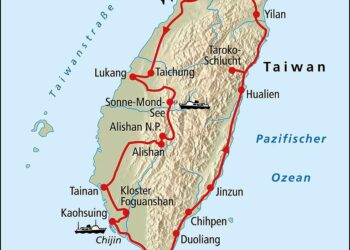

in a important progress for the semiconductor industry,Nvidia has reportedly secured approximately 70% of TSMC’s advanced packaging capacity for 2025,as highlighted by Taiwan media.This strategic move underscores Nvidia’s commitment to enhancing its production capabilities amid growing demand for AI-driven technologies and high-performance computing. TSMC, or Taiwan Semiconductor Manufacturing Company, is a pivotal player in the global semiconductor ecosystem, known for its cutting-edge manufacturing processes.By locking in a substantial portion of TSMC’s resources, Nvidia not onyl strengthens its supply chain position but also reinforces its competitive edge in the fast-evolving tech landscape.This article delves into the implications of this agreement, exploring its potential impact on Nvidia’s market strategy, the broader semiconductor sector, and the future of advanced packaging technologies.

Nvidia’s Strategic Move in advanced Packaging Capacity

Nvidia’s recent decision to secure 70% of TSMC’s advanced packaging capacity for 2025 marks a significant milestone in its strategic plans to enhance its product offerings and maintain a competitive edge in the semiconductor industry. This move highlights the growing demand for high-performance chips,driven by the expansion of artificial intelligence,gaming,and data-centric applications.By ensuring a substantial share of TSMC’s cutting-edge manufacturing capabilities, Nvidia is positioning itself to rapidly innovate and scale its operations, addressing the surging need for more complex chip designs and higher processing power.

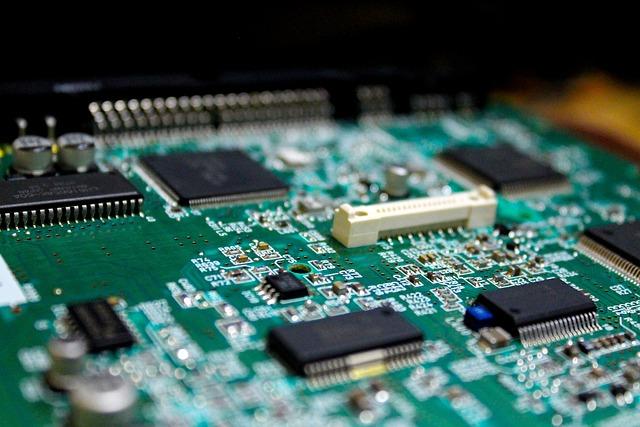

this securing of advanced packaging capacity allows Nvidia to harness the latest technologies, reducing latency and improving energy efficiency in its products. Key benefits of this strategic partnership include:

- Enhanced Performance: Improved thermal management and efficiency in chip design.

- Scalability: Ability to meet increasing demand across various sectors.

- Innovation Acceleration: Greater flexibility in developing next-gen products.

As the industry navigates supply chain challenges and increasing demands for advanced computing solutions, nvidia’s foresight in locking substantial packaging capacity considerably strengthens its market position, ultimately benefiting its end-users through improved performance and innovation.

Implications of TSMC’s capacity Allocation for the semiconductor Industry

As Nvidia secures a significant share of TSMC’s advanced packaging capacity for the coming years, the semiconductor industry is poised for a pivotal change. TSMC’s decision to allocate 70% of its advanced packaging output to a single customer like Nvidia underscores the growing dominance of high-performance computing and graphics processing units. This capacity allocation signals a critical shift toward meeting the soaring demand for advanced chips in AI applications, machine learning, and gaming, fostering increased competition among other tech giants striving for their own slice of the semiconductor pie.

The implications for the broader semiconductor landscape are profound. Smaller players may face challenges in securing the necessary resources to innovate and compete, potentially leading to a consolidation trend within the industry. Key points to consider include:

- Increased investment in research and development by competitors to enhance chip capabilities.

- Potential for supply chain disruptions as TSMC prioritizes Nvidia’s production schedules.

- Shift in partnerships as companies seek alternative foundries or increase in-house fabrication.

Furthermore, the ripple effect on pricing and technology access could reshape market dynamics, influencing everything from consumer electronics to automotive applications. This situation presents a unique chance for TSMC to fortify its reputation as a leader in advanced semiconductor manufacturing while pushing other industry players to evolve rapidly.

