Who Really Killed Sri Lanka’s Economy? - MSN

In the wake of one of the most profound economic crises in its history, Sri Lanka finds itself grappling with not just the aftermath, but the pressing question of accountability: who is to blame for the collapse of its economy? The repercussions of recent events have resonated far beyond the island nation, drawing attention from global economists, political analysts, and citizens alike. As essential perils like soaring inflation, crippling debt, and widespread protests continue to unfold, this article delves into the myriad factors that have converged to create a perfect storm of economic turmoil in Sri Lanka. From mismanagement and policy failures to external pressures and societal unrest,we seek to uncover the layers of responsibility that have led to the current predicament. As we navigate through expert analyses and firsthand accounts, we aim to shed light on not only what went wrong but also on the urgent need for a roadmap to recovery.

The Political landscape and Its Impact on Economic Stability

The intricate web of political dynamics in Sri Lanka has long been a double-edged sword, impacting the nation’s economic resilience in various ways. Recent political turmoil, characterized by instability, corruption, and governance failures, has curtailed investor confidence and led to significant fluctuations in foreign investments. Key factors contributing to this predicament include:

- Poor Policy Decisions: Fluctuations in fiscal policy and erratic trade regulations have caused uncertainty for businesses, deterring both local and foreign investments.

- Political protests: Continuous unrest and protests have disrupted economic activities,leading to a decline in productivity.

- Corruption: Systemic corruption has undermined public trust and misallocated resources that could have been directed towards sustainable progress.

The impact of thes political challenges is most palpable in key economic sectors. A stark illustration is the agricultural sector,once a cornerstone of the economy,now struggling with diminishing yields and farmer dissatisfaction. The following table presents a snapshot of the agricultural productivity decline registered over the past three years due to political instability:

| Year | % Decline in Agricultural Productivity |

|---|---|

| 2021 | 5% |

| 2022 | 15% |

| 2023 | 20% |

As the data suggests, the interrelationship between political actions and economic outcomes is undeniable. The spiraling decline of economic stability in Sri Lanka is a poignant reminder of how politics can profoundly shape the economic landscape.

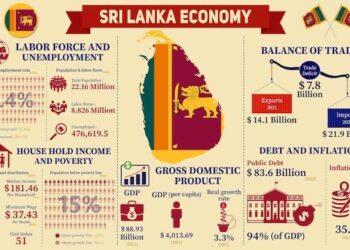

Understanding the Role of External Debt in Sri Lanka’s Financial Crisis

The notion of external debt looms large in the discussion surrounding Sri Lanka’s current financial turmoil. A significant portion of the nation’s debt is owed to international creditors, which poses risks that are much broader than local economic policies. High interest rates, unfavorable terms, and a constant push for repayments have exacerbated the situation, leaving little room for critical sectors like education and healthcare to thrive. As the contry grapples with ample foreign obligations, it becomes increasingly reliant on loans to service existing debts, creating a vicious cycle that stifles economic growth.

Amid this backdrop, the government has struggled to find a sustainable path forward. Efforts to restructure debt have often been met with resistance, both from lenders and domestic stakeholders. Key elements contributing to the crisis include:

- Currency depreciation: This has increased the local currency cost of repaying foreign loans.

- Reduced foreign reserves: Making it harder to procure necessary imports like fuel and medicine.

- Over-reliance on specific nations: Significant debts are owed to countries with less flexible repayment terms.

With economic indicators showing declines across various sectors, the external debt situation remains a critical juncture that demands urgent attention and reform. Understanding these factors is key to dissecting the complexities of the crisis, providing a lens through which to view potential resolutions.

Analyzing the Agricultural Policies that Contributed to economic decline

The agricultural policies implemented in Sri Lanka over recent years have sparked significant debate regarding their role in the country’s economic downturn.One pivotal aspect was the abrupt shift to organic farming, which aimed to boost sustainability and cater to a global market increasingly focused on health and environmental concerns.However, this transition came at a hefty price. farmers faced immediate challenges, such as:

- Loss of income: The sudden ban on chemical fertilizers resulted in decreased crop yields.

- Market instability: Export crops, which traditionally provided strong revenue, suffered from reduced productivity.

- Food insecurity: Domestic food production plummeted, leading to reliance on imports and escalation in food prices.

Additionally, the lack of proper infrastructure and support systems to facilitate this transition exacerbated the situation. The government failed to provide adequate training and resources for farmers, leading to widespread confusion and resistance among the agricultural community. the issues were further compounded by:

- Unsustainable debt levels: Farmers, already strained from reduced income, found themselves unable to repay loans.

