MML Investors Services LLC Bolsters Portfolio with Significant Holdings in Taiwan semiconductor Manufacturing Company

In a strategic move signaling confidence in the semiconductor sector, MML Investors Services LLC has reported holdings valued at approximately $78.87 million in Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM). As one of the world’s leading semiconductor manufacturers, TSMC plays a crucial role in the global technology landscape, supplying chips to major players in various industries. This investment not only underscores MML’s commitment to tapping into the growth potential of the technology market but also highlights the increasing importance of semiconductor firms amidst escalating demand for advanced electronics. In this article, we delve into the details of this investment, the implications for both MML Investors Services and the broader market, and what it may signal about future trends in the semiconductor industry.

MML Investors Services LLC Strengthens Position in Taiwan Semiconductor manufacturing Company

MML Investors Services LLC has demonstrated a significant commitment to the semiconductor sector by increasing its stake in Taiwan Semiconductor Manufacturing Company Limited (TSMC). As of the most recent financial reporting period,MML now holds approximately $78.87 million in TSMC, representing a strategic move to capitalize on the burgeoning demand for semiconductor technology. This increased investment underscores MML’s confidence in TSMC’s market position and growth potential, especially given the ongoing global challenges in the tech supply chain and the rising reliance on advanced semiconductor chips across various industries.

TSMC,recognized as a leader in semiconductor manufacturing,plays a vital role in supporting the technological advancements of numerous companies globally. Analysts have highlighted several key factors fueling TSMC’s growth trajectory:

- Expanding demand for high-performance computing and AI applications

- strategic investments in cutting-edge fabrication technologies

- Long-term partnerships with leading tech firms

With MML’s bolstered holdings, the firm appears well-positioned to benefit from TSMC’s continuing innovation and market leadership as the semiconductor industry navigates an increasingly complex landscape.

Analyzing the Implications of Increased Holdings in TSM for Investment strategy

The substantial stake held by MML Investors Services LLC in Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) could signal a shift in investment strategy that highlights the increasing importance of semiconductor firms in today’s economy. As major players in technology and electronics, semiconductor companies are pivotal to the supply chains of various sectors, from automotive to consumer electronics. with TSMC being a leader in advanced chip manufacturing, MML’s investment may reflect a broader trend among institutional investors who prioritize technology firms, especially amid growing global demand for innovative solutions.

Key implications of increasing investments in TSM might include:

- Demand for Chips: An anticipated rise in the need for semiconductors could lead to improved revenue forecasts for TSM.

- Market Volatility: With increased interest, stock volatility may follow, driven by both the chip market and global economic conditions.

- Strategic Partnerships: Greater holdings in TSM might lead MML to foster closer ties with the company, perhaps opening the door for strategic collaborations.

| Investment Factors | MML Stake | Market Reaction |

|---|---|---|

| Revenue Growth | $78.87 Million | Positive Trend |

| Sector Expansion | Increased Holdings | Potential Volatility |

| Technological Advances | Focus Shift | Investor Confidence |

Expert Recommendations for Investors Considering Taiwan Semiconductor Shares

Investors eyeing shares of Taiwan Semiconductor manufacturing Company Limited (NYSE: TSM) are advised to consider several pivotal factors before making investment decisions. Analysts emphasize the importance of understanding TSM’s robust position in the semiconductor market, especially as the global demand for chips continues to escalate across various sectors, including automotive, consumer electronics, and artificial intelligence. To navigate potential volatility and maximize gains, investors should focus on:

- market Trends: Stay updated on technological advancements and shifts in consumer demand.

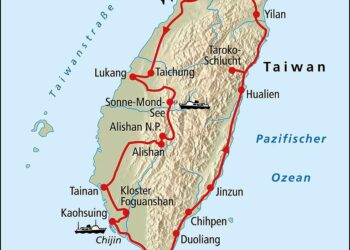

- Geopolitical Factors: monitor relations between Taiwan and neighboring countries, notably China, as these can impact operations.

- Financial Health: Regularly review TSM’s earnings reports and financial stability metrics.

Moreover, diversification remains a fundamental strategy for investors looking to mitigate risks associated with single-stock investments. Allocating a portion of the portfolio to TSM while balancing it with other tech or growth-oriented stocks can provide a buffer against market fluctuations. Investors are encouraged to tailor their strategies based on:

- Risk Tolerance: Assess personal financial situations and investment horizons.

- Economic Indicators: Keep an eye on interest rates and inflation that may affect tech stock performance.

- Expert Insights: Leverage professional analyses and forecasts to inform buying or selling decisions.

Insights and Conclusions

MML Investors Services LLC’s significant investment of $78.87 million in Taiwan Semiconductor Manufacturing Company Limited underscores the firm’s confidence in the semiconductor industry’s growth potential. As TSM continues to play a pivotal role in the global technology supply chain, this strategic move highlights the ongoing interest from investors in major players within the sector. As the market evolves, all eyes will remain on TSM’s performance and its ability to adapt to the dynamic landscape of technology and manufacturing. Investors and analysts alike will be monitoring the company’s developments closely, as it navigates challenges and capitalizes on opportunities in the ever-competitive semiconductor market.