How Nvidia’s Dominance Could Influence Market Competition

Nvidia’s acquisition of 70% of TSMC’s advanced packaging capacity for 2025 signifies a pivotal moment not only for the company but also for the entire semiconductor industry. With such a substantial share, Nvidia is set to bolster its production capabilities, enabling it to enhance its existing lineup of GPUs and expand into new markets. This monopolistic hold may result in a scenario where other tech firms face challenges in securing necessary resources, possibly stunting innovation and slowing down development timelines for competitors. The ripple effect could led to:

- Increased Prices: Competitors may be forced to raise prices due to scarcity of advanced chips.

- Market Consolidation: Smaller players might struggle to sustain operations, leading to potential mergers or acquisitions.

- Supply Chain disruptions: Companies may encounter longer wait times for components, affecting product launch schedules.

Moreover, as Nvidia continues to set the pace for technological advancements, it could overshadow other companies’ efforts to innovate. This dynamic will force competitors to either pivot strategically or invest heavily in alternative technologies. Notably, key players in the industry might seek partnerships or collaborations to mitigate the risk of being outpaced, potentially fostering a new environment of cooperative competition. The future landscape could feature:

- Diverse Talent Pools: Increased collaboration may lead to a blending of expertise across companies.

- Innovative Solutions: Teams may create novel technologies to alternate sources or approaches.

- Agile Market Responses: Competitors may adapt faster in a bid to counter Nvidia’s stronghold.

Analysis of Potential Benefits for Nvidia’s Product Lineup

Nvidia’s strategic acquisition of 70% of TSMC’s advanced packaging capacity not only solidifies its supply chain but also opens up a plethora of opportunities for its product lineup. By securing this significant portion of capacity, Nvidia is poised to enhance its production efficiency and reduce potential bottlenecks in the supply chain, which have plagued various tech companies in recent years. This move allows Nvidia to expedite the development and launch of cutting-edge products, particularly in high-demand areas such as AI hardware, gaming GPUs, and data center solutions. Consequently, with streamlined production timelines, Nvidia can respond more adeptly to market trends and consumer demands.

Moreover, this collaboration with TSMC can lead to innovations in thermal and electrical performance—key factors for high-performance computing. By leveraging TSMC’s advanced packaging technologies, Nvidia can potentially reduce chip sizes while simultaneously boosting their processing power. This gives rise to products that are not only more compact but also more efficient, expanding possibilities in sectors such as automotive AI and edge computing. The anticipated enhancements in product capabilities may not only ensure a competitive edge but also cultivate lasting partnerships across various industries eager to integrate Nvidia’s solutions.

recommendations for Investors in the Semiconductor Sector

As Nvidia continues to secure a significant share of TSMC’s advanced packaging capacity, investors should adjust their strategies to reflect this evolving landscape. The importance of packaging technology in enhancing semiconductor performance cannot be overstated. Investors should consider diversifying their portfolios to include companies focused on innovative packaging solutions or those that could benefit indirectly through partnerships or supply chain connections. Understanding the technological advancements and market trends associated with TSMC’s operations will be crucial in identifying potential growth opportunities.

Along with exploring direct investments in firms like Nvidia, stakeholders should pay attention to the broader semiconductor ecosystem. Key factors to watch include:

- Technological Advancements: Monitor trends in AI, machine learning, and IoT devices that are driving demand for high-performance chips.

- Geopolitical Dynamics: Be aware of the influence of US-China relations on semiconductor trade policies and supply chains.

- Investment in R&D: Look for companies significantly investing in research and development for next-gen semiconductor technologies.

Furthermore, building a keen understanding of the financial health and market positioning of semiconductor players is essential. A comparative analysis table can provide insights into prominent companies in the sector:

| Company | Current Market Share (%) | Projected growth Rate (%) |

|---|---|---|

| Nvidia | 25 | 20 |

| AMD | 15 | 15 |

| Intel | 30 | 10 |

| Qualcomm | 10 | 12 |

By synthesizing these insights, investors can make informed decisions that align with both current market dynamics and future trends in the semiconductor sector.

wrapping Up

Nvidia’s recent deal to secure 70% of TSMC’s advanced packaging capacity for 2025 signals a significant shift in the semiconductor landscape.This strategic move not only positions Nvidia at the forefront of next-generation chip technology but also underscores the increasing competition in the AI and GPU markets. As demand for advanced computing capabilities surges,the reliance on TSMC’s expertise highlights the crucial role that advanced packaging plays in enhancing performance and efficiency. Investors and industry stakeholders will be closely monitoring how this partnership unfolds and its potential implications for both Nvidia and the wider tech ecosystem. With the race for semiconductor supremacy intensifying, Nvidia’s proactive approach could set new benchmarks for innovation and market dynamics in the years to come.