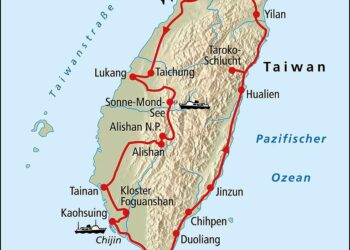

In a pivotal development for the semiconductor industry, a recent analysis by TechInsights has revealed that the cost of manufacturing wafers at Taiwan Semiconductor Manufacturing Company’s (TSMC) new facility in Arizona is only 10% higher than in its traditional home base of Taiwan. This significant finding not only highlights the competitiveness of TSMC’s U.S. operations but also underscores the broader implications for global supply chains and the ongoing shift toward localizing semiconductor manufacturing in response to geopolitical tensions and supply chain vulnerabilities. As the demand for advanced chips continues to rise, the relative affordability of production in Arizona may play a crucial role in shaping the future landscape of the semiconductor market, while enhancing the resilience of supply lines in North America. This article delves into the factors influencing production costs at TSMC’s Arizona facility and explores what this means for the semiconductor industry at large.

Evaluating Cost Implications of Chip Production in Arizona Versus Taiwan

In a recent analysis by TechInsights, the financial dynamics of semiconductor fabrication in Arizona have come under the spotlight, revealing that producing wafers at TSMC’s Arizona facility incurs only a 10% higher cost compared to its operations in Taiwan. This slight premium can be attributed to several key factors that highlight the differences in infrastructure, labour, and regulatory environments in the two locations.Arizona benefits from being closer to a rapidly growing domestic automotive and tech industry, fostering regional supply chain efficiencies that can offset some operational overheads.

To break down some of these cost implications, consider the following components that influence pricing in both regions:

- Labor Costs: Arizona has a more expensive labor market due to local demand for tech talent.

- Utilities: Energy costs may vary, with Arizona’s requirements influenced by its arid climate.

- Government Incentives: Arizona provides attractive tax breaks to stimulate semiconductor investments.

| Cost component | Arizona | Taiwan |

|---|---|---|

| Labor Costs | Higher | Lower |

| Utilities | moderate | Varies |

| Government Incentives | Significant | Minimal |

These factors illustrate a nuanced picture of semiconductor production costs. While the pricing in Arizona might be slightly elevated, the proximity to key industries and potential for innovation could justify the expenditure. The ongoing investment in domestic chip manufacturing highlights a strategic pivot that companies are willing to adopt,aiming to mitigate risks associated with reliance on overseas production.

Understanding TSMC’s Strategic Expansion and its Impact on Global Supply Chains

The recent analysis from TechInsights highlights a significant aspect of TSMC’s manufacturing shift to Arizona, drawing attention to its relative cost efficiency. While the production of semiconductor wafers in Arizona comes at a 10% higher price compared to taiwan, this figure unveils a complex narrative about localization. By establishing a footprint in the U.S., TSMC not only aims to reduce geopolitical risks but also aligns with rising demands for domestic production. This strategic move is indicative of a broader trend where companies are increasingly prioritizing supply chain resiliency, often at the expense of slightly higher costs, to ensure more stable access to critical components.

Moreover, the implications of this expansion extend beyond simple cost calculations. The presence of TSMC in Arizona is poised to foster technological advancements and development in the local semiconductor ecosystem, potentially creating a ripple effect throughout the industry. Not only will it serve the immediate needs of American tech companies, but it could also attract further investments and talent, enhancing innovation. the strategic balance TSMC strikes between location and expense serves as a testament to the evolving landscape of global supply chains, highlighting a shift towards …

| Key Aspects | insights |

|---|---|

| Cost Comparison | Arizona production costs are only 10% higher than Taiwan |

| Strategic Benefits | Mitigates geopolitical risks and supports domestic supply needs |

| Innovation Potential | Encourages local tech development and workforce growth |

The Role of Local Incentives in Mitigating Production Costs at TSMC Arizona

Local incentives play a crucial role in balancing the higher production costs associated with semiconductor manufacturing at TSMC’s Arizona facility. With ongoing pressure to compete against lower-cost production hubs like Taiwan, these incentives become vital in streamlining operational expenses. The Arizona state government has been proactive, offering a suite of benefits that can include:

- Tax credits: ample reductions in state tax obligations for companies investing in semiconductor manufacturing.

- Grants: Direct financial assistance to offset initial investment costs and operational expenses.

- Job training programs: Support to develop a skilled workforce tailored to the unique needs of semiconductor production.