- Policy inconsistency: Fluctuation in policies undermined long-term planning and investment in agriculture.

- Regional discrepancies: Some areas were left more vulnerable than others due to uneven policy implementation.

The Influence of Global Market Trends on sri Lanka’s Economy

the global economy is an intricate web, and shifts in market trends can send ripples across nations, especially those with emerging economies like Sri Lanka. the interconnectedness of trade networks and financial markets means that local economies are often vulnerable to external influences. Recently, factors such as fluctuating commodity prices, international trade policies, and changes in consumer demand have considerably impacted Sri Lanka’s economic landscape. As a notable example, the decline in tea prices, one of the country’s main exports, has reduced foreign exchange earnings, creating a domino effect on import capacities and inflation rates.

Additionally, the rising interest rates in developed countries and geopolitical tensions have led to decreased investments in South Asian markets, further straining Sri Lanka’s financial stability. To navigate these waters, it is crucial for policy-makers to focus on enhancing domestic production capabilities, diversifying export products, and fostering strong trade relationships. The key to economic resilience lies in:

- Diversification of Economy: Reducing dependency on a few key sectors.

- Strengthening Trade Agreements: Enhancing access to larger markets.

- Investment in Sustainable Practices: Increasing competitiveness in a price-sensitive global market.

| Impact Factor | Current Status | Potential solutions |

|---|---|---|

| Commodity Prices | Declining | Diversify exports |

| Interest Rates | Increasing | Attract investments |

| Trade Relations | Unstable | Strengthen agreements |

Recommendations for Sustainable economic Recovery and Growth

To pave the way for a resilient economic recovery, a multi-faceted strategy targeting key sectors is essential. Sustainable agriculture should be prioritized to rebuild food security and promote self-sufficiency. This includes investing in environmentally-friendly farming practices,introducing crop diversification,and enhancing irrigation infrastructure. Additionally, supporting small and medium enterprises (SMEs) through accessible microloans and grants can stimulate job creation and local production, thereby invigorating the economy.

Moreover, a shift toward green energy solutions can lay the groundwork for a sustainable future. Establishing incentives for renewable energy projects,such as solar and wind farms,will not only reduce dependency on imported fossil fuels but also create employment opportunities in a burgeoning sector. Urban development must also embrace sustainability by integrating efficient public transportation systems and green spaces. Collaborating with international organizations for technical assistance and funding can further amplify these efforts, ensuring a holistic approach to economic revitalization.

Lessons Learned: Building Resilience Against Future Economic Challenges

in the wake of Sri Lanka’s economic crisis, it has become increasingly clear that resilience must be at the forefront of our national strategy.The recent turbulence has taught us critical lessons that could serve to better prepare us for future challenges. One of the most significant takeaways is the necessity of diversifying the economy. relying heavily on specific sectors, such as tourism or agriculture, leaves a country vulnerable to global market fluctuations. By investing in a broader range of industries, we can create a more stable economic environment, allowing for smoother transitions during hard times.

Moreover, fostering a culture of innovation and entrepreneurship is paramount. Encouraging local startups and supporting small businesses can help create job opportunities and stimulate economic diversification. Partnerships between government, private sector, and education institutions can spur research and development, creating an ecosystem that thrives on creativity and adaptation. Additionally, strengthening financial literacy among citizens will empower individuals to make informed decisions, ultimately fortifying personal and national economic resilience. To highlight some strategies that can enhance economic stability, consider the following table:

| Strategy | Description |

|---|---|

| Diversification | Expand beyond traditional sectors to minimize risks. |

| Support for SMEs | Facilitate access to resources for startups and small businesses. |

| Investment in Education | Equip the workforce with skills for future job markets. |

| Financial Literacy Programs | Educate citizens on managing personal and business finances. |

Closing remarks

the complex tapestry of factors that led to the current state of sri Lanka’s economy reveals a multitude of influences, from historical mismanagement and political instability to the impact of global events and natural disasters. While it is tempting to pinpoint specific individuals or groups as the architects of this crisis, the reality is far more nuanced. As the nation grapples with the consequences of these intertwined elements,it becomes imperative that policymakers learn from the past to forge a path toward sustainable recovery. Understanding who really killed Sri lanka’s economy necessitates a comprehensive analysis of the interplay between political decisions,economic policies,and external pressures. only through such critical reflection can the country begin to rebuild and restore its economic vitality, ensuring a more resilient future for all Sri Lankans. As the dialog around recovery continues, it is essential for citizens and leaders alike to engage in collective efforts aimed at fostering accountability, transparency, and sustainable development.