In a critically important growth for South Asia’s financial landscape, Sri Lanka’s Colombo Stock Exchange (CSE) has officially partnered with India’s National Commodity & Derivatives Exchange (NCDex) to explore the potential of a collaborative derivatives exchange. This strategic move aims to enhance the trading ecosystem in Sri Lanka by leveraging India’s established expertise in commodities and derivatives markets. The collaboration underscores a growing trend of regional integration in finance, as both nations seek to bolster liquidity, diversify investment opportunities, and attract foreign capital. As global markets continue to evolve, this partnership could pave the way for a more robust trading framework, positioning Sri Lanka as a key player in the increasingly interconnected South Asian economic sphere.

Sri Lanka’s CSE Collaborates with India’s NCDex to Enhance Derivative Trading Landscape

The collaboration between Sri Lanka’s Colombo Stock Exchange (CSE) and India’s NSE Clearing Limited (NCDex) marks a significant leap towards enhancing the derivative trading framework in Sri Lanka. This partnership aims to bring advanced infrastructure and trading expertise to the local market, ultimately fostering a more dynamic trading surroundings. The move is anticipated to attract more investors by promoting liquidity and clarity in the derivatives market. Key benefits of this collaboration include:

- Access to Advanced Technologies: leveraging NCDex’s sophisticated technology and trading platforms.

- Enhanced Risk Management: Implementing robust risk management protocols to bolster market confidence.

- Increased Product Offerings: Expanding the range of derivative products available to local investors.

As both exchanges work together, they plan to conduct training sessions and workshops designed to upskill local investors and traders, thus ensuring that the market participants are well-equipped to take advantage of new opportunities. moreover, this initiative aligns with Sri Lanka’s broader economic goals, as it seeks to position itself as a thriving trading hub in the South Asian region. The integration of derivative products is expected to play a pivotal role in this strategic vision, as reflected in the following table:

| Initiative | Expected Impact |

|---|---|

| Training Programs | Empower investors with knowlege and skills |

| enhanced Technology | boost trading efficiency and reliability |

| Diverse Product Range | Attract new investors and promote trading volume |

Significance of the Partnership for Sri Lanka’s Financial Markets

The collaboration between Sri Lanka’s Colombo Stock exchange (CSE) and india’s National Commodity and Derivatives Exchange (NCDex) marks a pivotal shift in the landscape of financial markets for the island nation. This partnership not only facilitates the introduction of advanced trading mechanisms and diverse financial instruments but also enhances liquidity and market depth. Furthermore, with the potential for cross-border trading, local investors may gain access to a broader array of investment opportunities, which could stimulate greater economic growth and stability.

Moreover, the alignment with a proven entity like NCDex could bolster investor confidence in Sri Lanka’s financial system. Key benefits anticipated from this partnership include:

- Knowledge Transfer: Exchange of expertise in derivatives trading.

- Market Expansion: Opportunities for local commodities on an international platform.

- Regulatory Framework Enhancement: Improved compliance and risk management practices.

- Innovation in Financial Products: Introduction of new derivatives that cater to diverse investment strategies.

| Aspect | Impact on Sri Lanka |

|---|---|

| Liquidity | Increased trading activity and financial stability |

| diversity of Investment | Broader access to different financial instruments |

| International Collaboration | Enhanced credibility and reputation of CSE |

| Investor Education | Improved understanding of derivatives by local investors |

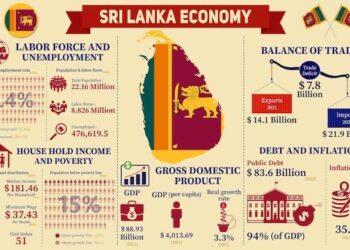

Potential Economic Benefits of Expanding Derivative Products in Sri Lanka

The expansion of derivative products in Sri Lanka’s financial market holds significant potential for boosting the economy. As the country aligns itself with India’s NCDex for this initiative, it could lead to several key benefits, including greater liquidity in the markets, enhanced risk management tools for investors, and increased foreign investment. derivatives such as futures and options can provide local and foreign traders with various avenues to hedge risks associated with currency fluctuations, commodity prices, and other economic variables.

