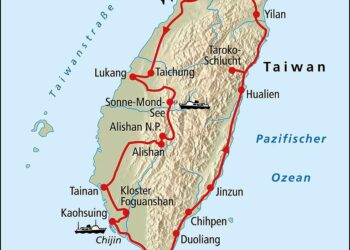

As global trade tensions escalate in the wake of the Trump administration’s aggressive tariff policies, investors are assessing the implications for key industries adn their key players. one focal point in this evolving landscape is Taiwan Semiconductor Manufacturing company (TSMC), a behemoth in the semiconductor sector. With rumors of further trade restrictions and ongoing debates surrounding supply chain security, market analysts are closely scrutinizing TSMC’s stock performance in the lead-up to the critical date of April 17. This article delves into the potential impacts of trade wars on TSMC and whether its stock remains a viable investment amidst the uncertainty. As stakeholders navigate thes turbulent waters, understanding the interplay between international trade policies and semiconductor markets is more crucial than ever.

Analyzing the Impact of Escalating Trade Tensions on Taiwan Semiconductor’s Market Position

The increasing strain of trade tensions,especially between the United States and China,has created an environment of uncertainty for global markets,significantly impacting major players such as Taiwan Semiconductor Manufacturing Company (TSMC). As one of the largest semiconductor companies in the world,TSMC holds a crucial position in not only the tech landscape but also the broader economic fabric interwoven with U.S.-China relations. The latest round of tariffs, imposed by the Trump administration, raises critical questions about supply chain stability, production costs, and overall profitability for TSMC as it navigates these turbulent waters. Some of the key implications of these tensions include:

- Supply Chain Disruptions: Increased tariffs could lead to higher costs for raw materials and components critical to manufacturing processes.

- Revenue Impact: Dependence on markets affected by tariffs may hinder sales growth, particularly in regions like the U.S. and China.

- Investment Sentiment: trade disputes can create volatility, leading to fluctuations in investor confidence and stock performance.

To assess TSMC’s resilience,it’s important to analyze market responsiveness and competitive positioning amidst these geopolitical concerns. While trade tensions present challenges, TSMC’s strategic initiatives—including diversifying its customer base, investing in advanced technologies, and bolstering production capabilities in regions less impacted by tariffs—may offer a buffer against immediate market volatility. Consider the following factors when evaluating the company’s long-term outlook:

| Factor | potential Impact |

|---|---|

| Global Demand for Semiconductors | High demand may offset tariff impacts |

| R&D Investment | Innovation could ensure competitive advantage |

| Diversification Strategy | Less reliance on any single market or region |

Evaluating Financial Performance and Future Prospects Ahead of April 17

As the geopolitical landscape shifts amidst escalating trade tensions, particularly with respect to Trump’s tariffs, investors are keenly scrutinizing the financial metrics of major players like Taiwan Semiconductor Manufacturing Company (TSMC). The recent quarterly report showcased robust earnings characterized by a double-digit growth rate year-over-year,underscoring the company’s resilience even in turbulent waters.Analysts are particularly encouraged by TSMC’s ability to maintain margins while facing rising material costs and a competitive semiconductor environment. The company’s strategic pivot towards advanced 5nm chip production is critical as consumer demand for high-performance processors continues to soar.

Looking ahead to the critical date of april 17, TSMC’s pipeline appears promising, fueled by increasing global demand from sectors such as automotive and artificial intelligence. Experts forecast that the start of new projects may further solidify TSMC’s position, particularly if they can effectively navigate the following challenges:

- Supply Chain Disruptions: ongoing issues could affect production timelines.

- Tariff Effects: Potential tariffs could influence pricing and profit margins.

- Market Competition: Rivals are rapidly advancing in tech capabilities.

| key Metrics | Q1 2023 | Q1 2022 |

|---|---|---|

| revenue Growth | 15% | 10% |

| Net Income | $4.5B | $3.9B |

| Gross Margin | 50% | 48% |

strategic Considerations for Investors in Light of Trump’s Tariff Policies

The evolving landscape of tariff policies under the Trump administration presents both risks and opportunities for investors,particularly in sectors heavily impacted by international trade dynamics. As tariffs fluctuate, companies like Taiwan Semiconductor Manufacturing Company (TSMC) must navigate these changes carefully. Amid increasing semiconductor demand, TSMC has to assess its pricing strategies, supply chain logistics, and potential cost increases stemming from tariffs on raw materials. Understanding how these elements intersect will be crucial for investors considering the stock in the current climate.Additionally, fluctuations in currency exchange rates and geopolitical tensions can further compound these factors, affecting TSMC’s competitive edge against rivals.

Investors should also keep a close eye on potential retaliatory measures from affected countries, which could prompt a broader trade war.As tensions escalate, semiconductor companies that are dependent on global supply chains may face significant challenges, including rising production costs and disrupted trade routes. Conducting diligence on TSMC’s exposure to key markets such as the U.S. and China is essential. Below is a quick snapshot of critical considerations:

| Consideration | Details |

|---|---|

| Market Exposure | Focus on revenue derived from U.S. and China markets. |

| Production Costs | Assess impact of tariffs on raw materials. |

| Competitive Position | Evaluate how TSMC stacks against competitors. |

| Supply Chain Resilience | Identify potential disruptions in logistics. |

the Conclusion

as the geopolitical landscape continues to shift with escalating trade tensions and the implications of Trump’s tariffs looming large, investors must carefully assess the potential impact on key players in the semiconductor industry, particularly Taiwan Semiconductor manufacturing Company (TSMC).With an eye on upcoming earnings reports and industry developments leading up to April 17,the question of whether TSMC stock remains a viable buy is more pertinent than ever.Industry analysts suggest that while challenges abound,the company’s strategic positioning and innovation pipeline could provide a robust counterbalance to external pressures. As we navigate these uncertain waters, investors should weigh the risks against the opportunities, keeping a close watch on both market movements and policy changes that could further influence the semiconductor sector.