In the wake of a notable downturn in US markets, European stocks exhibited resilience, stabilizing amidst investor uncertainty. Following a sharp decline on Wall Street, where major indices recorded steep losses, European financial markets opened on a cautious note, wiht key benchmarks navigating early trading with slight fluctuations. Analysts are closely monitoring the implications of the transatlantic market movement, as geopolitical tensions and inflationary pressures continue to loom.Despite the turbulence across the Atlantic, European investors appear to be positioning themselves for potential opportunities, suggesting a complex interplay of sentiment and strategy in response to global economic conditions. This article delves into the recent market dynamics, exploring the factors influencing the stability of European stocks in the face of US volatility.

Impact of US Market Decline on European Investor Sentiment

The recent turbulence in US markets has sent ripples across the Atlantic, affecting the sentiment of European investors significantly. Following a notable plunge in the US stock indices, many analysts are closely monitoring how this downturn influences investment strategies and confidence levels within Europe. Amid concerns of potential contagion, investors are weighing their options, leading to increased caution in buying decisions. Key factors contributing to this wary atmosphere include:

- Economic Interconnectivity: growing anxieties about the US economy’s health may lead to a reevaluation of European market fundamentals.

- Currency Fluctuations: Variations in dollar strength can impact European companies with significant US exposure.

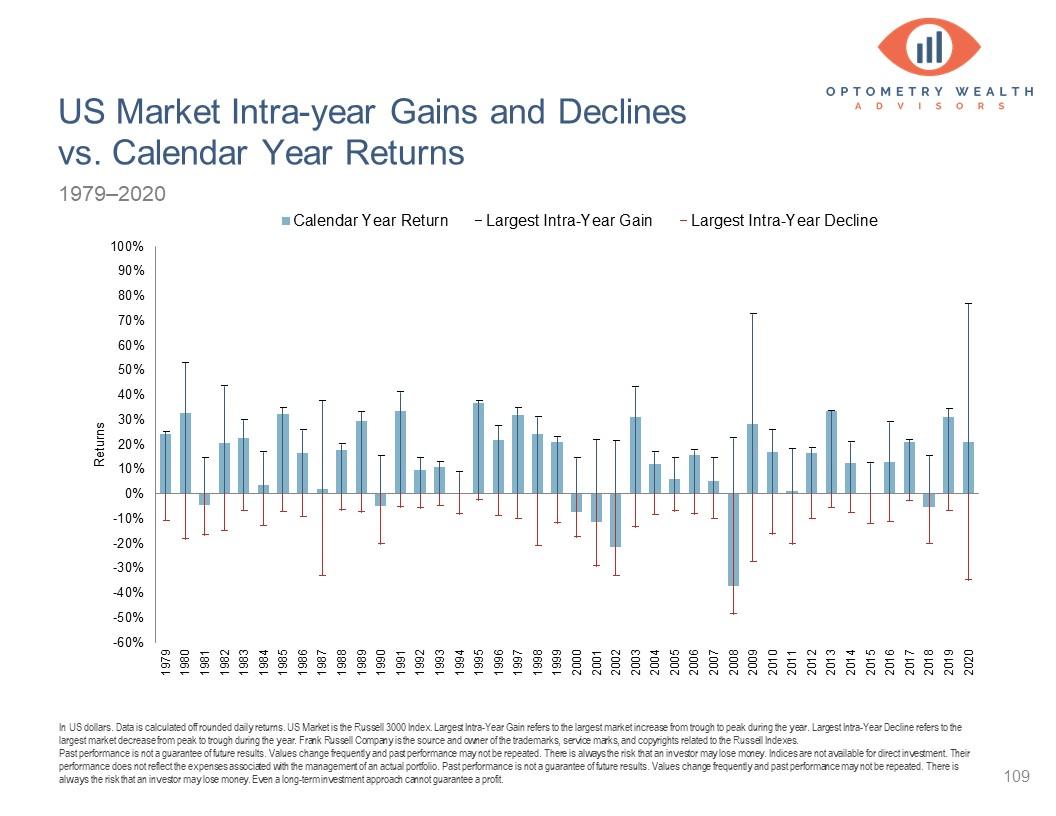

- Market Correlation: Past data shows heightened correlation between US and European stock performance, amplifying investor concerns.

In response to market shifts, European investors are engaging in a myriad of strategies, with many opting to diversify their portfolios to mitigate risk. This includes reallocating investments to emerging markets and sectors deemed more resilient to economic shocks. Furthermore, the current market conditions have unveiled opportunities within specific industries that are less reliant on US performance. A comparative look at key sectors reveals:

| Sector | Performance Outlook | Investor Sentiment |

|---|---|---|

| Technology | volatile | Wary |

| healthcare | Stable | Positive |

| energy | Promising | Optimistic |

Analysis of Key European Sectors Amidst Global Volatility

Despite the recent turbulence in the US markets, European stocks have exhibited a commendable resilience, navigating through the tempest of global volatility. Analysts suggest that the divergence in performance can be attributed to several factors influencing key European sectors:

- Energy Sector: The ongoing energy crisis in Europe has prompted a strategic pivot towards renewable sources, bolstering the stocks of companies specializing in sustainable energy solutions.

