landscape

The South Korean steel market stands at a pivotal crossroads as it braces for the implications of renewed tariffs brought on by changing political dynamics, particularly those stemming from the U.S.administration’s stance. Local manufacturers are already feeling the pinch, with many grappling with increased production costs and a shrinking export market. This scenario is highly likely to compel them to explore alternative strategies, such as:

- Diversifying export markets to reduce dependence on the U.S.

- Investing in technology to enhance production efficiency.

- Collaborating with local governments to secure financial support and tax incentives.

Moreover, as these tariffs reconfigure the competitive landscape, the need for robust market intelligence becomes paramount. Companies must adapt not only to a shifting supply chain but also to evolving consumer demands, particularly in sustainability. Focusing on eco-pleasant practices—such as recycling initiatives and reducing carbon footprints—could serve as a differentiating factor capable of attracting a growing segment of environmentally conscious buyers. As the South Korean steel industry navigates these challenges, ongoing dialogues with trade partners and policymakers will be crucial in shaping a resilient future.

Insights and conclusions

As South Korea’s ‘steel city’ grapples with the implications of impending Trump tariffs, the intersection of trade policy and local industry remains a focal point of concern and adaptation. This evolving landscape highlights not only the challenges faced by steel manufacturers but also the resilience and innovation that define the region’s response to external pressures. As stakeholders navigate the complexities of international trade dynamics, the path forward will undoubtedly require strategic foresight and collaboration. The situation in South Korea’s steel city serves as a poignant reminder of the far-reaching effects of trade policies and the ongoing dialog between economic security and global commerce. As developments unfold, all eyes will be on the local and national strategies employed to sustain this vital sector in the face of uncertainty.