Additionally, introducing a broader range of derivative instruments can stimulate the development of related financial sectors, such as banking and insurance, thus fostering a more robust financial ecosystem. The potential impact on employment is also noteworthy, with the creation of jobs in finance, trading, and analytics. With a transparent and regulated derivative market, the confidence of international investors could be bolstered, leading to an influx of investments that could support infrastructure and economic growth initiatives across the nation. A comparative analysis table of potential economic impacts is illustrated below:

| Impact Area | Before Expansion | After Expansion |

|---|---|---|

| Market Liquidity | Low | increased |

| Foreign Investment | Minimal | Heightened |

| Job Creation | Limited | Expanded |

| Risk Management Options | Basic | Diverse |

Challenges and Risks associated with Derivative Trading in Emerging Markets

Engaging in derivative trading in emerging markets such as Sri Lanka poses several challenges and risks that can substantially impact traders and investors. Market volatility is a primary concern; emerging markets often experience rapid fluctuations due to economic instability, political unrest, or changes in currency value. This volatility can lead to ample losses for those unprepared for such shifts. Other risks include a lack of liquidity, which can hinder the ability to execute trades without significantly affecting prices.In environments where trading volume is low, getting in and out of positions can become costly and impractical.

Additionally, the financial infrastructure in emerging markets may not be as robust as in developed economies, leading to regulatory challenges and transparency issues.Traders may face difficulties navigating local regulations, which can vary significantly and change frequently. Moreover, operational risks due to inadequate technological capabilities can complicate trading processes, exposing participants to potential failures in risk management and transaction execution. Stakeholders must remain vigilant, conducting thorough due diligence and being aware of these inherent risks to make informed trading decisions in such dynamic environments.

Recommendations for Regulatory Framework to Support Derivative Exchange Operations

To facilitate the triumphant operation of derivative exchanges, a extensive regulatory framework is essential. This framework should prioritize transparency, risk management, and investor protection to ensure that all stakeholders can engage confidently in trading activities. Key recommendations include:

- Implementation of Robust Disclosure Norms: Mandating listed companies to publish clear and comprehensive information about their derivative instruments to minimize the asymmetry of information.

- Regular Stress Testing: Encouraging exchanges to conduct regular stress tests to gauge the impact of extreme market conditions on derivative portfolios.

- Enhanced Surveillance Mechanisms: Establishing advanced surveillance in monitoring trading patterns to detect and mitigate any potential market manipulation.

- Investor Education Programs: Promoting educational initiatives aimed at improving investor understanding of derivative products and associated risks.

Moreover,collaboration between regulatory bodies and exchanges is crucial in fostering an innovative trading environment. By aligning regulations with international best practices, Sri Lanka’s capital market can enhance its global competitiveness. Significant considerations for this initiative include:

- Streamlined Regulatory Processes: Simplifying the approval processes for new derivative products to encourage market innovation.

- Increased Collaboration: Facilitating dialogues between regulators and market participants to continuously adapt to changing market dynamics.

- Adaptive Regulatory Approach: Implementing a dynamic regulatory framework that can evolve with technological advancements and market practices.

Future Prospects for investor Participation and Market Growth in Sri Lanka

The synergy between Sri Lanka’s Colombo Stock Exchange (CSE) and India’s National Commodity and Derivatives Exchange (NCDex) signifies a pivotal shift in the trading landscape, aiming to enhance investor participation in the local market. By leveraging the robust infrastructure and experience of india’s established derivative market, sri Lanka is poised to attract a diverse range of investors including local retail traders, institutional investors, and foreign capital.This collaboration promises to create a more dynamic trading environment, encouraging greater liquidity and longer-term investment strategies through innovative financial products.

as Sri lanka steps into this new era of trading, several factors will factor into the prospects of market growth:

- Increased Financial Literacy: Initiatives aimed at educating investors about derivatives will empower them to make informed decisions.

- Diverse Product Offerings: The introduction of a variety of derivatives will cater to different risk profiles, appealing to a wider investor base.

- Regulatory Support: Continued engagement from regulators to create a conducive environment for derivatives trading will be pivotal.

- Technological Advancements: Investment in technology will enhance trading efficiency and access.

in terms of quantifying this growth potential, the introduction of new derivative products can lead to increased trading volumes, which may positively impact overall market capitalization. The following table illustrates potential growth metrics expected from this collaboration:

| Year | Estimated Increase in Market Capitalization (%) | Projected Trading Volume increase (%) |

|---|---|---|

| 2024 | 15% | 25% |

| 2025 | 20% | 30% |

| 2026 | 25% | 40% |

To Conclude

Sri Lanka’s Colombo Stock Exchange (CSE) has taken a significant step towards enhancing its financial market by partnering with India’s National Commodity & Derivatives Exchange (NCDex) in a bid to create a more robust derivatives trading platform. This collaboration not only aims to diversify trading options for investors but also seeks to foster greater liquidity and efficiency within the region’s financial landscape. As both exchanges work together to navigate the complexities of derivative trading, they open the door to new opportunities for Sri lankan investors and aim to position the CSE as a competitive player in South Asia’s financial ecosystem. The coming months will be pivotal in shaping the success of this initiative and its potential to transform the trading experience in Sri Lanka. Stakeholders will be watching closely as this partnership unfolds and its impact on both local and regional markets becomes clearer.