- Financial Services: European banks are benefitting from rising interest rates, improving lending margins, and overall economic recovery post-pandemic, which offers a silver lining amidst global tensions.

- Consumer Goods: This sector is facing challenges due to inflationary pressures, yet companies that can adapt to changing consumer behaviors have managed to maintain robust performance.

investors are closely monitoring these sectors for signs of broader market trends. A table below summarizes the recent stock performance across these key areas:

| Sector | Current Performance | Key Drivers |

|---|---|---|

| Energy | +2.5% | Shift to Renewables |

| Financial Services | +1.8% | Increasing Interest Rates |

| Consumer Goods | -0.5% | Inflation Risks |

Strategic Investment Approaches in Uncertain Times

In the face of market volatility, investors are increasingly turning to diversified portfolios to mitigate risk and capitalize on emerging opportunities. By spreading investments across various asset classes, investors can shield their capital from sharp downturns while positioning themselves for recovery during uncertain times. This strategy often includes a balanced mix of stocks, bonds, commodities, and alternative investments, allowing for resilience against abrupt market shifts.

Another effective approach is the adoption of defensive stocks and sectors known for their stability during economic downturns. These can include utilities, healthcare, and consumer staples, which tend to maintain steady demand regardless of economic conditions. Additionally, employing strategies such as dollar-cost averaging can help smooth out the effects of volatility. Below is a simple comparison of defensive sectors and their characteristics:

| Sector | Characteristics | Examples of Stocks |

|---|---|---|

| Utilities | Stable demand, consistent dividends | NextEra Energy, Duke Energy |

| Healthcare | Essential services, resilient earnings | Pfizer, Johnson & Johnson |

| Consumer Staples | Everyday essentials, lower volatility | Procter & Gamble, Coca-Cola |

Economic Indicators to Monitor Following Market Fluctuations

In the wake of significant fluctuations in the stock markets,it becomes imperative for investors and analysts to keep a close eye on several economic indicators that provide insight into future market trends. These indicators serve as a barometer for economic health and can often predict shifts in market sentiment. Key metrics to monitor include:

- Gross Domestic Product (GDP): A crucial measure of economic performance, reflecting the total value of goods and services produced.

- Unemployment Rate: Changes in employment levels can indicate economic strength or weakness,impacting consumer spending and confidence.

- Consumer Price Index (CPI): This index tracks inflation, giving insight into the purchasing power of consumers and potential changes in interest rates.

- Retail Sales: An increase in retail sales often signals consumer confidence,while a decline may indicate potential economic downturns.

Furthermore, central bank policies and interest rates play a pivotal role in shaping market conditions. Investors should notably note:

| Indicator | Current Status | Implication |

|---|---|---|

| Federal Reserve Interest Rate | 2.25% – 2.50% | Potential for economic slowdown if rates rise. |

| European Central Bank Rate | 0.00% | Encourages borrowing and spending in the Eurozone. |

| Inflation Rate | 3.1% | Impacts purchasing power and consumer spending habits. |

By monitoring these indicators, market participants can better navigate the complexities of economic shifts, positioning themselves strategically to mitigate risk and capitalize on opportunities that may arise in both the short and long term.

expert Opinions on Future Market Trends in Europe

As European markets respond to the recent volatility in US stock prices, financial analysts are keenly observing the shifting landscape.Experts predict several key trends that could shape investment strategies in the coming months. These include:

- Increased Focus on Sustainability: analysts suggest that firms prioritizing sustainable practices are likely to outperform their competitors as environmental regulations tighten.

- Digital Transformation Acceleration: The pandemic has catalyzed a swift transition to digital platforms, with companies in tech and e-commerce projected to thrive more than conventional sectors.

- Rising Inflation Concerns: As inflation rates creep higher,financial experts highlight the importance of adjusting portfolios to hedge against potential market corrections.

Moreover, the European Central Bank’s stance on interest rates will play a pivotal role. Insider commentary indicates that ongoing uncertainty in the US economy might prompt the ECB to adopt a more cautious approach. This scenario can lead to:

| Trend | Potential Impact |

|---|---|

| Low Interest Rates | could sustain borrowing and investment levels. |

| increased Regulatory Scrutiny | May impact sectors like finance and energy. |

| Currency Fluctuations | Affect trade balances and foreign investments. |

Wrapping Up

the stability observed in european stock markets amidst the turmoil of a significant decline in US markets underscores the complex interconnectivity of global financial systems. Investors across Europe remain cautiously optimistic, with many monitoring the unfolding economic indicators and geopolitical developments that could influence market dynamics in the coming days. As both optimism and uncertainty continue to shape investor sentiment, market watchers will be keen to see how these factors unfold and impact trading patterns. with vigilance and strategic planning, stakeholders in Europe may well navigate through this uncertain terrain, positioning themselves for resilience amidst the prevailing volatility.