Moreover, these incentives not only lower immediate financial burdens but also aim to foster long-term growth in the region. By encouraging investment in critical infrastructure and workforce development, local authorities are positioning Arizona as a key player in the global semiconductor supply chain. companies like TSMC benefit from the enhanced ecosystem, which includes:

| Incentive Type | Potential Benefit |

|---|---|

| Economic Development Tax Incentives | Lower operational costs leading to price competitiveness |

| Research Grants | Funding for innovation in manufacturing processes |

| Infrastructure Investments | Improved logistics and supply chain efficiency |

By leveraging these local incentives, TSMC can considerably mitigate production costs, making Arizona an attractive choice to traditional manufacturing centers while ensuring sustainable growth and technological advancement in the semiconductor industry.

implications for the Semiconductor Market: How Arizona’s Costs Affect Competitiveness

The recent insights from TechInsights have brought to light the nuanced dynamics of the semiconductor sector as manufacturers evaluate the operational costs associated with production facilities in Arizona compared to traditional strongholds in Taiwan. While the news that wafer production costs at TSMC Arizona are only 10% higher than those in Taiwan may seem moderate,the broader implications are significant. Factors influencing this cost difference encompass local labor rates, energy expenses, and logistics infrastructure. Moreover, the ongoing developments in U.S. semiconductor policy and federal incentives play a crucial role in shaping the local landscape, potentially affecting future competitiveness against established regions.

As visionaries in the tech industry assess these findings, key considerations will include:

- Investment in workforce development: To mitigate cost disparities, companies may prioritize training programs and partnerships with educational institutions to cultivate a skilled labor force.

- Innovative technologies: Embracing cutting-edge manufacturing techniques can help reduce production expenses and enhance yield rates, offsetting some costs.

- Supply chain optimization: Localizing supply chains can further minimize logistics costs, presenting a strategic advantage for Arizona-based manufacturers.

| Cost factors | Arizona | Taiwan |

|---|---|---|

| Labor | Moderate | Lower |

| Energy | higher | Lower |

| Logistics | Developing | Established |

Future Prospects for U.S. Semiconductor Manufacturing considering Global Trends

The landscape of semiconductor manufacturing in the U.S. is rapidly evolving, especially as global dynamics shift. Recent analyses indicate that TSMC’s Arizona facility, while subject to higher production costs, is making significant strides in localizing supply chains.Several factors contribute to this optimization, including government incentives, geopolitical considerations, and the demand for American-made technology. As manufacturers face pressures from various fronts, the strategic move to establish a footprint in the U.S. could offset some of the costs by reducing the dependence on imports, particularly from nations with fluctuating trade policies.

Moreover, the growing emphasis on sustainability and innovation in the semiconductor sector fosters a competitive atmosphere where U.S. manufacturers are compelled to enhance efficiency. Collaboration between tech companies and research institutions is becoming essential for driving advancements in semiconductor materials and fabrication processes. Considering these changes, U.S.semiconductor firms must capitalize on opportunities to invest in cutting-edge technology while remaining adaptable to global market demands. Future initiatives may focus on shortening supply chains, enhancing workforce training programs, and improving resilience against international disruptions.

Recommendations for Stakeholders in the Semiconductor Ecosystem

As the semiconductor industry continues to evolve, stakeholders must adapt their strategies to maximize opportunities presented by production facilities like TSMC Arizona. Given the relatively modest increase in production costs—only 10% higher than Taiwan—it is essential for industry players to consider the following recommendations:

- Investment in Localized Supply Chains: Establishing supply chains within the region can mitigate risks associated with global disruptions and enhance resilience.

- Talent Development Programs: Foster partnerships with local educational institutions to develop a skilled workforce capable of supporting advanced semiconductor manufacturing.

- Strategic Collaborations: Engage in collaborations with technology firms,research institutions,and local governments to leverage resources and share expertise.

- Policy Advocacy: Work closely with policymakers to create a favorable regulatory environment that encourages innovation and investment in the semiconductor sector.

To further solidify their competitive edge, stakeholders should focus on the following operational adjustments:

| Operational Focus | Benefits |

|---|---|

| Automation implementation | Reduces labor costs and enhances production efficiency. |

| Energy Efficiency Initiatives | Lowers operational costs and supports sustainability goals. |

| Advanced R&D Investments | Drives innovation and maintains technological leadership. |

By embracing these strategies, stakeholders can not only navigate the complexities of the semiconductor landscape but also position themselves for long-term success, especially in a competitive environment shaped by regional manufacturing capabilities.

Key Takeaways

TechInsights’ analysis reveals that while the cost of producing semiconductor wafers at TSMC’s Arizona facility is only 10% higher than its taiwanese counterpart,this slight increase reflects a broader strategy of resilience and versatility in global supply chains. As TSMC continues to invest in U.S. operations,it not only strengthens domestic production capabilities but also mitigates risks associated with geopolitical tensions and global disruptions. The implications of these cost dynamics extend beyond TSMC itself, influencing market prices, technological innovation, and the future landscape of semiconductor manufacturing. As the industry adapts to new challenges, TSMC’s Arizona initiative represents a pivotal shift in the ongoing quest for sustainability and efficiency in semiconductor production. Moving forward, stakeholders will be keenly watching how these developments unfold in a rapidly evolving tech ecosystem.

![ISWK[Cambridge] Students Bring Glory to Oman at the 2nd Asian Yogasana Sport Championship! – Times of Oman](https://asia-news.biz/wp-content/uploads/2025/05/165927-iswkcambridge-students-bring-glory-to-oman-at-the-2nd-asian-yogasana-sport-championship-times-of-oman-120x86.jpg)